Shiba Inu price prediction: How SHIB traders can find profits soon

- Shiba Inu has a strongly bearish outlook, but the range formation might see some consolidation.

- Despite presenting a buy signal, the selling pressure was too high for bulls to overcome.

Shiba Inu [SHIB] fell beneath a longer-term range on the 14th of June and has not yet reversed the bearish price trend. However, traders can still profit from the current situation as the meme coin appeared to form a range.

A recent price report noted that Shiba Inu will likely post double-digit percentage losses over the coming weeks.

The lower timeframe charts agreed with that and provided more context on the Shiba Inu price prediction.

Shiba Inu price prediction

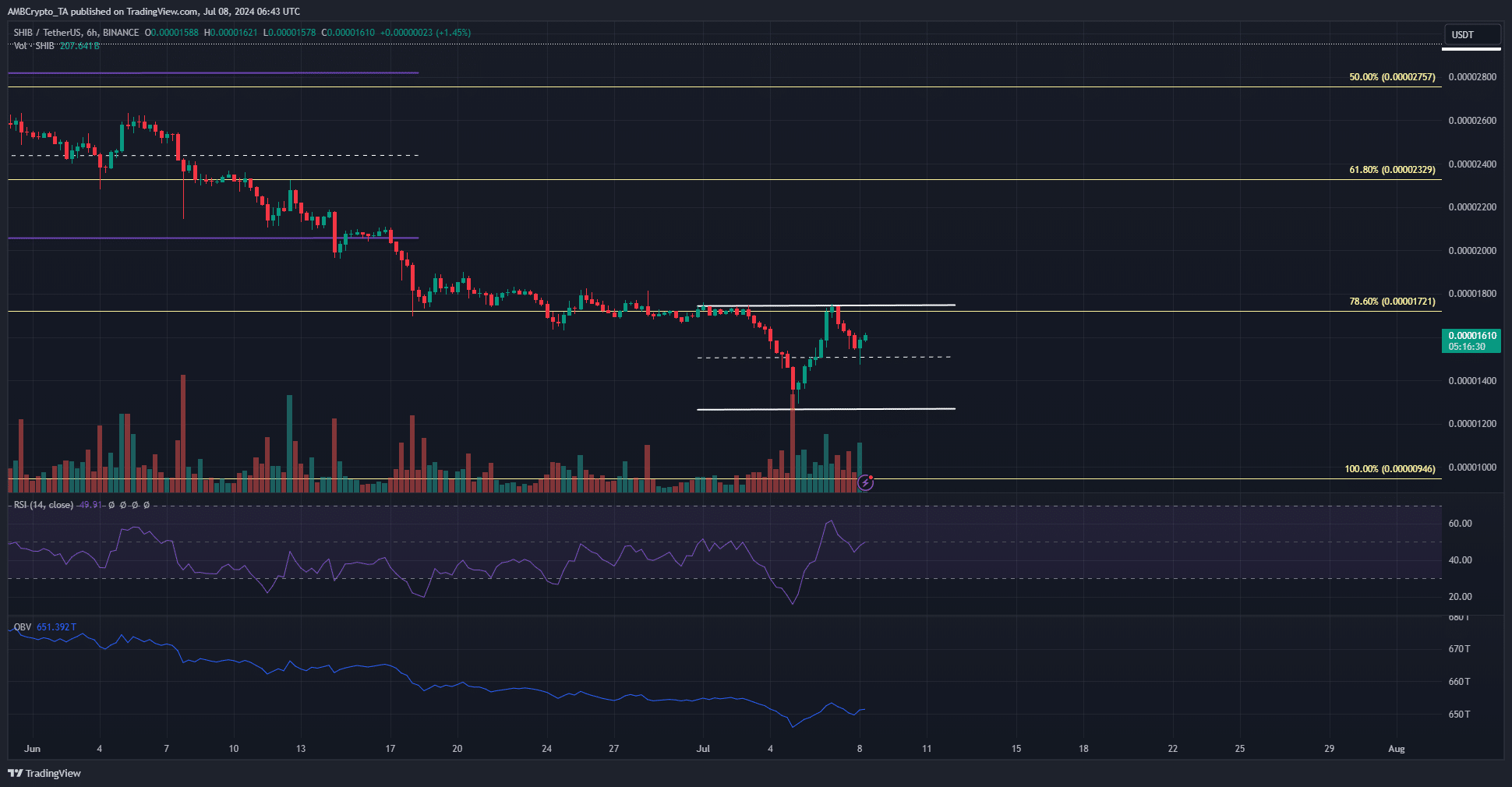

Over the past ten days, Shiba Inu formed a range (white) between the $0.0000174 and $0.0000126 levels. The mid-range level at $0.000015 served as support in the hours preceding press time.

