Shiba Inu: Reason to expect an 18% price hike is…

- Shiba Inu reclaimed a support zone that had been in place since mid-March.

- The increased buying pressure could see the token begin its recovery.

Shiba Inu [SHIB] was trending downward in the lower timeframe charts over the past month.

Yet, with Bitcoin [BTC] trading within a range and showing signs of consolidation after the halving, altcoins could see added volatility.

The reduced correlation between Shiba Inu and Bitcoin could help the bulls enforce a recovery.

Retest of the former support could set the next direction

The market structure on the 12-hour chart was bullish, but the past month’s pullback meant that the internal structure remained bearish.

SHIB was unable to make a recovery, facing resistance at the 50% Fibonacci retracement level.

Unless it can climb above $0.0000275 and $0.0000295, a bearish short-term bias was justified. In the meantime, the attempts at recovery appeared to have some legs.

The CMF was above +0.05 and signaled heavy capital inflow and buying pressure. The RSI on the 12-hour chart was at 47 at press time, but briefly rose above neutral 50 in recent days.

This could be a precursor to a move higher.

Network-wide accumulation was a huge positive

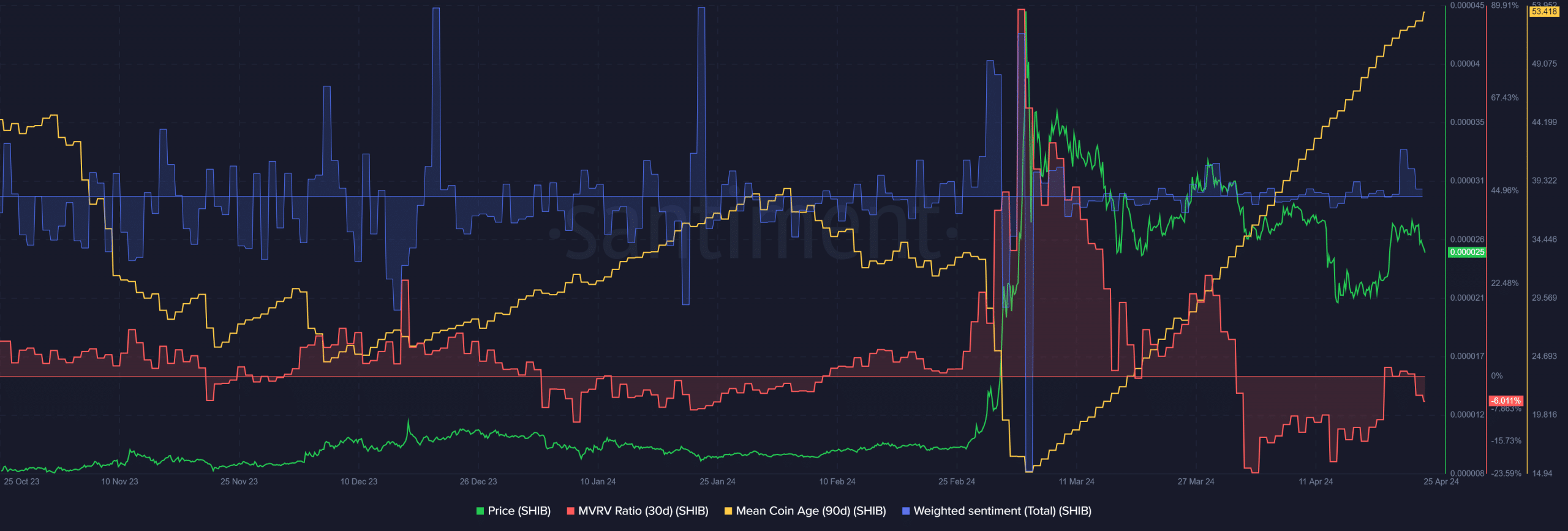

Source: Santiment

The 30-day MVRV ratio has been negative for most of April. This showed holders were at a loss and a lack of conviction. Also, the mean coin age has trended firmly upward in the past six weeks.

Together with the MVRV, it signaled a good buying opportunity. The Weighted Sentiment was also positive in the past few days, highlighting a sentiment shift in favor of the bulls.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

At press time, SHIB was trading at $0.00002486. The short-term technical outlook remained bearish, but traders must be prepared for a move higher.

A wave of selling in the Bitcoin market could still drag Shiba Inu and other altcoins lower.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.