SHIB cools near May high – Should you long it?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SHIB maintained its bullish streak over the weekend.

- Open Interest rates increased, too, over the weekend.

Shiba Inu [SHIB] extended its bullish streak over the weekend (5-6 August). The memecoin posted extra +25% gains between 4-5 August and forayed above the May high of $0.00001020. But it recorded a sharp retracement on Sunday (6 August) and could give bulls another long opportunity if the uptrend stays on course.

Is your portfolio green? Check out the SHIB Profit Calculator

Should you bid at these levels

The strong rally seen at the end of last week (from 3 August) was fronted by the bullish breaker block of $0.00000785 – $0.00000824 (cyan). During the upswing, SHIB’s price action mounted above the previous price range in May but stalled above the May high.

SHIB chalked a sharp retracement near the weekly bearish order block (OB) of $0.00001050 – $0.00001089 (red). Besides, the weekend upswing left a price imbalance and FVG (fair value gap) at $0.00000886 – $0.00000938 (white).

If the bullish sentiment prevails, the retracement could ease at March/April support of $0.00000965 or the confluence area of the FVG and previous range-high ($0.00000903). If so, a rebound could present two possible long set-ups.

The first and conservative approach is longing upon a retest of the $0.00000965, targeting $0.00001188. Secondly, longing upon retest above the confluence area, at $0.00000940, with take-profit at the recent high ($0.00001050).

A drop below the FVG zone of $0.00000886 – $0.00000938 (white) will invalidate the bullish idea. A retest of the bullish breaker block (cyan) could be likely in such an extended pullback scenario.

The RSI and CMF recorded positive readings, underscoring the strong buying pressure and capital inflows in the last few days.

Buying volumes improved slightly

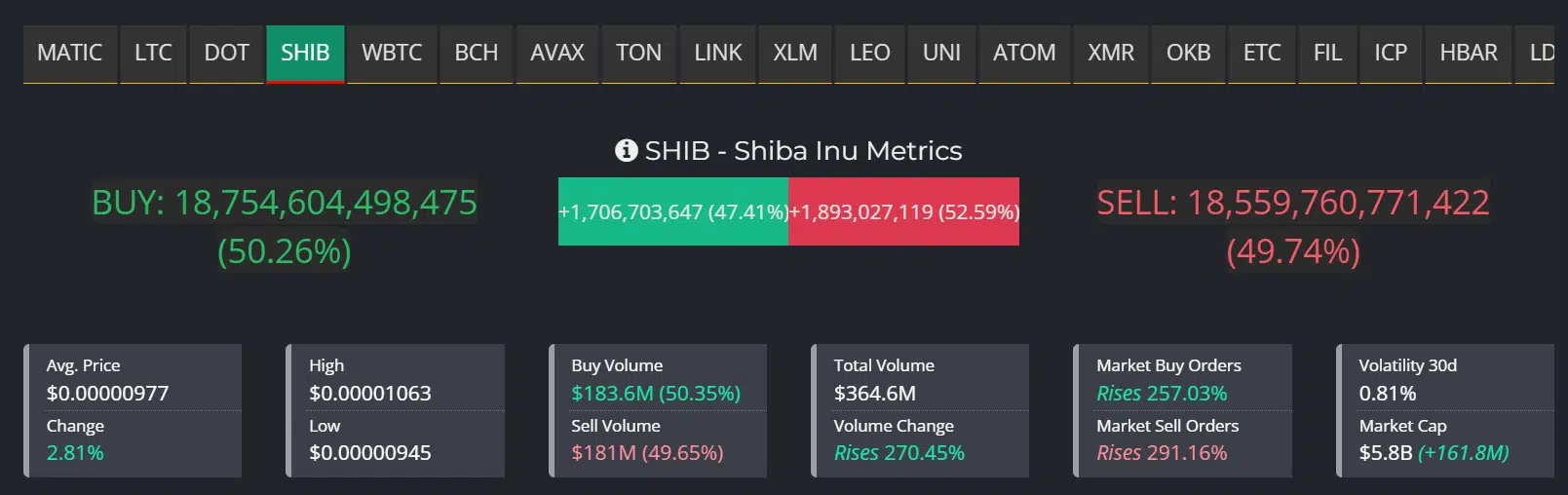

At the time of writing, market sell orders rose by >290%, capturing the sharp retracement seen over the weekend. Nevertheless, market buy orders also surged, with an overall buy volume of 50.26%, against a sell volume of 49.74%.

The inference from above is that the price could take any direction, given the little spread between buy/sell volumes.

How much are 1,10,100 SHIBs worth today?

But the futures market had a bullish inclination and suggested a likely further upside. For example, the Open Interest rates and volume increased by +8% and 130%, respectively, according to Coinglass.

If the uptrend continues, the FVG and March/April support will be key interest price levels for SHIB bulls.