Shiba Inu [SHIB] blocked at 61.8% Fib level – will sellers gain leverage

![Shiba Inu [SHIB] blocked at 61.8% Fib level - will sellers gain leverage](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-39.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SHIB hit a key hurdle on the four-hour chart.

- Trading volumes declined while the exchange flow balance was positive – a boon to sellers.

Shiba Inu [SHIB] has hit a critical resistance level that may impact short-term traders. Since 6 April, SHIB has traded between 61.8% ($0.00001117) and 38.2% ($0.00001087). Most of the price action was in the lower range between 200 MA (moving average) and 20 EMA (exponential moving average).

Is your portfolio green? Check out the Shiba Inu Profit Calculator

The upswing above the 20 EMA, following Bitcoin’s [BTC] breakout and advent into $30k, has hit a price ceiling at 61.8% Fib level. It could expose SHIB to increased selling pressure unless BTC surges beyond $30k.

Will sellers gain leverage?

At press time, the price action had retested the 61.8% Fib level ($0.00001117) thrice on the four-hour chart. If the obstacle persists and BTC fails to go beyond $30k, more sellers could be attracted to the market.

The increased selling pressure could drop SHIB to the range lower boundary at 38.2% Fib level ($0.00001087). But near-term sellers must clear the hurdle at 20 EMA ($0.000001101). The 200 MA ($0.00001077) could check an extreme downswing beyond the $38.2% Fib level.

Conversely, bulls could overcome the 61.8% Fib level obstacle, especially if BTC surges beyond $30k. Such a move could set SHIB to aim at 78.6% Fib level ($0.00001138) or the overhead resistance at $0.00001165.

At the time of writing, the RSI climbed above its equilibrium level but cooled slightly above the 60 mark – indicating buying pressure eased and could expose the market to more selling pressure. However, the ADX (Average Directional Index) moved northwards, indicating that recovery was strong by press time.

Trading declined, but the exchange flow balance was positive

Read Shiba Inu’s [SHIB] Price Prediction 2023-24

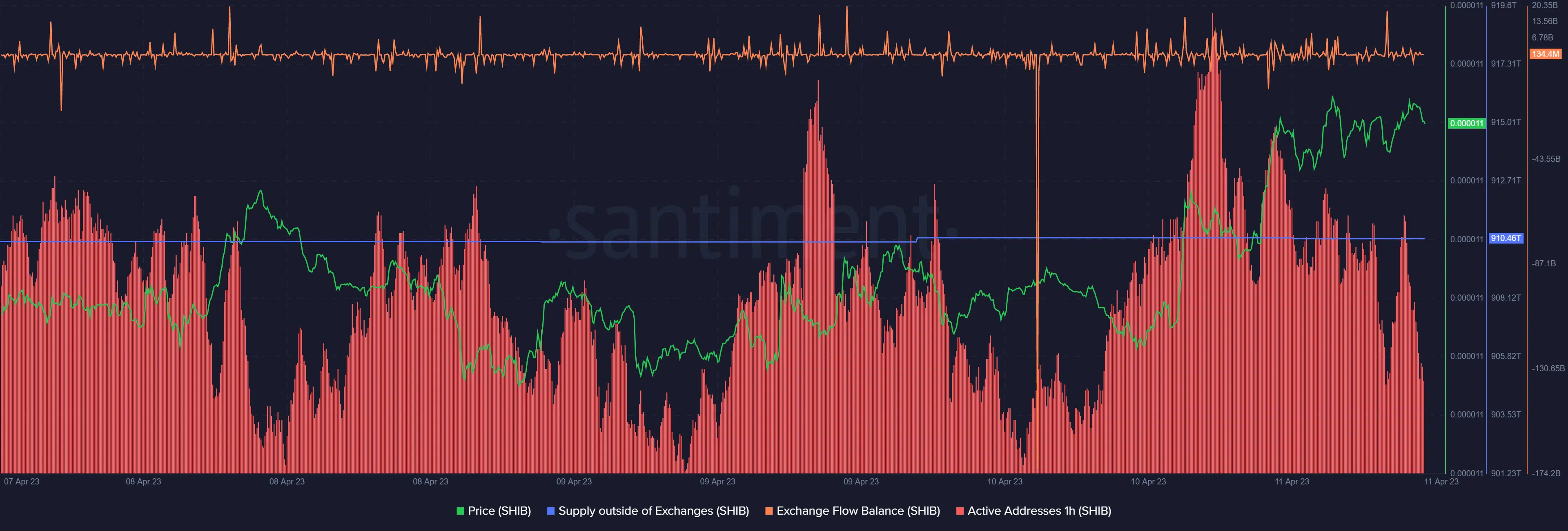

According to Santiment, the active hourly addresses have declined significantly since April 10, indicating a dip in buying pressure, which may attract more sellers. Moreover, the supply outside exchanges fell, showing a limited accumulation of SHIB at the time of writing.

The exchange flow balance was also positive, showing more SHIB moved into CEXs, probably to cash out the recent upswing. As such, SHIB could drop lower to 20 EMA or 38.2% Fib level before attempting a rebound.