After the drop to the lows, the bounce was accompanied by an increased trading volume. However, this might not be enough to sustain a recovery.

The OBV has been trending downward since June, and its trend has not shifted yet.

The RSI on the 6-hour chart has been below neutral 50 since the beginning of June but forayed past 60 on the 6th of July.

This might be an early sign of a shift in momentum, but until the price breaks out of the range, a recovery will not be on the cards.

Should participants continue to buy?

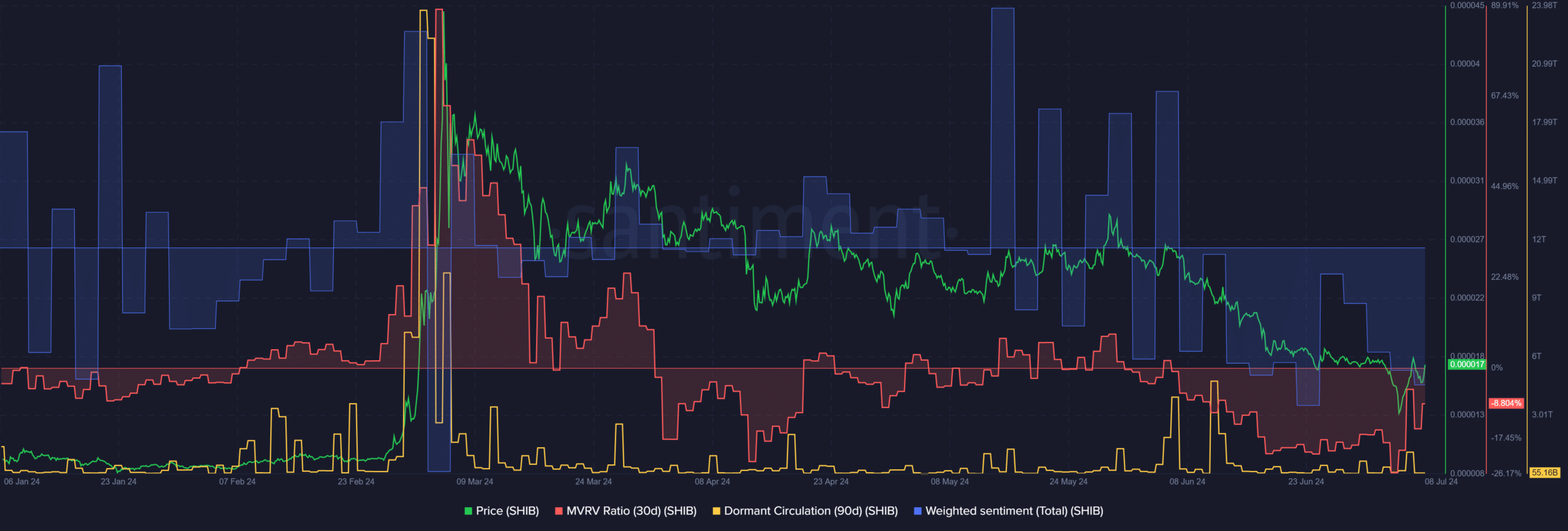

Source: Santiment

The 30-day MVRV ratio has been negative since late May. This metric signaled the meme token is undervalued, but that did not stop the prices from trending downward.

The Weighted Sentiment was also firmly negative.

Is your portfolio green? Check out the SHIB Profit Calculator

The dormant circulation saw small spikes in the past ten days, but the biggest one recently was on the 11th of June.

Overall, it is probably not the right time for investors to re-enter Shiba Inu markets, while traders can wait for a retest of the range highs to sell.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.