Shiba Inu burns 18.7 mln tokens – But SHIB’s price isn’t budging

- SHIB’s burn rate surged to over 18.7M tokens in a day but dropped 31% the following day, highlighting short-term volatility.

- With only 36% of holders in profit and price facing strong resistance at the 50 EMA, SHIB’s next move remains uncertain.

Shiba Inu [SHIB] witnessed a massive spike in its token burn rate on the 22nd of March, climbing by a staggering 774,273.92% in 24 hours, with over 18.7 million tokens destroyed.

However, the momentum fizzled out soon after, with the burn rate plunging by 31.75% to 11.6 million within the following day.

This sharp shift raises questions about the sustainability of SHIB’s deflationary drive and whether market participants are responding accordingly.

Shiba Inu’s burn rate soars, then fades

Data from Shibburn revealed that the token’s total weekly burn stood at 74.9 million on the 22nd of March but climbed to nearly 85 million by the 23rd of March — despite the dramatic drop in daily burns.

While such burn spikes can create bullish sentiment, Shiba Inu’s market reaction remained muted. Over the last 24 hours, SHIB gained only 1.58%, trading around $0.00001289 at press time.

Price holds ground, but trend is unconvincing

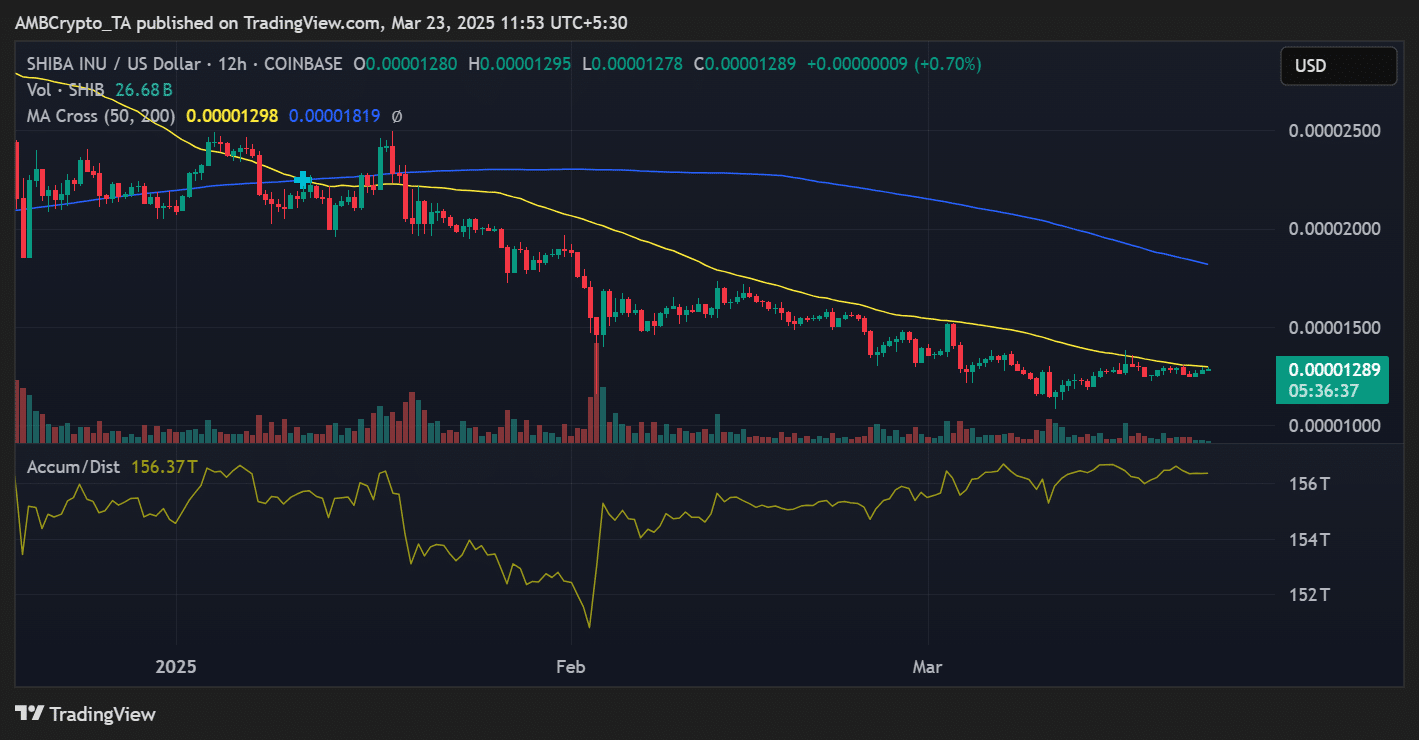

On the charts, Shiba Inu’s 50 EMA [$0.00001298] remained above the price, acting as a key resistance level.

Price action over the past two weeks showed a slight uptick, but there’s little evidence of breakout momentum. The Accumulation/Distribution indicator stood at 156.37T, showing a steady inflow of capital.

Yet, it’s not enough to catalyze a strong price rally.

Divided Shiba Inu sentiment

As per IntoTheBlock data, only 36% of SHIB holders were in profit at the current price, with 59% in the red. Meanwhile, 76% of holders have held SHIB for over a year, suggesting strong long-term conviction.

Notably, whales controlled 74% of the supply, reinforcing the risk of sudden price swings due to large-volume moves.

Correlation with BTC and what lies ahead

With a 0.75 correlation to Bitcoin, SHIB’s price action may remain influenced by broader market trends rather than internal burn mechanics alone.

While the burn activity adds a deflationary layer, price breakouts will likely depend on either whale accumulation or a broader market rally.

In conclusion, despite the sharp rise in Shiba Inu’s burn rate, its short-term price remained relatively flat.

Unless accompanied by sustained accumulation or a break above key resistance levels, these burns may have a more symbolic than material impact on price trajectory.