Shiba Inu struggles in bearish channel – SHIB could drop 30% IF…

- 61.91% of top traders were found to be shorting SHIB.

- Traders were over-leveraged at $0.0000117 on the lower side and $0.00001245 on the upper side.

Shiba Inu [SHIB] appears bearish and is poised for a price decline.

Currently, the overall cryptocurrency market sentiment remains uncertain due to notable volatility in top assets, making traders and investors hesitant to participate in memecoins.

Amid this, SHIB recorded a price decline of 3.50%, at press time, over the past 24 hours and was trading near $0.0000119.

During the same period, its trading volume dropped by 17%, indicating lower participation from traders and investors.

This ongoing decrease suggests waning interest in the memecoin among both individual traders and institutions.

Shiba Inu’s technical analysis and upcoming levels

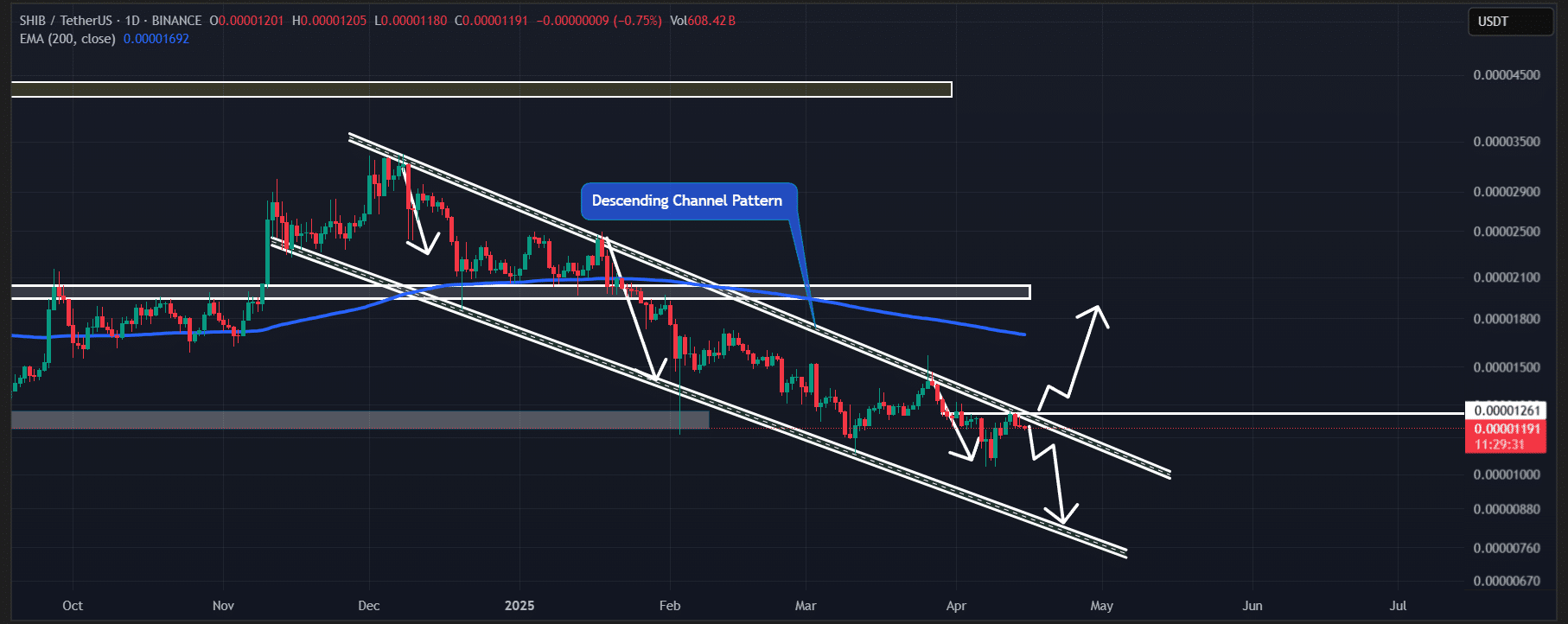

AMBCrypto’s technical analysis shows that SHIB has followed a bearish descending channel pattern since December 2024.

During this period, it has consistently formed lower highs and lower lows, reflecting a downward trend.

Recently, SHIB attempted to break out of this pattern amid a broader market recovery. However, it failed to do so.

At the time of writing, the memecoin was hovering near the upper boundary of the channel. This level has historically triggered price reversals.

If SHIB fails to break the upper boundary of the descending channel pattern again, a 30% decline is possible. The price could drop toward the $0.0000084 level, marking the lower boundary of the pattern.

Low trading volume increases the risk of a sudden dip, especially if broader market selling pressure intensifies.

Notably, SHIB was trading below both the 50 and 200 Exponential Moving Averages (EMA) on the daily timeframe. This suggests a strong bearish trend with no signs of upward momentum.

The daily chart indicates that SHIB could turn bullish under two conditions. First, a sudden shift in market sentiment. Second, a daily candle closing is above the $0.0000128 level.

62% of top traders go short on SHIB

Looking at the current market sentiment, SHIB traders appear to be heavily betting on the bearish side, according to on-chain analytics firm Coinglass.

As of this writing, SHIB’s Long/Short Ratio stood at 0.615, indicating strong bearish sentiment among traders.

The on-chain metric further reveals that 61.91% of top traders are holding short positions, while only 38.09% hold long positions.

At press time, traders were heavily leveraged at two key levels: $0.0000117 as support and $0.00001245 as resistance.

Long positions totaled $375K, while short positions amounted to $952K, indicating a strong bearish presence. This suggests that short sellers currently dominate the asset and could drive its price lower in the coming days.