Analysis

Shiba Inu awaits a golden cross: A signal for you to buy SHIB today?

The price action and momentum were bullish, but the buying volume was tepid. This trend was seen in the mean coin age as well.

- Shiba Inu has defended the fair value gap and is likely to retest the nearby resistance.

- The lack of accumulation could delay bullish efforts.

Shiba Inu [SHIB] was up 3.5% in the past 24 hours and 12.2% in the past month. However, it was unable to match Dogecoin’s [DOGE] performance after the leading meme coin by market capitalization surged 24% within a month.

The token was trading beneath a zone of resistance, but there were positive expectations in the coming weeks and months.

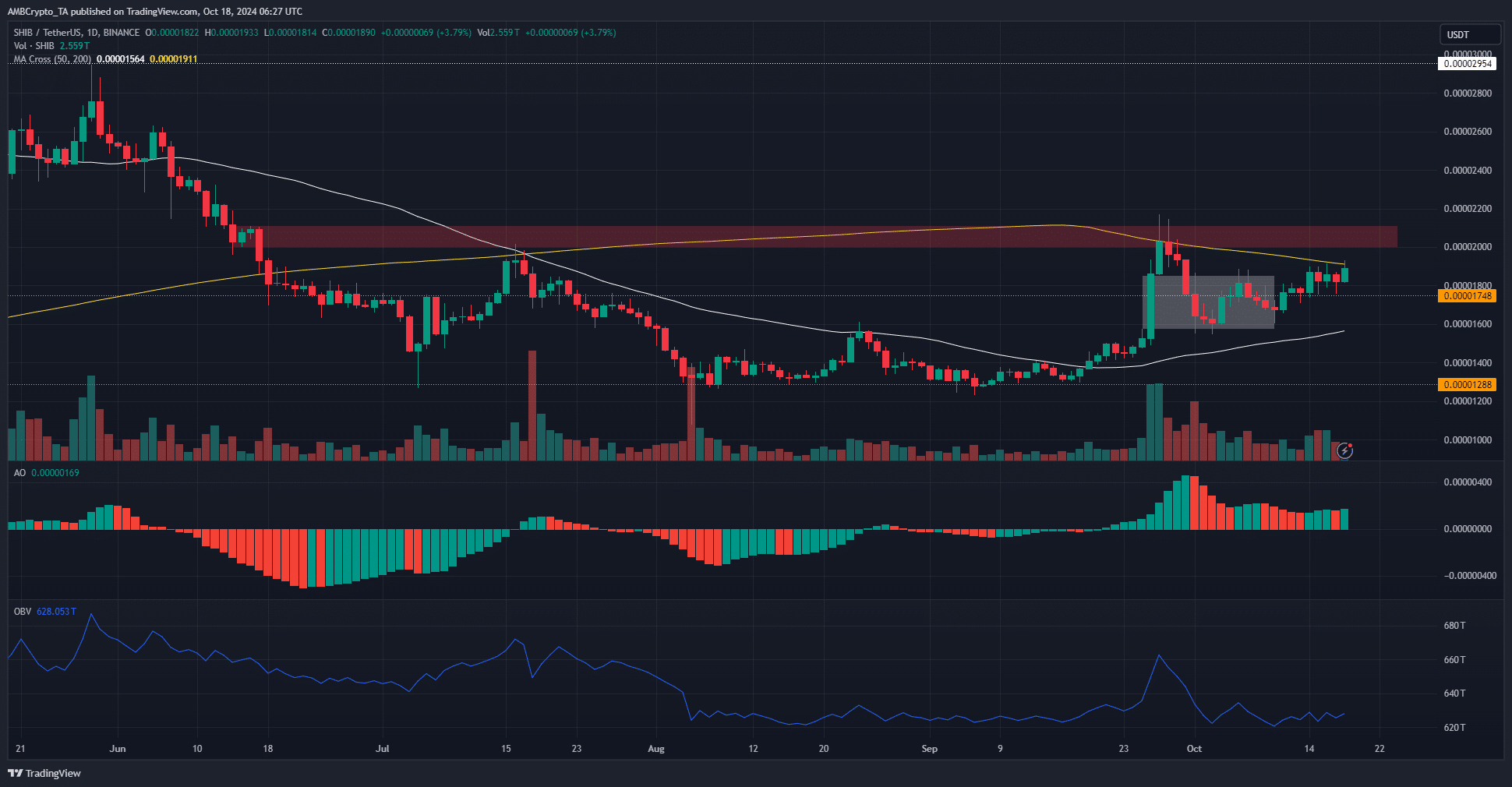

The Shiba Inu golden cross could herald the next uptrend

The Awesome Oscillator showcased bullish momentum behind Shiba Inu. The market structure on the daily chart was also bullish. The trading volume was higher than it was in September.

This was a positive sign as the price closed in on the resistance zone at $0.00002. However, the OBV continued to meander near the August and September lows. Buying pressure needs to ramp up to boost the chances of a strong breakout.

The golden cross is a phenomenon where the 50 and 200-period moving averages make a bullish crossover. At press time, this is not the case. When it does occur, it could be a sign to traders that Shiba Inu is well positioned for a strong rally.

Challenges for SHIB bulls

Source: Santiment

The price action and momentum were bullish, but the buying volume was tepid. This trend was seen in the mean coin age as well. The steady downtrend since September showed that there was network-wide distribution in progress.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

Additionally, the recent gains meant that short-term holders were at a profit. This can incentivize them to sell SHIB, potentially delaying the breakout past $0.00002.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion