Shiba Inu price prediction: Why traders should brace for more losses

- Shiba Inu has a bearish market structure in the near term and is likely headed for more losses.

- The range formation from earlier this month might be defended, allowing swing traders to enter.

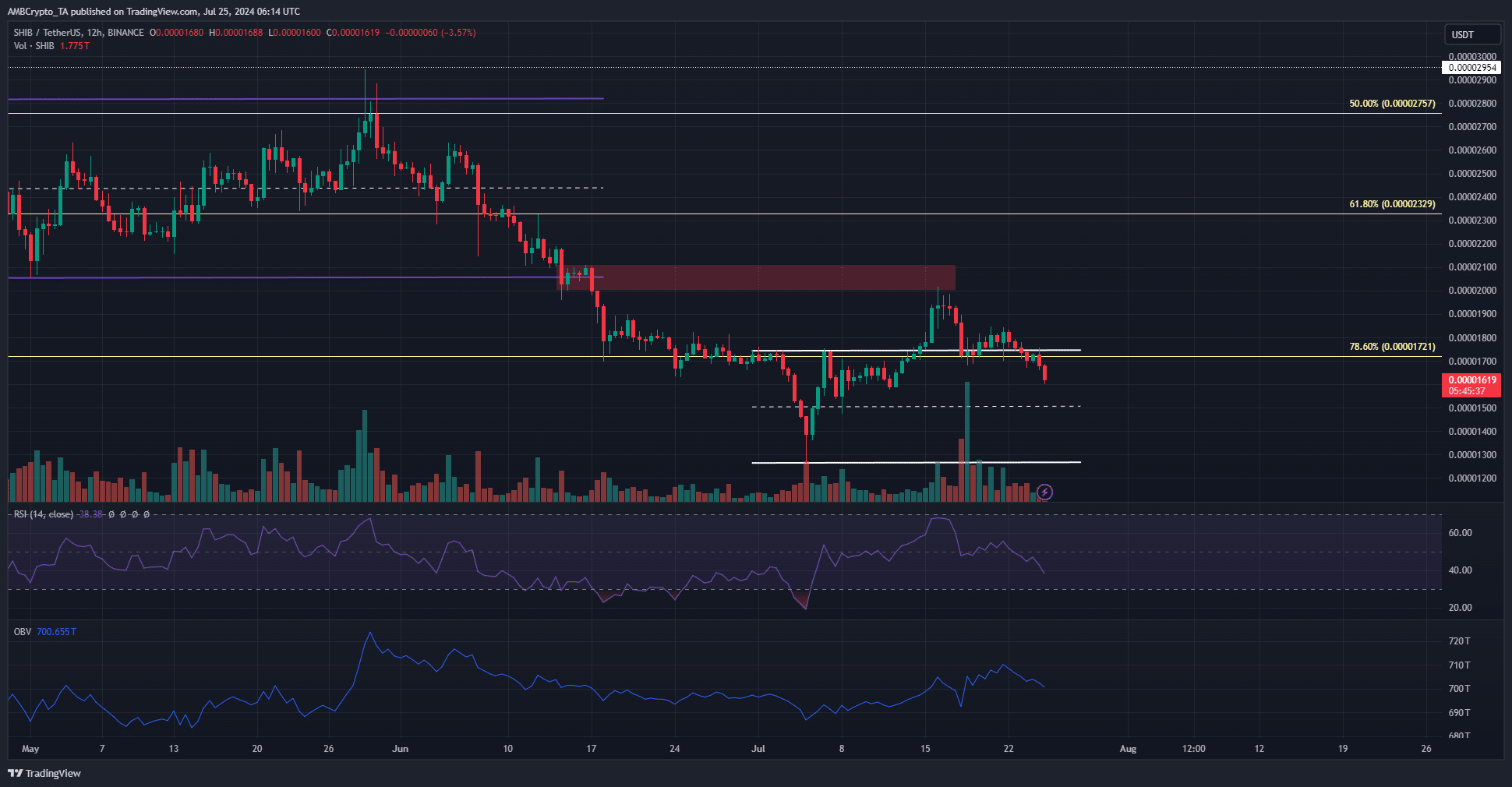

Shiba Inu [SHIB] faced rejection at a former support zone and the price was forced back within a range formation from earlier this month. A recent investigation into the on-chain metrics showed that selling pressure had increased.

A nearly 20% price drop followed the rejection from $0.0000205 last week. Momentum and buying pressure were fading, which could lead to further losses.

Back into July’s range formation

The $0.0000205 resistance zone had been the low of a former range that the meme coin had traded within from April to mid-June. The breakout past the current range (marked in white) occurred on the 14th of July.

At press time, the price was below the $0.0000172 support zone. The RSI showed bearish momentum was on the rise. The OBV, which had attempted to recover over the past two weeks, was beginning to slump.

