Shiba Inu: Market trends suggest tough road ahead for SHIB traders

- SHIB faces a significant challenge as a key resistance level could dictate its next moves.

- Insights from on-chain metrics indicate a deceivingly bearish sentiment among traders, putting SHIB at risk of further losses.

Over the past week, Shiba Inu [SHIB] has dropped by 11.65%, and the downtrend continues with a 2.11% decrease in the past 24 hours alone, signaling a lack of market interest to push its price higher.

If Shiba Inu cannot overcome this resistance, the bearish trend could continue. Investors and traders alike should watch these developments closely as SHIB approaches this critical crossroads.

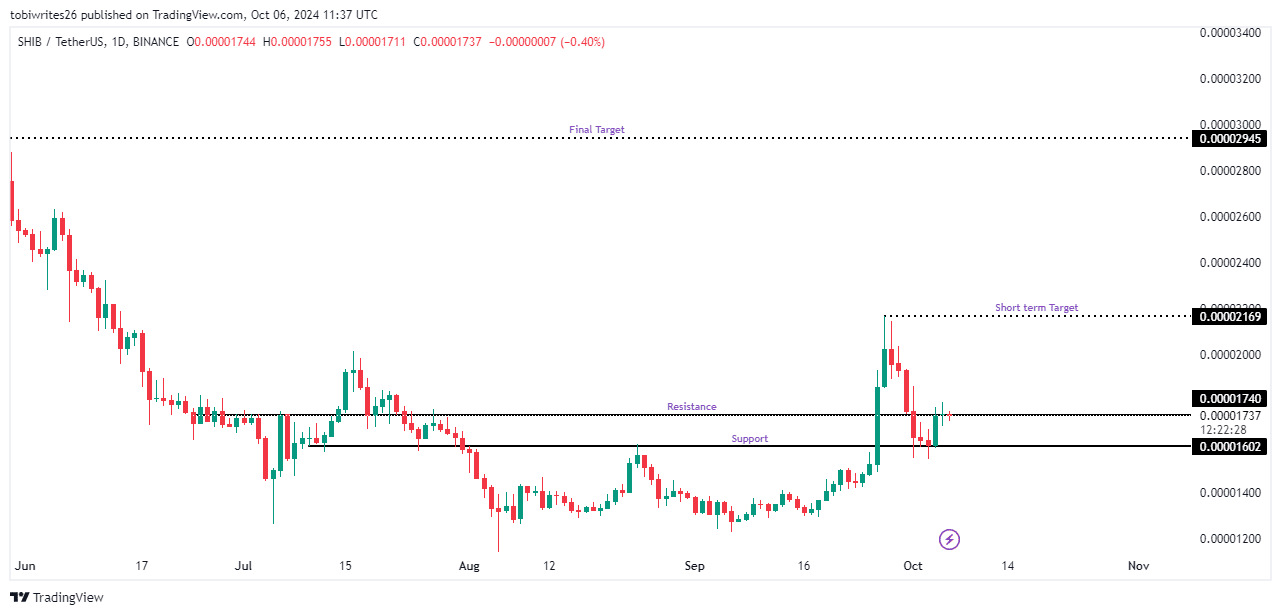

Obstacles to Shiba Inu’s rally

After the recent market crash, Shiba Inu found support at the 0.00001602 level and initially showed signs of recovery. However, its upward momentum has been challenged by a significant resistance zone at 0.00001740.

Resistance zones typically trigger selling pressure, pushing prices lower. The question now is whether market momentum will align with the usual outcomes expected from these zones. Should this occur, the SHIB will drop back to 0.00001602 or further lower.

However, breaking through this barrier could pave the way for SHIB to reach higher targets, setting its sights on a short-term goal of 0.00002169 and a more ambitious long-term target of 0.00002945.

Yet, doubts linger: what do on-chain metrics indicate? Are trading activities suggestive of a bullish trend, or is a downturn on the horizon? Here’s the latest analysis from AMBCrypto on SHIB’s market behavior.

