Shiba Inu [SHIB] holders need these tips to sail through the crypto winter

A man goes out in heavy rain with nothing to protect him from it. His hair doesn’t get wet. How does he do that?

Well, the answer to this riddle is in the article itself- one needs to have patience and faith to reach that point. Likewise, the holders of the Shiba Inu ought to respect the law of HODLing. And, believe in the market conditions in order to maximize their returns.

The canine token market has seen a majority of weak hands leave when the redistribution event was at its best. In fact, at the time of writing, 75% of SHIB holders were sitting in losses with crypto winter taking the center stage.

Not to the investors’ surprise, various partnerships have been failing to push the token up on the price chart. At press time, the token was trading at $0.00001073, with an appreciation of 1% over the last day.

Is it a pricey look?

Zooming out a little on the 1-day chart can give positional/swing traders a clear picture. Since January 2022, SHIB has been trading within the range of $0.00003925 to $0.00001079. Unless the bulls turn $0.00003925 into support, investors shouldn’t expect their portfolio to perform well.

Nevertheless, swing traders and intraday traders will have massive opportunities even though SHIB continues its rangebound movements in the coming weeks. A proper trading system with strong psychology can ensure success provided the stop losses are respected and the target price isn’t taken for granted.

However, traders who have been waiting for SHIB to enter a bull cycle can abstain from taking a long position since the indicators look heavily partial toward the bears. RSI for the past two weeks has rested in the oversold region. And, MACD explicitly has been hinting at the bearish momentum. Interestingly enough, the width of the Bollinger Bands (BB) shows that volatility has taken a sabbatical.

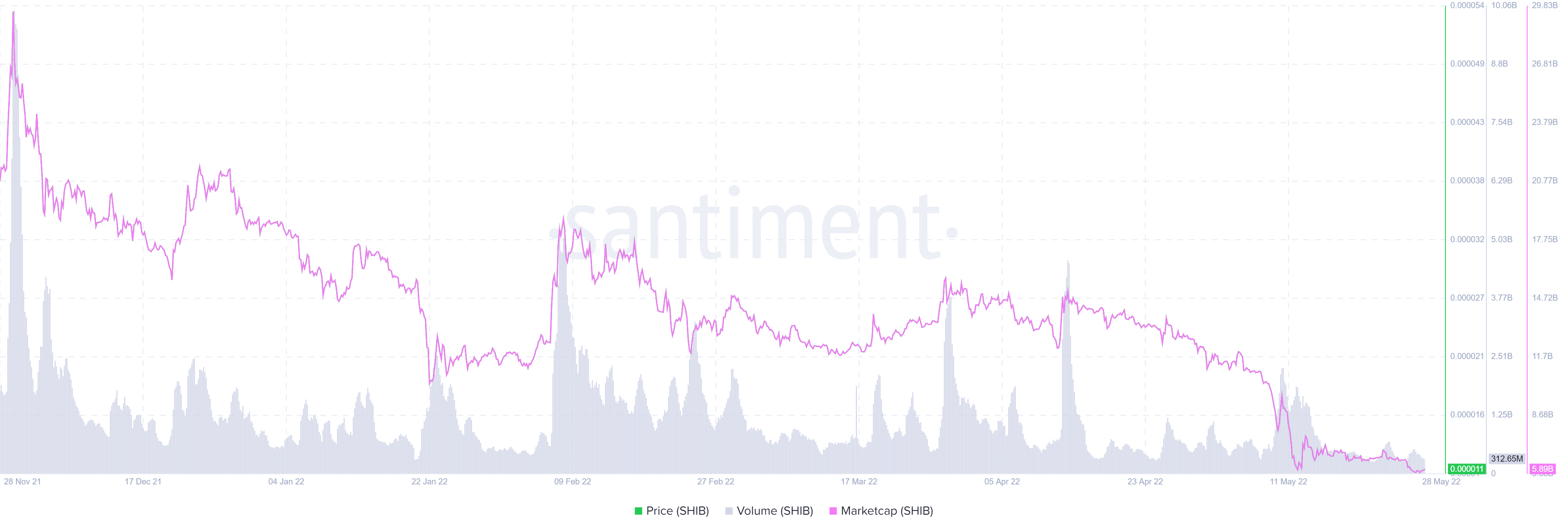

Now, if your risk appetite is that of an amateur trader then taking a look at market cap and volume will help you analyze your entry points. Even though volume has spiked at irregular intervals after 13 April, market capital has continued to follow gravity. This certainly can’t be a good sign for the traders who are looking to make quick money.

