Senators ask U.S. Treasury, IRS to speed up crypto taxation rules

- Given the Treasury’s delay, the proposed crypto taxation rules could not be implemented until 2026.

- The representatives asked the agencies to provide an update by 24 October.

A group of U.S. Senators has asked the Department of the Treasury and the Internal Revenue Service (IRS) to expedite the implementation of crypto tax rules.

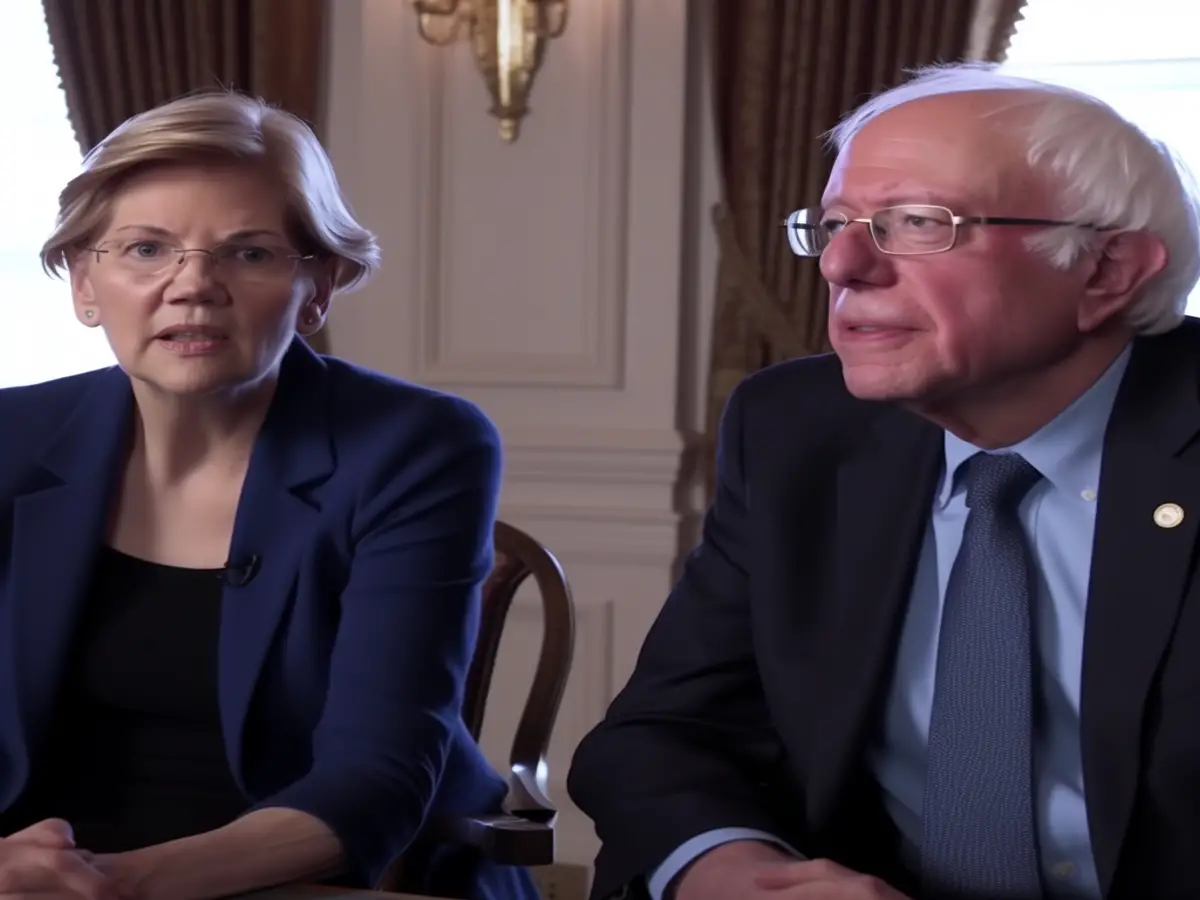

Senators Elizabeth Warren, Angus S. King, Jr., Richard Blumenthal, Gary C. Peters, Bernard Sanders, Sheldon Whitehouse, and Brian Schatz wrote a joint letter to both the agencies on 10 October.

The Congress members expressed their concerns that given the Treasury’s delay of around two years in issuing the rules, it wouldn’t be possible for the proposed rules to be implemented until 2026.

The 2021 Infrastructure Investment and Jobs Act stipulated crypto broker reporting requirements on all tax returns filed from 2024 onwards. The delay contravened the above directive, the senators wrote.

$50 billion in unpaid crypto taxes a year, CNBC says

The representatives cited a May 2022 CNBC report to express their disappointment with the fact that the IRS might be losing out on $50 billion a year in unpaid crypto taxes. The reason for this huge loss could be lack of understanding about crypto taxation among consumers or willful tax evasion.

The members argued that as soon as these rules get implemented, authorities could curtail “industry efforts to evade regulation.”

It would also provide clarity to taxpayers, and generate “billions in tax revenue” from a “chronically tax-avoidant” crypto industry.

The IRS proposed crypto tax reporting rules in August. The proposed rules would regard crypto brokers as regular brokers. They would oblige crypto brokers to furnish users with necessary details to file their taxes.

They would also require the brokers to submit income details about crypto trades to the IRS. These measures would help the IRS maintain a robust crypto taxation system and track down suspected tax evaders.

Representatives applaud three elements of the proposed rules

The members nonetheless applauded the efforts of the agencies in preparing crypto tax rules. In particular, the members highlighted three elements of the proposed rules that satisfied them.

The first is the definition of the term “brokers” as any party that facilitates crypto sales while knowing the identity of the seller and the nature of the transaction.

The second is the definition of the term “digital asset” that means a digital representation of value recorded on a cryptographically secure ledger or similar technology.

The third element refers to both the administrative bodies updating Section 6045A. The rule, if and when updated, will compel crypto brokers to report the transfer of crypto assets to the IRS and other brokers.

However, the senators were concerned that the delay might provide another chance to “crypto lobbyists” to hinder tax reporting measures of the government.

The representatives asked the agencies to provide an update by 24 October.

Meanwhile, a public hearing is scheduled for 7 November. The proposed rules have garnered nearly 140 comments so far. Comments are due at the end of October.