SHIB, DOT, Cardano prices crash – Do predictions say it’s a good time to buy?

- Traders lost millions of dollars to the widespread correction.

- The volumes of ADA, SHIB, and DOT increased but that might not be good news.

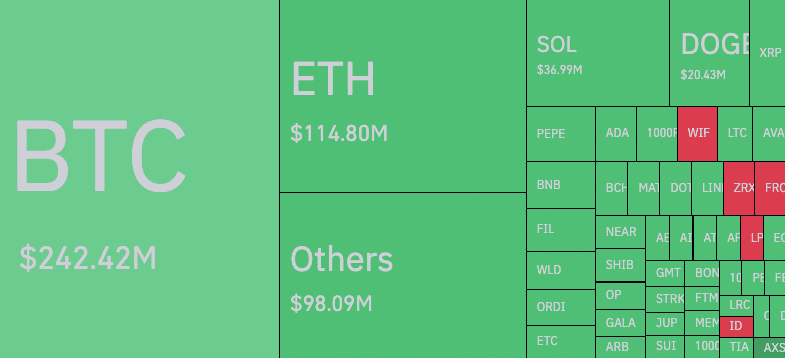

Triggered by Bitcoin’s [BTC] precipitous drop to $67,640, the prices of Shiba Inu [SHIB], Polkadot [DOT], and Cardano [ADA] experienced steep corrections in the last 24 hours.

At press time, SHIB had declined by a whopping 11.87%. This pegged back its price as it changed hands at $0.000029. However, the memecoin’s price was not the only affected metric. As a result of the price decrease, Shiba Inu’s market cap fell out of the top 10.

DOT, on the other hand, registered a 4.27% decrease within the same period as it value fell to $10.64. ADA, which was previously on its way to $0.80, decreased by 5.95% while trading at $0.71.

The storm cracks down on the excitement

According to AMBCrypto’s analysis, the turbulence caused massive liquidations in the market. In the context of the crypto market, liquidation is usually caused by unfavorable market movements.

It occurs when an exchange forcefully closes a trader’s position due to insufficient funds to keep it open. Within the last 24 hours, SHIB longs experienced a wipeout worth $1.19 million.

However, the Liquidation Heatmap gotten from Coinglass showed that shorts liquidation was worth $316,410

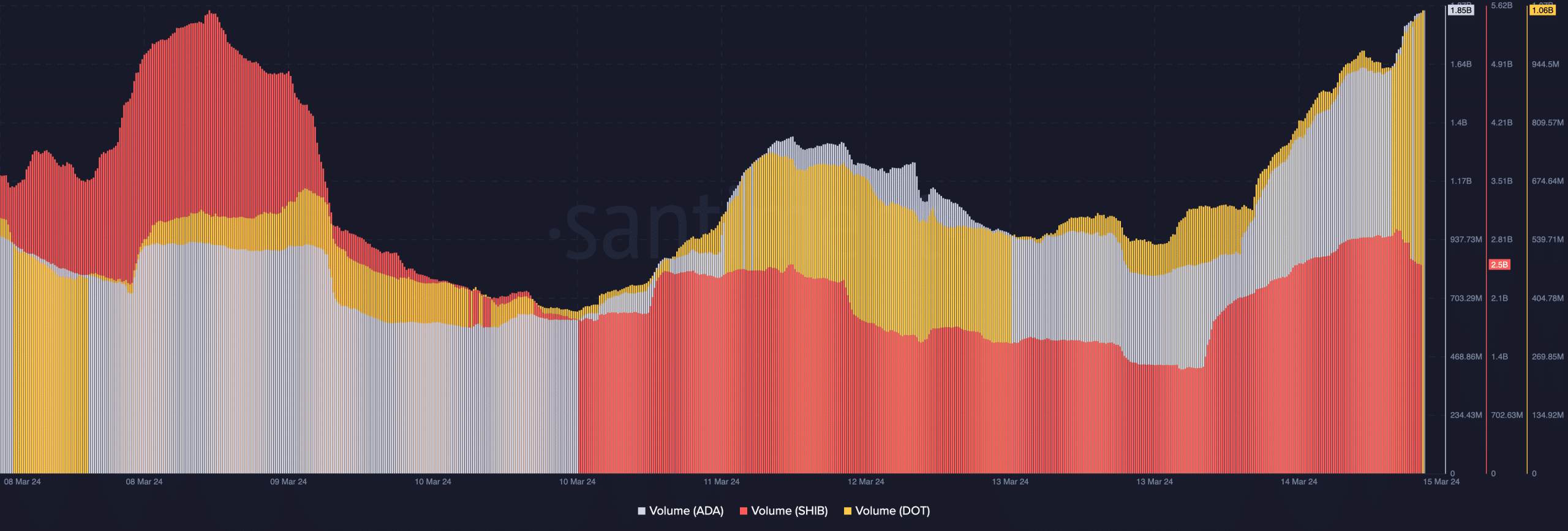

For ADA and DOT, it was a similar situation as there was more long liquidations than shorts. Beyond traders’ loss of fund, AMBCrypto also observed that the volume of these cryptocurrencies jumped.

