Shiba Inu: Selling pressure looms over SHIB after recent gains – What now?

- The network activity has been in decline in September.

- Mean coin age and MVRV showed short-term bearishness.

Shiba Inu [SHIB] has traded within a triangle pattern for 75 days. The meme coin promised a strong performance in the coming months after breaking out of this triangle last week.

Since Monday, the 16th of September, the entire crypto market has trended bullishly, and around 7% gains were seen. Shiba Inu made an 8% move higher and the breach of the $0.000014 local resistance signaled another 7%-8% move higher.

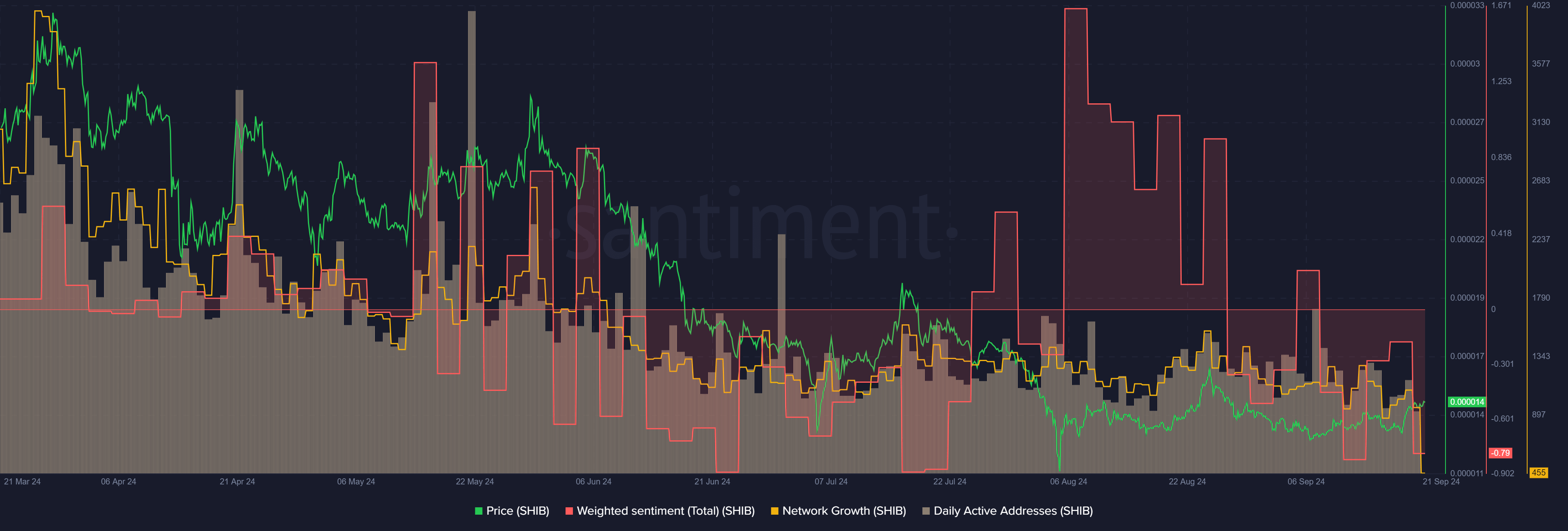

Network activity has been in decline

Source: Santiment

The daily active addresses saw a downtrend from May to July but began to stabilize till late August. There was a spike in activity in early September but since then, the metric fell lower once again.

The latest decline meant the daily activity reached the lowest levels it has been at since the first week of February earlier this year. The network growth has also declined since the final week of August.

The weighted sentiment was strongly positive in August, but like the active addresses and network growth, it too took a beating in September. Overall, Shiba Inu does not seem likely to see increased demand from rising user counts in the short term.