Market remains firmly bearish on SHIB

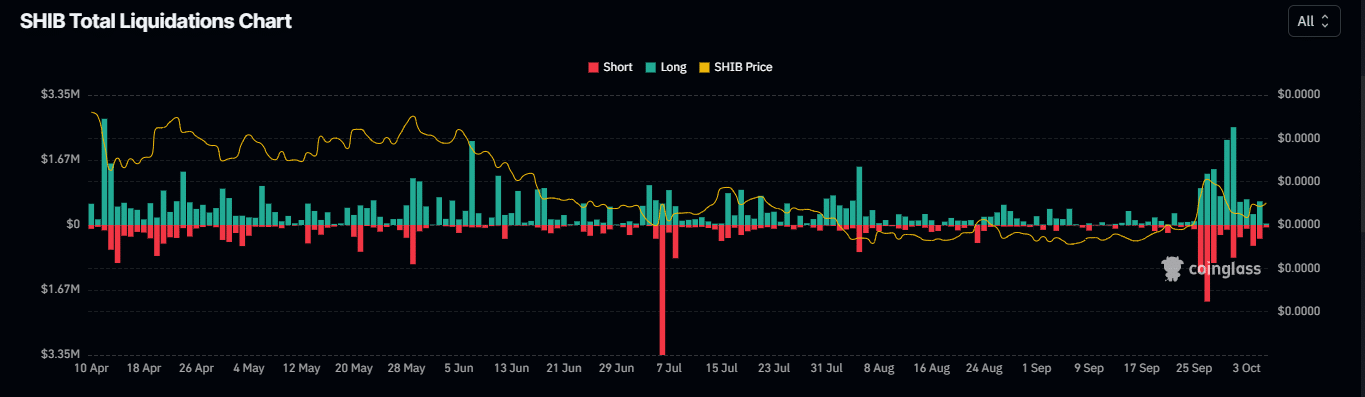

Market sentiment for SHIB continues to be predominantly bearish, with a large number of long traders facing liquidations. These traders had anticipated a price increase that did not materialize.

Moreover, current open interest indicators suggest a predominance of sellers over buyers, exerting further downward pressure on SHIB’s price.

As of the latest update, over $432,970 worth of long positions have been eliminated from the market. This substantial removal highlights the diminishing confidence in SHIB’s potential to rise, leading to considerable losses for traders.

Additionally, open interest—which measures the total level of engagement of market participants—indicates a stronger inclination towards short selling.

This trend suggests an expectation for further declines in SHIB’s price, a sentiment reflected by the volume of unsettled derivative contracts.

Are traders selling SHIB more rapidly?

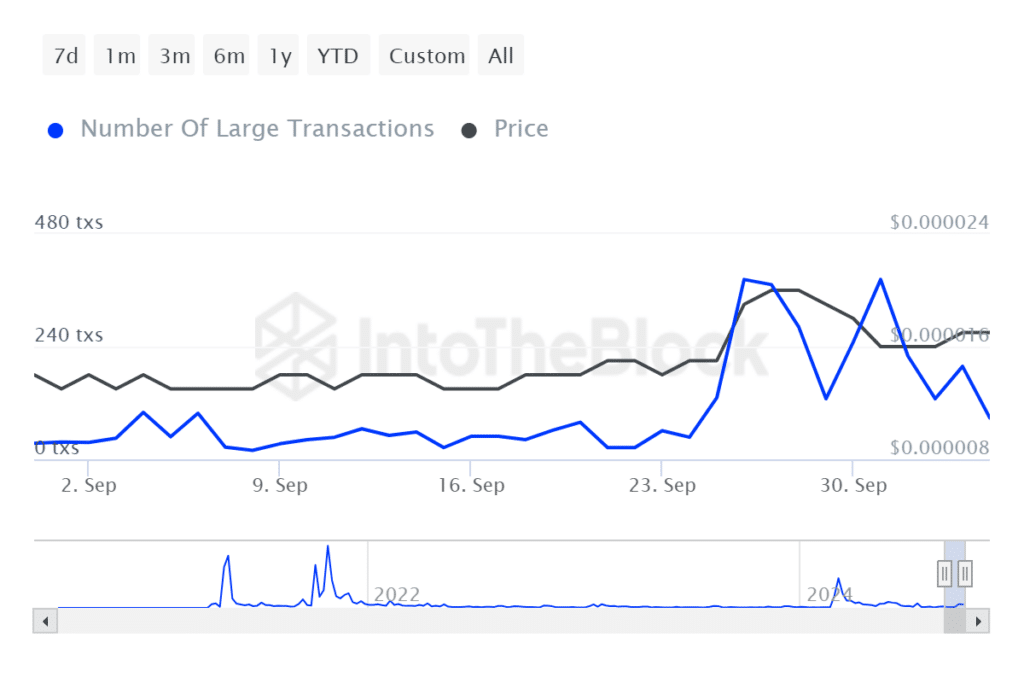

According to data from IntoTheBlock, analyzed by AMBCrypto, there has been a significant downtick in the volume of large transactions involving Shiba Inu, decreasing by 62.57% to $27.99 million.

This suggests that large investors are not buying at the moment, indicating a lack of confidence among this group.

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Coupled with previously mentioned bearish trends, this decrease suggests that traders are increasingly inclined to sell, contributing to the asset’s recent decline.

If this trend persists, SHIB could face further downward movement. However, if the selling pressure eases, there’s still a chance for the rally to regain its momentum.