Shiba Inu

Shiba Inu sees a spike in whale activity: What it means for SHIB

Shiba Inu sees a 41% spike in large transactions, amid price consolidation at $0.00002759. Whale activity signals renewed market interest.

- SHIB is getting close to settling on its short-moving average.

- Whale transactions have fluctuated as its price struggles.

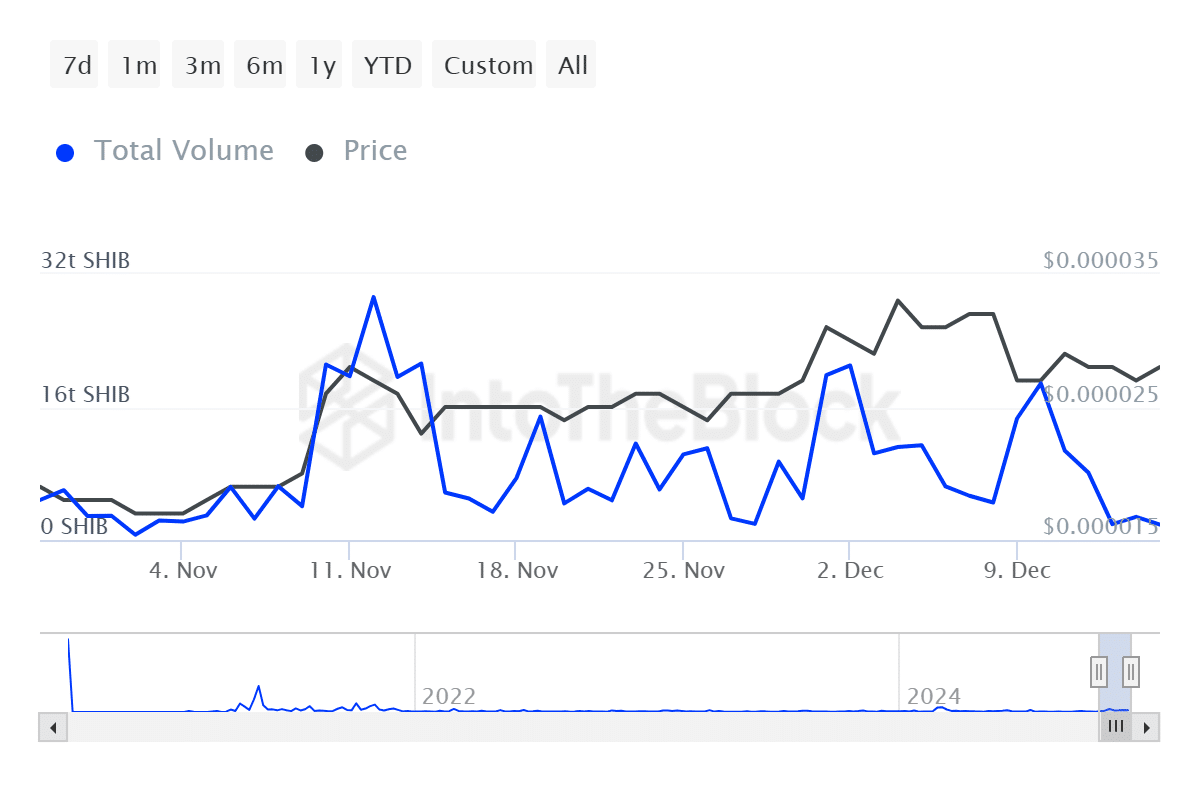

According to IntoTheBlock data, Shiba Inu’s large transaction volumes have shown significant fluctuations over the past few weeks. The sudden uptick in whale activity could signal a potential shift in market sentiment as SHIB consolidates.

Shiba Inu whale activity and transaction volume surge

Shiba Inu’s large transaction volumes surged 41.39% recently, reflecting a total of 2.79 trillion SHIB, valued at $76.48 million.

This spike comes after a noticeable decline since 10th December, when volumes dropped from 18.85 trillion SHIB to just 1.9 trillion SHIB by 13th December.

After a period of decline, the recent increase in whale transactions points to renewed interest from large holders. Typically, spikes in whale activity reflect strategic moves, such as accumulation or redistribution, both of which could influence price movement in the near term.

SHIB holds steady amid volume fluctuations

Shiba Inu’s price currently trades around $0.00002759, exhibiting resilience despite market volatility. The price chart shows that SHIB has maintained support above the 50-day moving average, indicating stability.

However, the Bollinger Band Percentage (BBP) highlights a slight bearish signal as momentum slows, suggesting consolidation could persist.

Volume data on Santiment shows a declining trend over recent days, with current daily volumes sitting below 1 billion SHIB after peaking earlier in the month.

Lower trading volumes during whale activity surges often reflect uncertainty among retail investors as they await confirmation of a broader trend.

Daily active addresses show mixed trends

Shiba Inu’s daily active addresses also mirror its volume activity. After peaking earlier in November with activity surpassing 18,000 addresses, the metric has gradually declined, settling at just over 2,500 active addresses at present.

This drop signals reduced participation among smaller holders despite the uptick in large transactions.

Shiba Inu whale moves and sentiment

The recent surge in large transaction volumes suggests that major players are closely monitoring Shiba Inu’s price movements. While the price remains steady and supported by technical indicators, the declining volume and address activity indicate a cautious retail sentiment.

Is your portfolio green? Check out the Shiba Inu Profit Calculator

Traders should watch for any price breakout or further whale activity, as these factors could determine SHIB’s direction in the short term.

If large holders continue accumulating, it may pave the way for a potential price recovery in the coming weeks.