Shiba Inu stuck at key support: Is a rebound likely

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

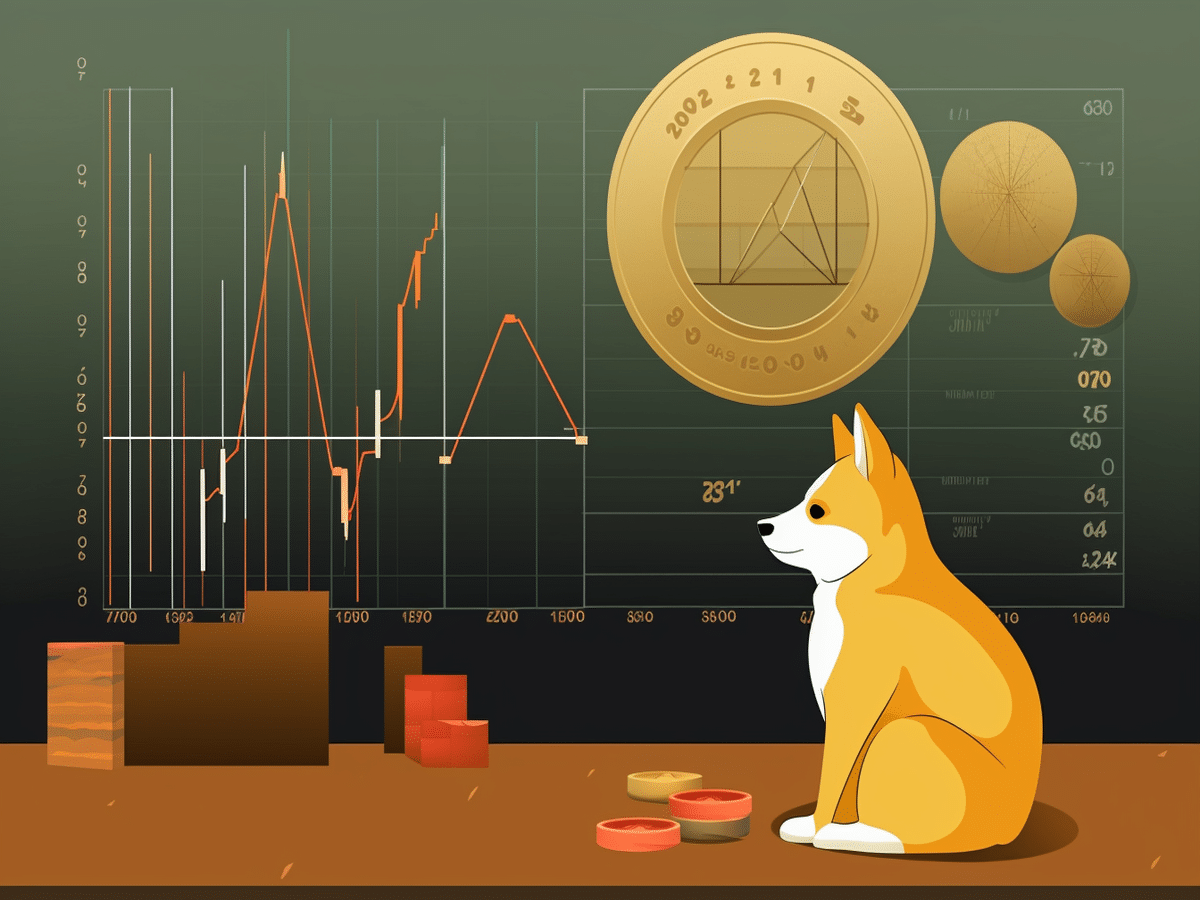

- Lack of volatility confined Shiba Inu to a key support level.

- Declining Spot CVD highlighted minimal demand for SHIB.

Shiba Inu [SHIB] continued to experience minimal trading volume on the higher timeframes. This impacted the meme coin’s ability to rebound off the key support level at $0.00000807.

Read Shiba Inu’s [SHIB] Price Prediction 2023-24

With Bitcoin [BTC] hovering over the $26.5k price range, this could extend Shiba Inu’s lack of significant price movement in the near term.

SHIB’s lack of volatility hindered price movement

The $0.00000807 support level has served as a strong rallying point for Shiba Inu bulls. It provided the foundation for SHIB’s January run to its YTD high of $0.0000160. When price descended to this key support level at the start of May, market speculators expected a swift rally, since it was the first time this support level was tested.

However, the lack of trading volume hampered Shiba Inu from initiating a rebound. While the market structure remained bearish, bulls’ attempts to rally were met with stiff resistance, as evidenced on 23 May.

The flat price action has kept the RSI under the neutral 50 mark. On the other hand, the OBV maintained its steady decline, hinting at decreased volatility while the CMF hovered above and under the zero mark, highlighting a lack of decisiveness in capital inflows.

Any significant movement for SHIB will depend on volume ramping up in the coming days. Sellers could either extend their leverage to close below the $0.00000807 support level or buyers could get the rebound and aim for the mid-April high of $0.0000116.

How much are 1,10,100 SHIBs worth today?

Declining Spot CVD hinted at weakening demand for SHIB

Data from Coinalyze pointed toward the prevalent bearish market sentiment for Shiba Inu. The spot CVD maintained its massive decline, reinforcing the advantage sellers currently have.

The Open Interest also declined hand in hand with the prices since 24 May, denoting strong bearish sentiment amongst speculators.