Shiba Inu buy signal spotted: Is a SHIB price reversal on the horizon?

- Whale accumulation buoyed bullish spirits on SHIB’s charts

- Deviation below the range followed by a quick reclamation gave a high probability buy signal

Shiba Inu [SHIB] has suffered losses alongside the rest of the memecoin sector since late November. Bitcoin’s [BTC] struggle to reclaim $100k and the accompanying price volatility did not aid SHIB bulls one bit.

However, the background doom and gloom sentiment did little to dissuade a whale from moving 8.18 trillion SHIB out of Crypto.com exchange. These tokens were valued at around $195.1 million at the time.

A SHIB buying opportunity near the range lows

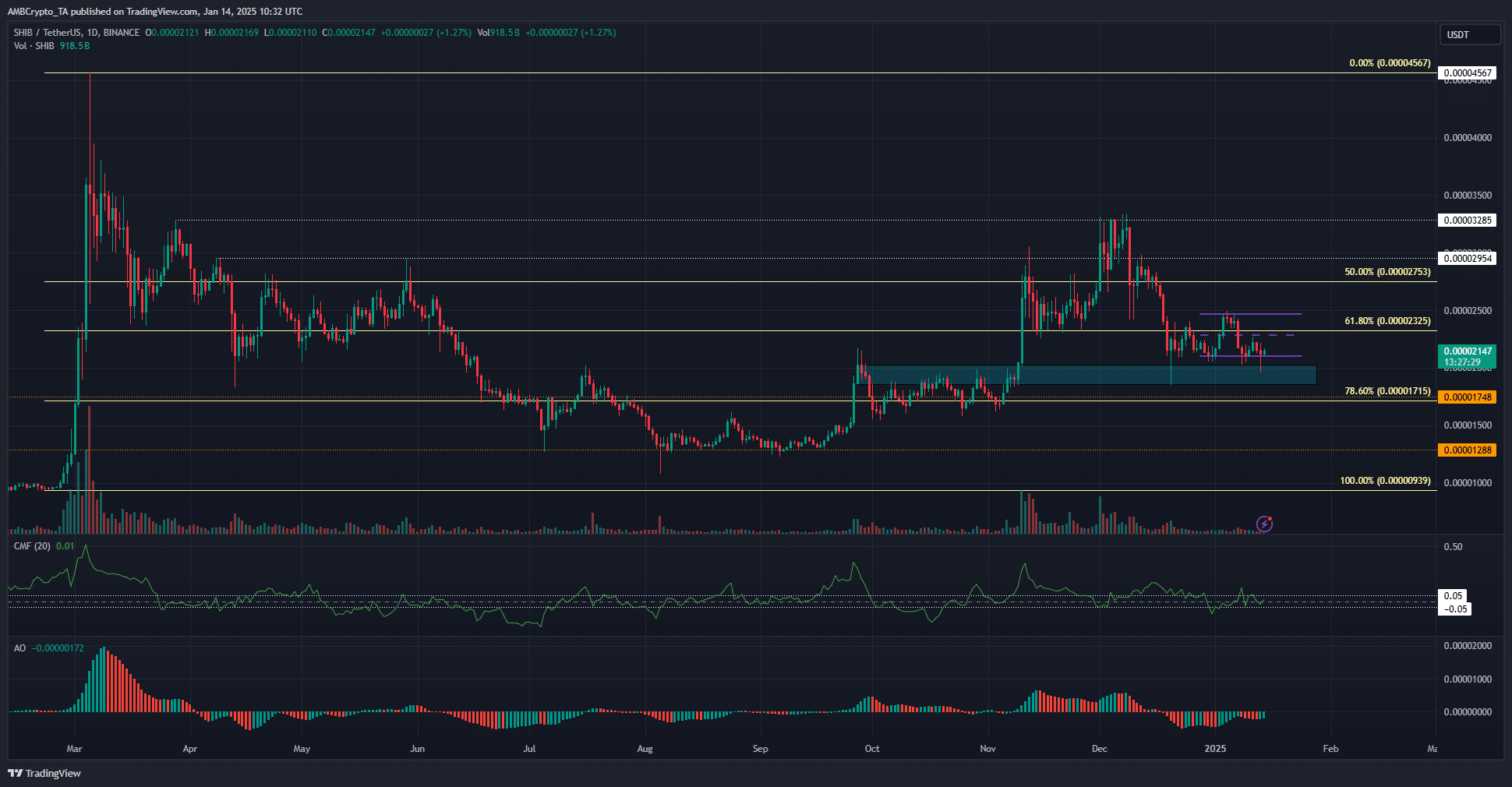

The daily chart revealed that Shiba Inu was on a slow path to recovery after the deep correction in mid-2024. The $0.00002 zone, which had been a resistance before November, remained a support zone at press time.

And yet, the daily timeframe structure was bearish after the December slump took the price below the 61.8% retracement level at $0.00002325. Since then, the same level has opposed bullish efforts to break out, leading to the formation of a short-term range.