As of this writing, Cardano’s volume had increased to 1.85 billion. Polkadot’s jumped to 1.06 billion while Shiba Inu’s volume initially rose to 2.81 billion before declining to 2.50 billion.

Typically, rising prices on surging volumes indicate an healthy uptrend. But in the case of SHIB, DOT, and ADA, the falling prices on increasing volume indicate the values might be gathering strength to the south.

Are these dips for buying?

If the volume continues to rise while the prices decreases, then the value might decline further. However, a falling volume could make the downtrend weak and probably foster a rebound.

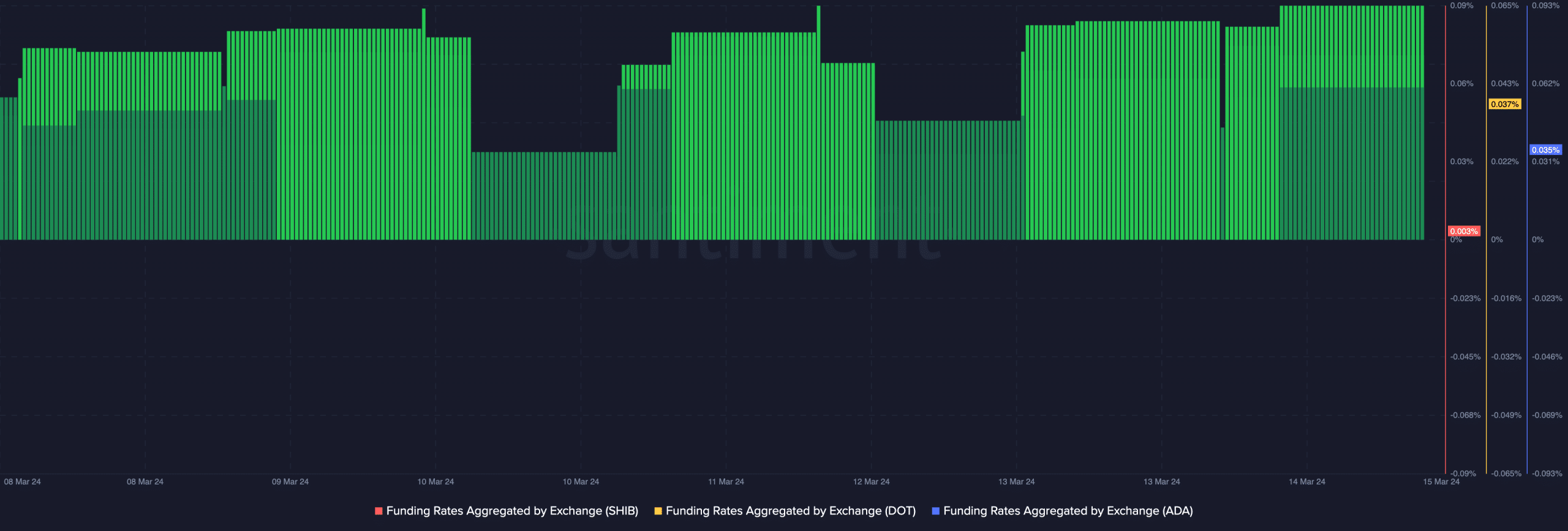

In terms of the Funding Rate, on-chain data showed that it was positive on all three ends. A positive Funding Rate implies that the perp price was trading above the spot value.

Whenever this happens, it becomes more expensive for traders to keep their positions open. To avoid possible liquidation, traders can sell the perp, buy the spot, and take the Funding Rate as an incentive.

Realistic or not, here’s SHIB’s market cap in ADA terms

From a price-based angle, the positive Funding Rate while price move lower could be bearish for ADA, SHIB, and DOT. In a situation like this, longs’ aggression is intense but rewards don’t seem to be forthcoming.

Therefore, this could causes the respective prices to key into resistance rather than pump into support. However, a further decline might not be entirely bad as participants could have a chance at buying the dip before the next leg up.