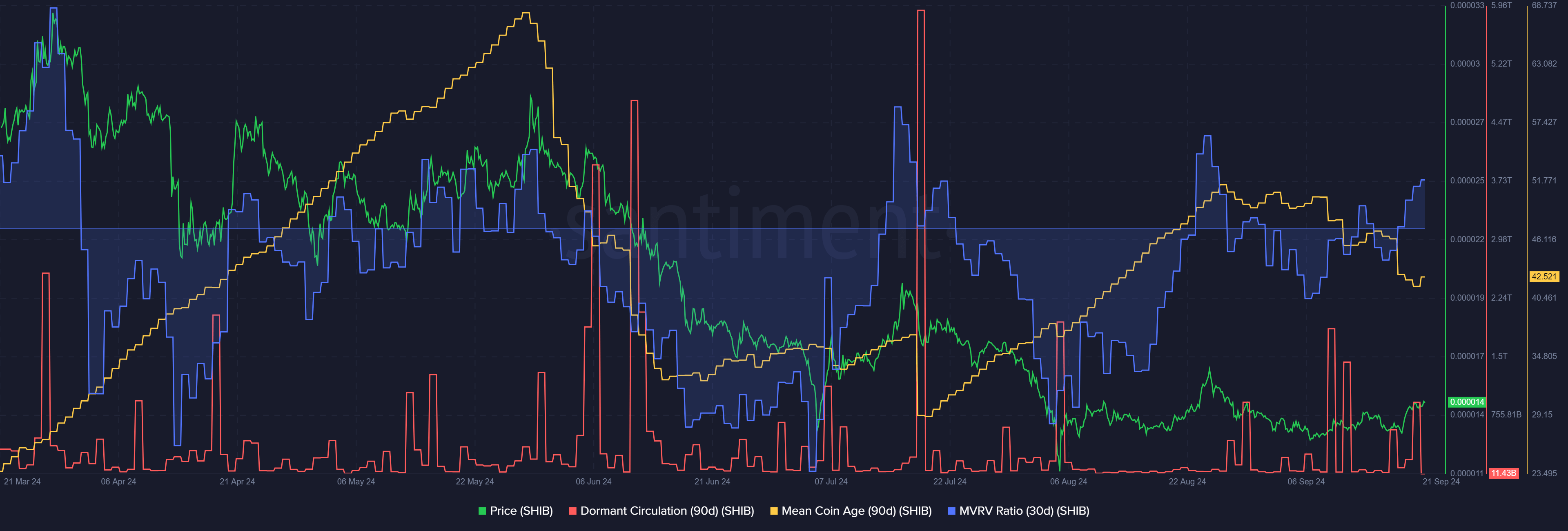

Short-term bearish sentiment for SHIB

Source: Santiment

The 30-day MVRV was positive. The last time a noticeable positive spike was seen was on the 24th of August and was followed by a sharp price correction of 12% over the next three days.

The dormant circulation saw a noticeable spike on the 20th of September, another sign of short-term bearish pressure. Meanwhile, the mean coin age was also in a downtrend over the past month, showing distribution across the network.

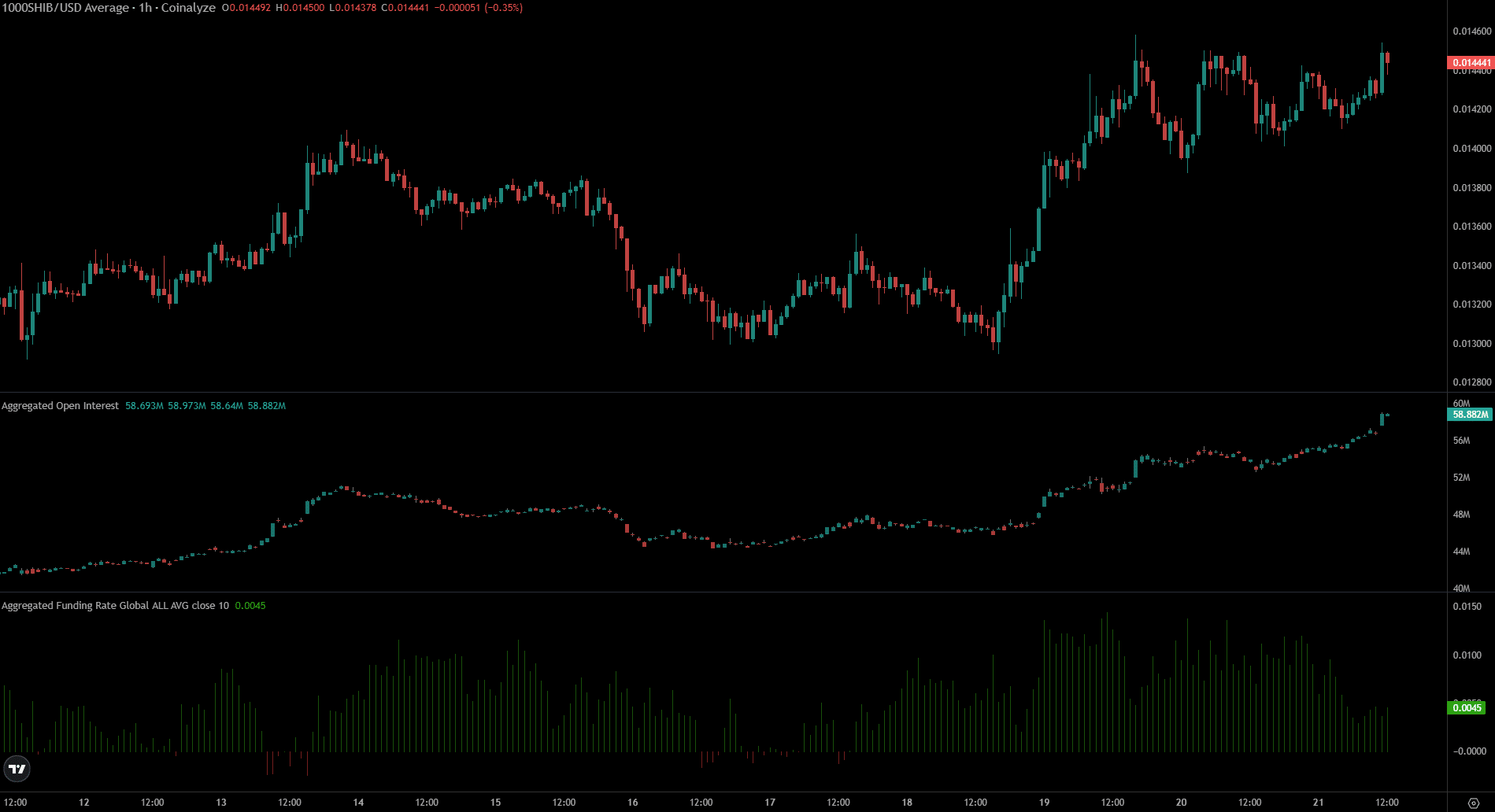

Source: Coinalyze

The Open Interest has been increasing alongside the prices over the past week, showing strong bullish sentiment. The funding rate was also highly positive but has dropped over the past 24 hours.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

This drop in funding rate suggested that the long/short imbalance was falling but long positions were still favored. Overall, the on-chain metrics signaled some short-term selling pressure is to be expected.