Shiba Inu in trouble: Is a comeback possible after a 12% plunge?

- Shiba Inu bears dominated this week, making it one of the top losers.

- SHIB wedge pattern underscores breakout possibility but on-chain data reveals weak demand.

Shiba Inu [SHIB] has concluded the week as one of the biggest losers among the top 20 cryptocurrencies. However, its performance highlights some interesting observations which may pave the way for a strong bullish comeback.

Shiba Inu was down by more than 12% in the last seven days. This performance made it the second most bearish coin in the list of top cryptocurrencies by market cap according to Coinmarkecap.

The downside also wiped out most of the gains that it had achieved earlier this month, bringing it within 5% of its October opening price.

The Shiba Inu performance was noteworthy because the memecoin has been trading within a wedge pattern and had already converge into the tight squeeze zone. The latest dip almost interacted its ascending support level, raising the possibility of another bullish bounce back.

SHIB had already bounced back by 6.15% to its press time price of $0.000016 at the time of writing. This confirmed that it did experience a significant demand resurgence in the last 24 hours which may foreshadow a potential bullish revival.

Shiba Inu had previously demonstrated a strong uptick at the tail end of September. However, the wedge pattern explains why any rally attempts after that were restricted. But that may change now that chances of a pattern break are quite high.

Evaluating the state of Shiba Inu accumulation

The SHIB wedge pattern should technically induce some activity that might allude to the possibility of a recovery and breakout, or an opposing outcome.

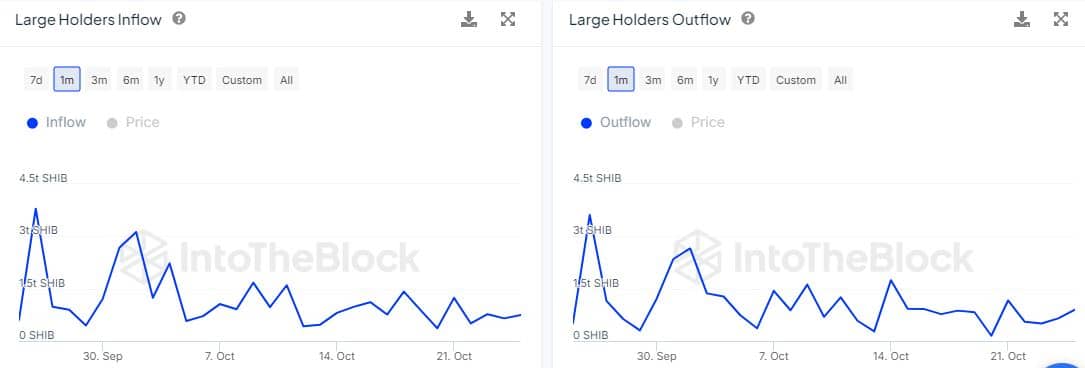

The latest data on large holder flows revealed that more whales were moving Shiba Inu from their balances than whales adding to their balances.

Large holder inflows amounted to 747.75 billion SHIB on 25 October with no noteworthy build up in the prior few days during the week. On the other hand, large holder outflows amounted to 898.96 billion SHIB with notable rise in outflows in the previous 3 days.

Read Shiba Inu [SHIB] Price Prediction 2024-2025

The large holder flows coincided with historical concentration data. The latter revealed that whale holdings dipped from 60.03% at the start of the month to 59.74% as of 25 October. This confirmed that whales trimmed their balances slightly so far this month.

Investor balances rose from 13.24% to 13.31% while retail trader balances gained from 26.73% to 26.75%. While both retail and investor balances rose, they did so my small margins. This reflects the low demand that prevailed I the last 3 weeks.

![Pudgy Penguins [PENGU]](https://ambcrypto.com/wp-content/uploads/2025/05/Evans-54-min-400x240.png)

![Optimism [OP] breaks $0.85 neckline — Here’s what it means for Optimism traders](https://ambcrypto.com/wp-content/uploads/2025/05/Lennox-3-1-400x240.png)