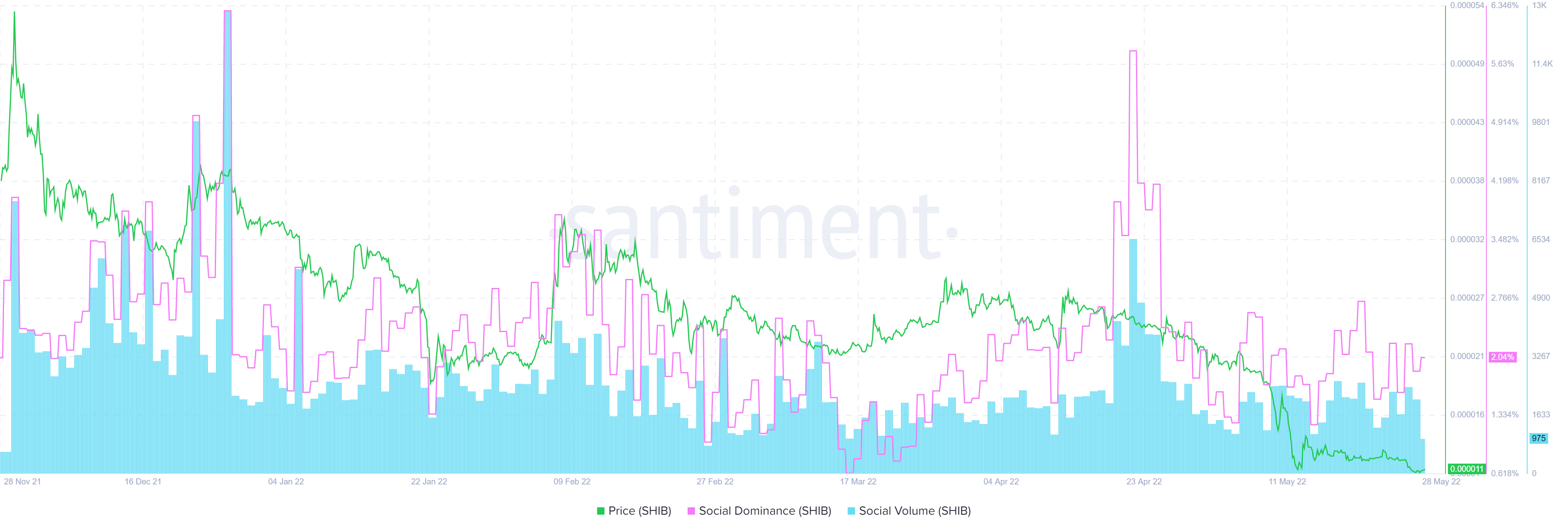

Moreover, it’s a well-known fact that while trading, ‘psychology’ plays an important role. It has faith as its main component. Looking at the social volume metric of the token, one can clearly understand that 21 April saw investors taking a huge interest in SHIB, perhaps believing that the price will appreciate. In fact, the meme token’s social dominance on that day stood at 5.79%. But, since the volume was waning, SHIB failed to impress its investors.

By and large, the state of the SHIB ecosystem looks depressed at the moment. Unless the king coin recovers from its bearish slumber, SHIB can’t be expected to go paragliding since SHIB’s correlation with Bitcoin, at press time, stood at 0.98.

Now to answer the riddle, just the way SHIB’s price charts are giving bald statements, the ‘man’ was also bald.