Taken together, it indicated that the $0.0000151 (mid-range) and $0.0000127 (range low) levels might be tested soon. Other popular meme tokens have defended the gains of the past ten days better.

Meanwhile, Shiba Inu sank back to the levels it was at before Bitcoin [BTC] pumped from $59k to $68k. This was a sign of relative weakness and a worry for long-term holders.

Unraveling the mixed signals from the futures market

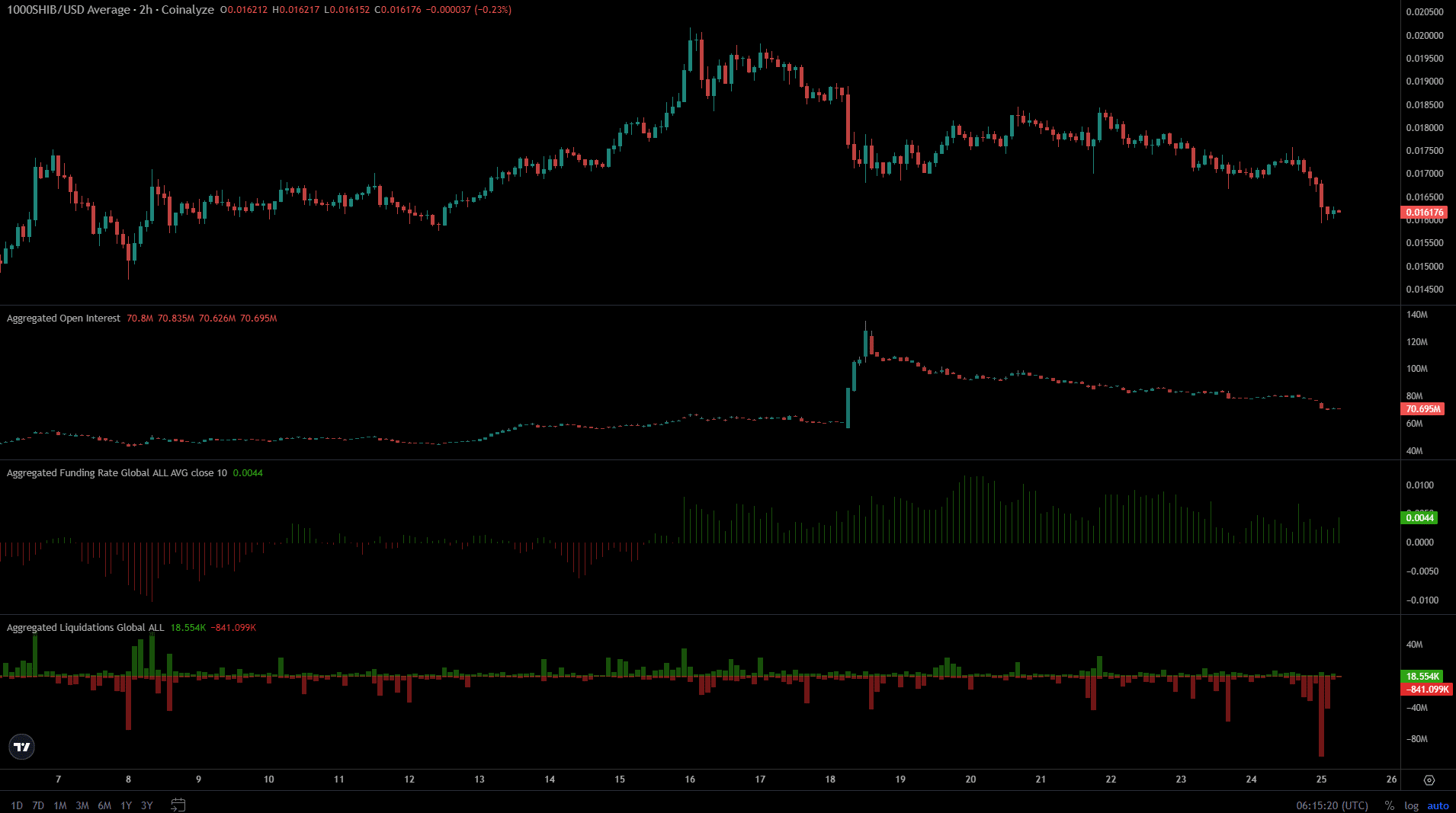

Source: Coinalyze

On the 17th and 18th of July, while SHIB prices were cratering, the Open Interest soared from $57 million to $127 million. This indicated a large amount of short sellers entering the market at that time and intense bearish sentiment.

The long liquidations the drop caused fueled the bearish bias.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

Since then, the metrics haven’t recovered. The OI continued to slide, showed bearish sentiment was still prevalent.

The funding rate was marginally positive, but the spate of long liquidations recently meant that speculators and swing traders would be even more wary of going long anytime soon.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)