The capital inflows were neutral and the momentum was slightly bearish on the daily chart, according to the Awesome Oscillator.

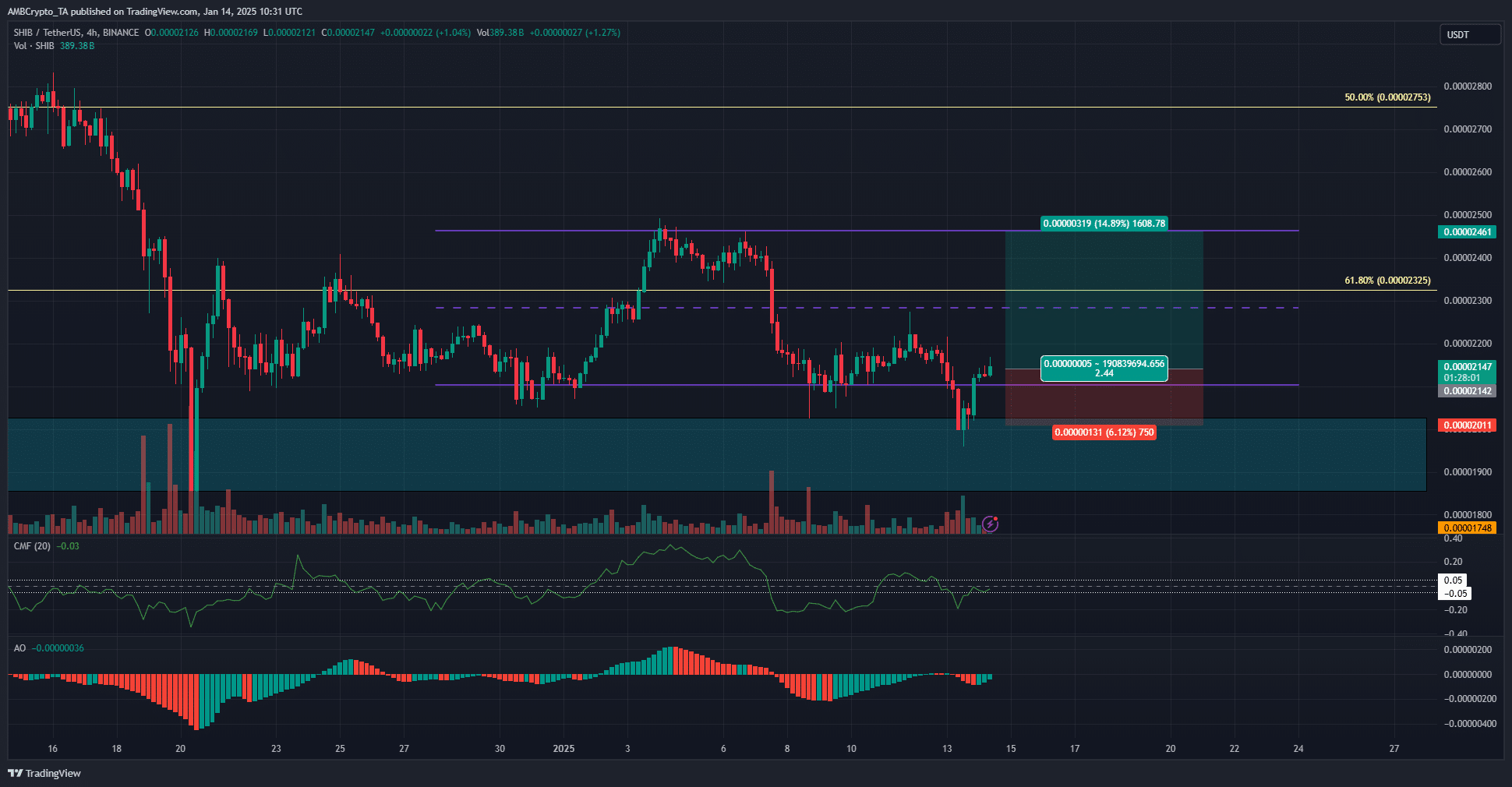

The short-term range formation was clearer on the 4-hour chart. The range lows at $0.000021 momentarily failed on Monday as BTC slid to $89.2k. Since then, Shiba Inu has recovered rapidly. This deviation below the range lows and the quick recovery was a strong buy signal.

Read Shiba Inu’s [SHIB] Price Prediction 2025-26

It meant that there may be a high chance of a bullish price move to the range highs at $0.0000246 over the next week. However, traders must be cautious. The CMF showed that capital flows were slightly negative. Without the buying pressure, SHIB might struggle to clear the mid-range resistance at $0.0000228.

Traders can set their stop-loss below the local lows, or at $0.0000202, since the lower timeframe fair value gap around $0.0000208 can be expected to halt any downward move.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion