Shiba Inu – Key indicator’s 200% price hike prediction after break from Bitcoin

- The correlation between the cryptocurrencies dropped after prices went in different directions recently.

- A thorough analysis showed that SHIB might hit $0.00013.

Shiba Inu’s [SHIB] red-hot start to March, ensured that the token’s correlation with Bitcoin [BTC] was a strong one. But ever since SHIB lost its lucky strike, the token and BTC have been moving in opposite directions.

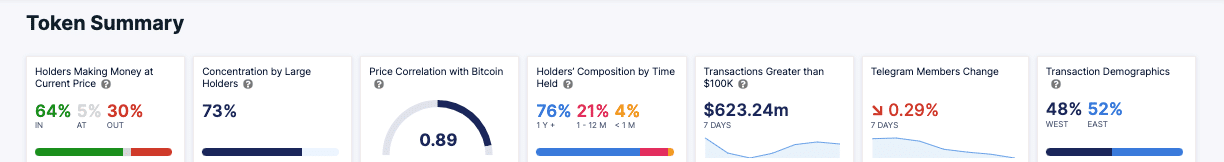

According to IntoTheBlock, SHIB’s price correlation with Bitcoin has not been closely knit. About a month and some weeks back, the 30-day correlation was almost 0.94. However, AMBCrypto observed that the metric had dropped to 0.89 at press time.

Correlation ranges from -1 to 1. Values from -1 to 0 imply that the prices of cryptocurrencies involved are skewed negatively. On the other hand, reading close to 1 suggests that the assets involved move in a similar direction.

Capital to flow from BTC to the memecoin?

In the last 30 days, Bitcoin’s price has increased while SHIB registered a 5.72% decrease. However, the performance of the memecoin could be in its favor.

In recent articles, we reported that capital from BTC might start flowing into altcoins. Should this be the case, SHIB’s declining correlation could deviate from Bitcoin’s potential bearish trend.

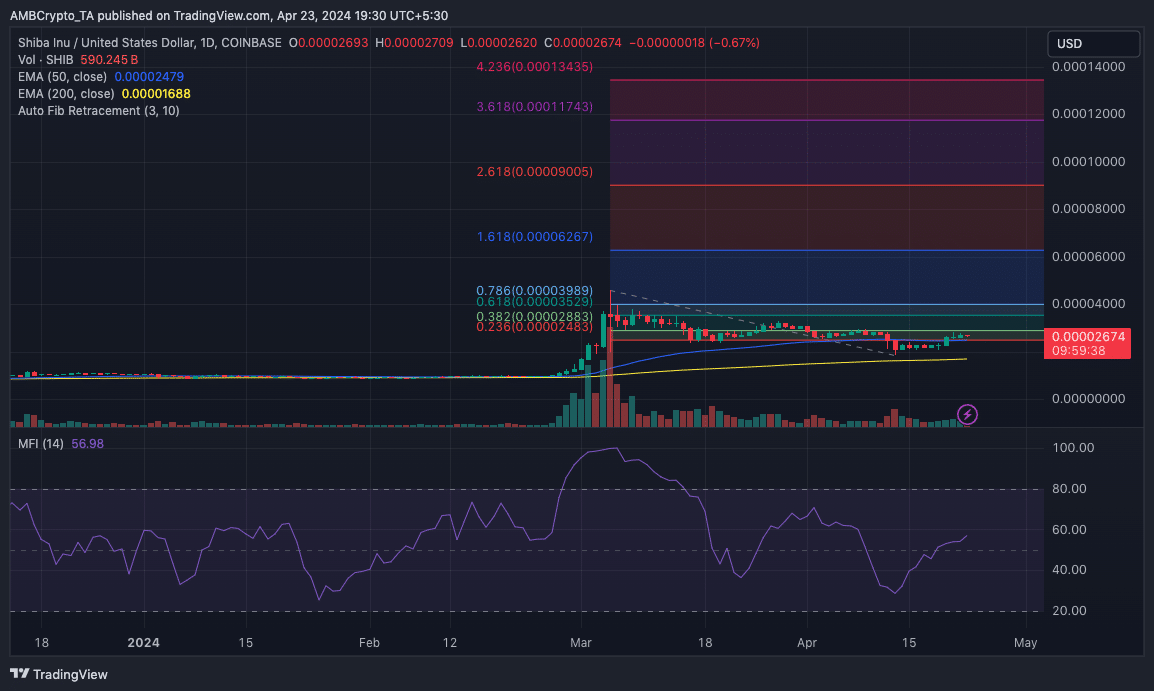

If this is the situation, what heights can the token reach? On the daily timeframe, the Exponential Moving Average (EMA) showed a bullish trend for SHIB in the long term.

At press time, the 50 EMA (blue) had crossed over the 200 EMA (yellow) and the token’s price was a lot higher than both EMAs. With this position, the price of the token might not fall below $0.000010 this cycle.

Instead, the Fibonacci indicator suggested that SHIB might tap $0.00013 at the height of the bull market. This means that the price still has the potential to surge higher than a 200% increase.

In the short term, SHIB’s price might revisit $0.000030 according to indications from the Money Flow Index (MFI). As of this writing, the MFI was close to 60.00, indicating that a great amount of capital was flowing into the token.

Both assets share the glory

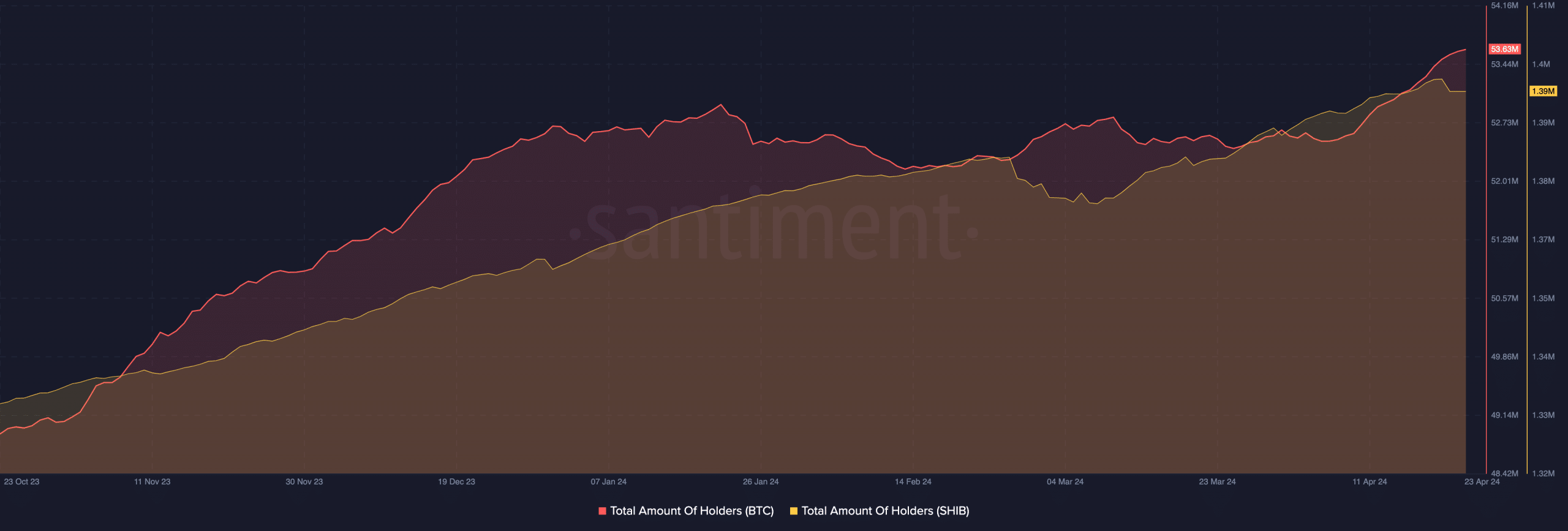

Should this continue, SHIB might outperform BTC in the weeks to come. Despite the potential to outpace BTC in the short term, SHIB might never get close to the number of holders with Bitcoin in their portfolio.

According to Santiment, the total amount of BTC holders was 53.63 million. Shiba Inu, on the other hand, had 1.39 million.

In addition, the simple interpretation of this means many market participants believe in the long-term potential of Bitcoin over SHIB.

Realistic or not, here’s SHIB’s market cap in BTC terms

However, that is not to say the SHIB’s long-term potential is not one to watch. But in years to come, the price action might not be able to match Bitcoin’s.

For the short to mid-term, this might not be the case as SHIB’s price might climb much higher.