Shiba Inu [SHIB] shows bullish intent, watch out for a breakout above…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure of Shiba Inu was bullish.

- The retest of a daily bullish order block meant buyers can await buying opportunities.

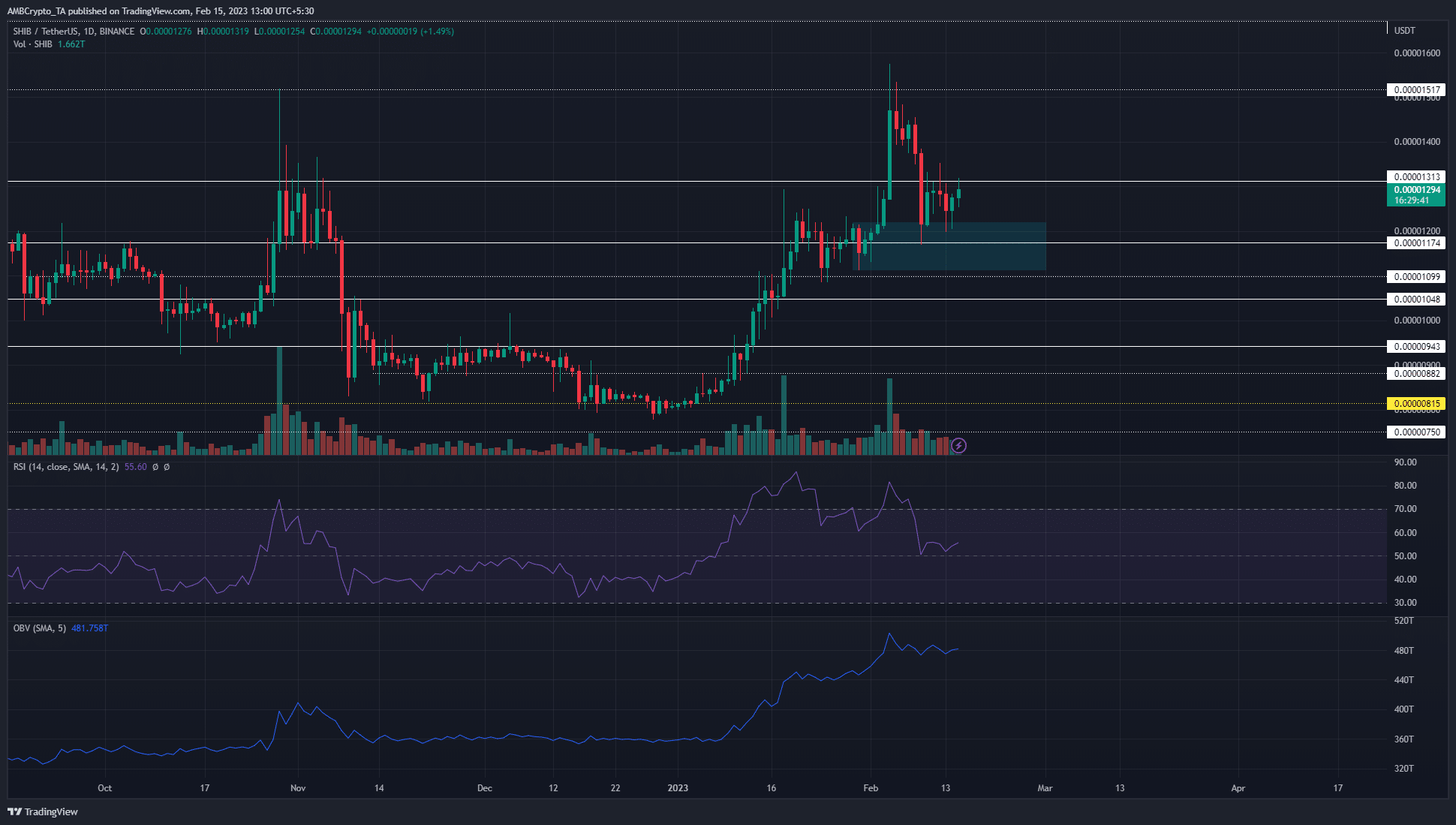

At press time, Shiba Inu [SHIB] traded at $0.0000129. It bounced from $0.0000117 after facing strong selling pressure on 9 February. Bitcoin [BTC] also fell to retest the $21.6k support level in the wake of selling pressure in recent days.

