SHIB prices down by 25% – Should you buy the dip?

- Shiba Inu was trading at a crucial demand zone.

- The fall to the 78.6% retracement level meant prices could continue to slowly bleed lower before a recovery.

Shiba Inu [SHIB] prices dropped by nearly 25% after the wave of selling on 3rd January. This was not isolated to the SHIB market. Bitcoin [BTC] shed 10.44% on the same day. However, both assets saw a bounce in prices.

AMBCrypto examined the Shiba Inu burn rates and what it could mean for 2024 prices in an earlier report. On-chain metrics also pointed toward a bullish bias, but investors might want to wait a while longer.

The 50% retracement level could be hotly contested

The market structure of SHIB was firmly bearish. The RSI also fell below neutral 50 to reflect downward momentum.

The OBV has slowly fallen over the past month. This drop was a mere dip compared to the early December gains on the OBV.

Hence, selling volume has not been as steady or high as the buying was on the way upward.

Shiba Inu prices dropped to $0.00000827 on 3rd January, which was the 78.6% Fibonacci retracement level (yellow). It bounced to $0.0000101 on 4th January.

Despite the bounce, the bullish prospects look somewhat weak for Shiba Inu. It was trading in a demand zone at press time.

This was a 12-hour bullish order block. Yet, the long downward candlewick would likely be filled in the coming days. In mid-November, the orange box highlighted a candlewick filled in a bullish trend.

The trend is bearish now, and was more reminiscent of the August drop. Therefore, a continuation downward to the 78.6% or slightly lower is a possibility investors must be prepared for.

The supply on exchanges saw a steady drop

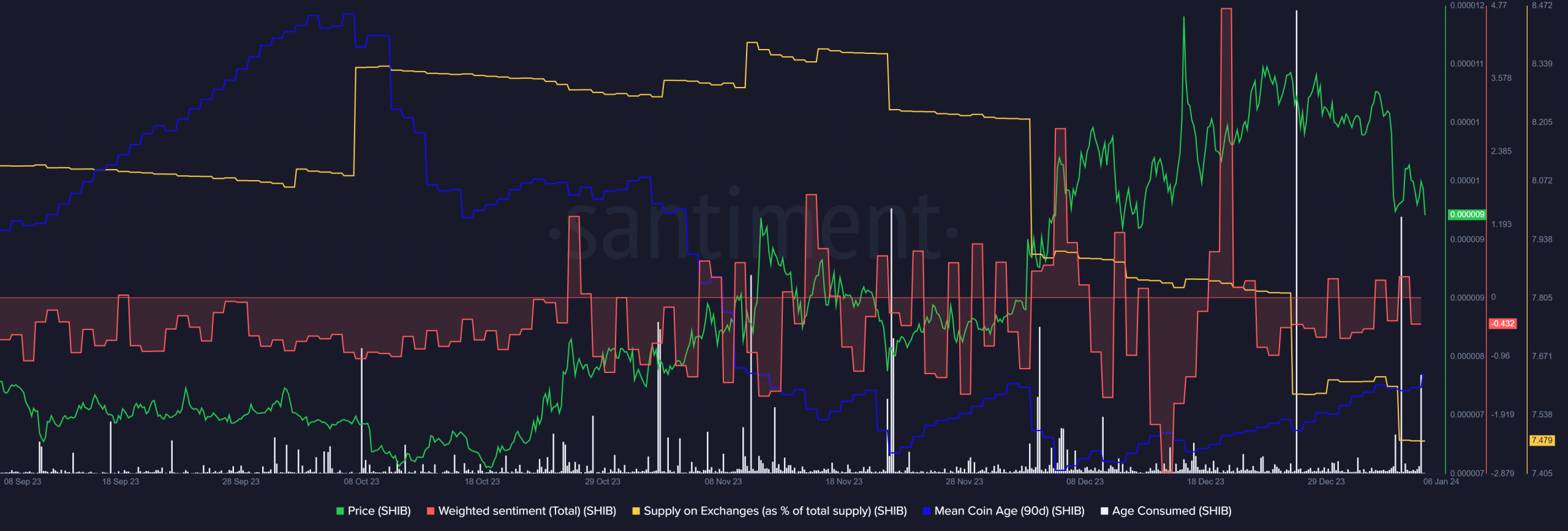

Source: Santiment

The supply on exchanges metric trended higher in October and the first half of November. Thereafter, it has fallen. This showed increased SHIB accumulation. The mean coin age also reversed its downtrend in the past month.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

Together, they showed that the meme coin has steady holders in recent weeks. Moreover they were likely looking to buy more. The market sentiment has been negative over the past two weeks. The age consumed metric saw a sharp surge on 3rd January.

This was a strong signal of a high volume of SHIB token movement and pointed toward the likelihood of a wave of selling. Another, smaller wave could be imminent.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.