Shiba Inu: A look at what February holds for SHIB traders

- Shiba Inu is expected to rally past $0.0000105 as per technical analysis.

- The on-chain metrics showed the meme coin could see distribution and a drop in prices.

Shiba Inu [SHIB] displayed a bullish bias on the 1-day price chart. It was yet to convincingly break the recent lower high, but its indicators showed promise. AMBCrypto noted that the Shiba Inu burn rate had turned negative on the 13th of February.

The one-day price chart showed that some significant obstacles remained for SHIB bulls to beat. Yet, odds favored the buyers, and a bullish Bitcoin [BTC] could help them out further.

Considering the market structure

AMBCrypto analyzed the one-day price chart of Shiba Inu. The meme coin noted gains of 13.2% since the 7th of February. Moreover, the Fibonacci retracement levels (pale yellow) for the mid-November rally highlighted the $0.00000854 level as the 78.6% retracement.

In the past two months, SHIB has retested this level thrice before bouncing higher. The more recent retest came on 23rd January. The past week saw the OBV climb higher, which hasn’t happened consistently since early January.

This uptick was indicative of a rise in buying volume. Additionally, the RSI was also above neutral 50 to signal bullish momentum was at hand. A move past $0.0000105 would flip the market structure bullishly on the daily chart.

In that scenario, a rally to the $0.00001195 and higher to the Fibonacci extension levels can be expected over the coming weeks.

Shiba Inu undergoing a distribution phase?

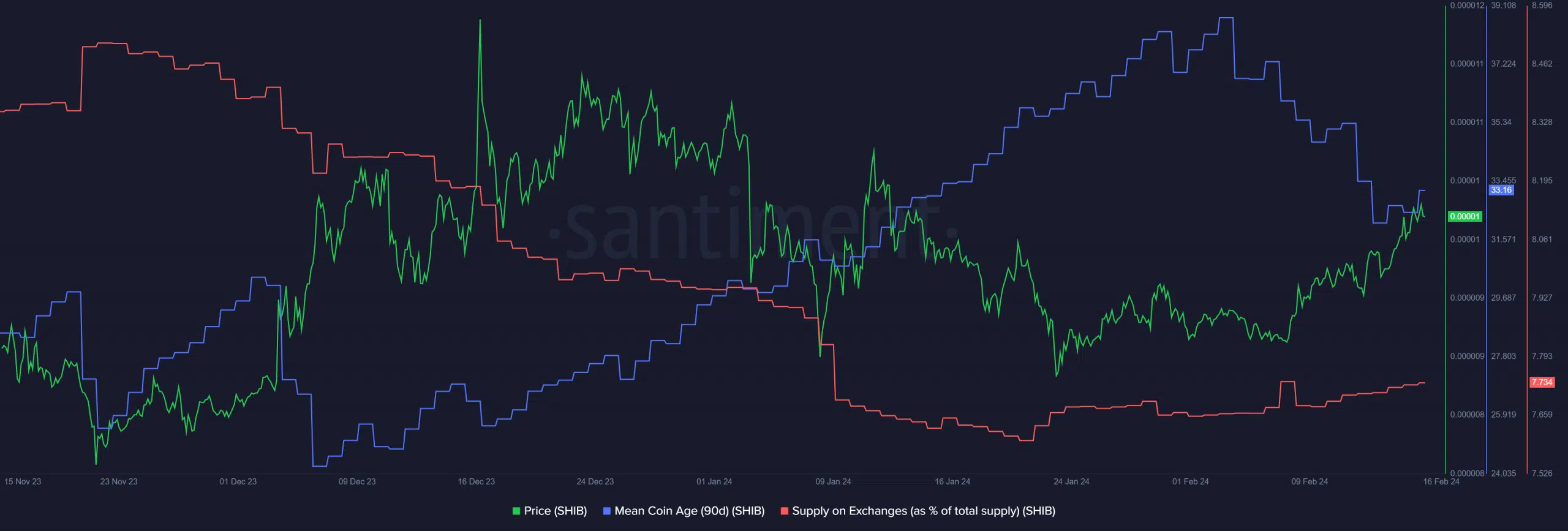

Source: Santiment

The mean coin age metric noted steady and significant gains in the latter half of December and throughout January. Yet, it took a sharp downturn in February. The downtrend meant holders were moving their SHIB, presumably to centralized exchanges to sell the token.

The supply on exchanges metric has tended slowly upward in the past three weeks.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

Therefore, it was likely that the token would see some selling pressure soon. It was unclear if this would be enough to undo the recent gains that the token has posted.

Recent news that large SHIB whales continued to accumulate the meme coin spelled a positive bias for the coming weeks. This explained the large gains that the mean coin age metric saw earlier in 2024.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.