Read Shiba Inu’s [SHIB] Price Prediction 2023-24

If Bitcoin can defend the $21.2k-$21.6k in the coming weeks, bullish prospects remain valid for SHIB. A rallying BTC can drive sentiment wildly positive for the meme coin. A 16% or even 28% move upward could occur if the ideal bullish scenario played out.

A swift northward pump followed by a slow pullback

The $0.0000117 level is a vital support level. It served as resistance in September and early October, and was flipped to support in late October before failing in November. The presence of a bullish order block around this crucial level meant that it was a strong zone of demand.

The RSI fell toward the neutral 50 mark on the daily chart to show bullish momentum has weakened. However, the bullish market structure remained intact. Moreover, the retracement did not see the OBV dip strongly, nor was the trading volume high.

Together with the bullish structure, the inference was that Shiba Inu was likely to resume its northward journey after venturing into the bullish order block. A daily session close beneath $0.0000109 will break the structure and flip it to bearish.

To the north, SHIB faced resistance at $0.000015 and $0.0000167. $0.000015 has not been breached since August 2022.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

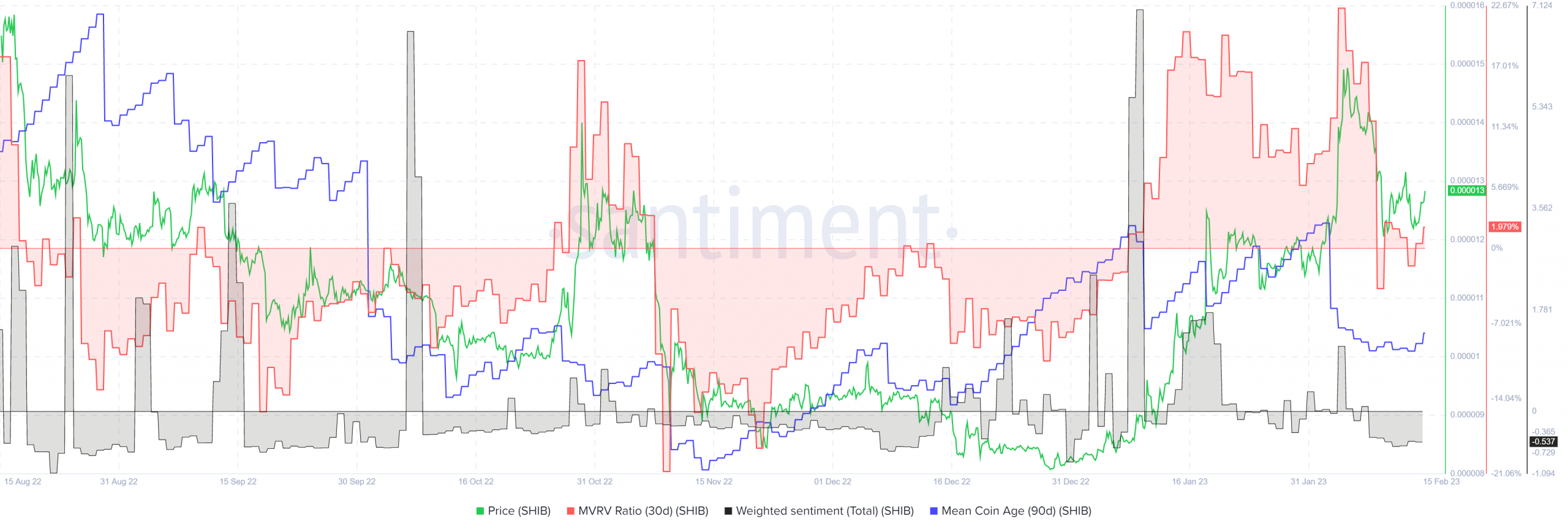

MVRV and mean coin age indicated strong sell-offs in February

Source: Santiment

The 30-day MVRV ratio fell rapidly in early February following the sell-off observed for Shiba Inu. This showed that short-term holders had taken profits. The drop in the mean coin age metric also noted large amounts of the coin moving between addresses. Once again, it pointed toward a rise in selling pressure.

The weighted sentiment also fell into negative territory. Since the technical structure remained bullish despite this wave of selling, it appeared likely that SHIB can resume its upward path again. A rise in the mean coin age metric would indicate a network wide accumulation. This could be followed by a rally in the price.