Shiba Inu’s August predictions – A possible breakout, but whales may be key!

- Shiba Inu may be heading for a pattern break from its long-term wedge pattern

- On-chain data critical to ascertaining where it’s time to buy

Shiba Inu (SHIB) has been bearish for the last two weeks, but it could finally be ready to shift into a bullish gear. The dog-themed memecoin has been struggling to find some bullish relief lately. In fact, after its latest attempt in the first half of July was watered down, the price pushed closer to its 4-month low.

At press time, zooming out on Shiba Inu’s price chart revealed an overall downward macro trend since its 2024 peak price of $0.000045. However, the same price chart also highlighted that SHIB has been trading in a wedge pattern.

Shiba Inu’s latest downtrend has pushed into a tight zone, one that could usher in the return of the bulls to the market.

At the time of writing, SHIB was trading at $0.0000146 – A 68% discount from its highest price in April.

Additionally, its price was almost oversold, according to its RSI. A combination of these factors, including the potential wedge pattern break ahead, seemed to underscore an attractive entry point for buyers.

Can Shiba Inu drum up enough bullish momentum?

SHIB currently has the advantage of being a major market memecoin. This may play out in its favor in terms of attracting attention to its price action.

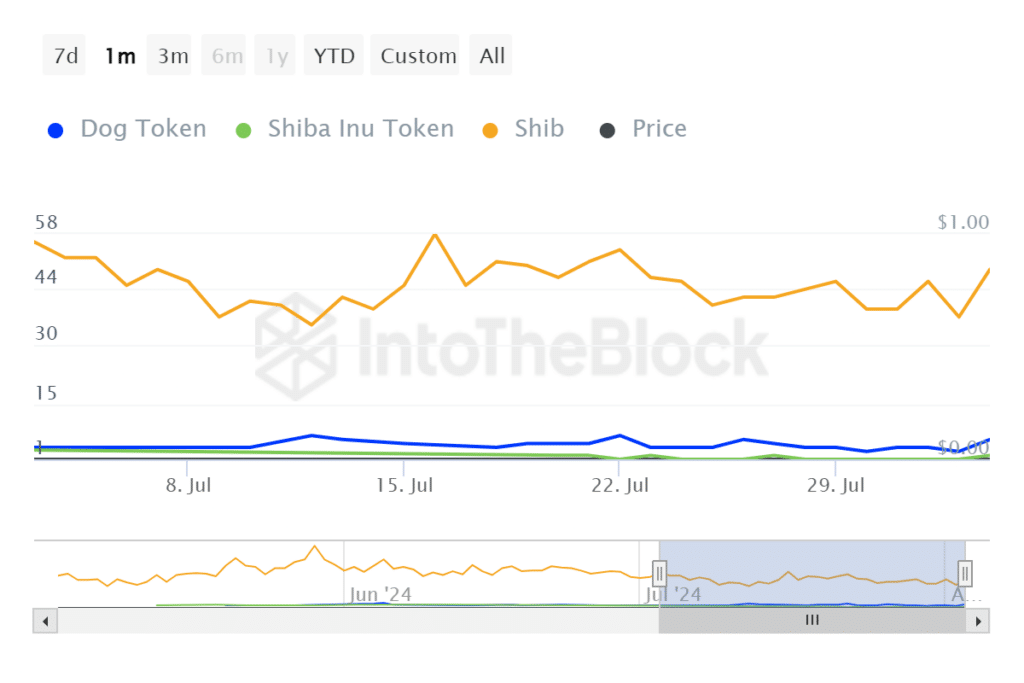

In fact, our analysis revealed that it might already be garnering some attention courtesy of its potential bullish opportunities. This may be why its social trends metric noted a significant uptick in the last 24 hours.

This spike pushed the metric to its highest level in 12 days. By extension, this observation might signal a surge in its popularity in the coming days too.

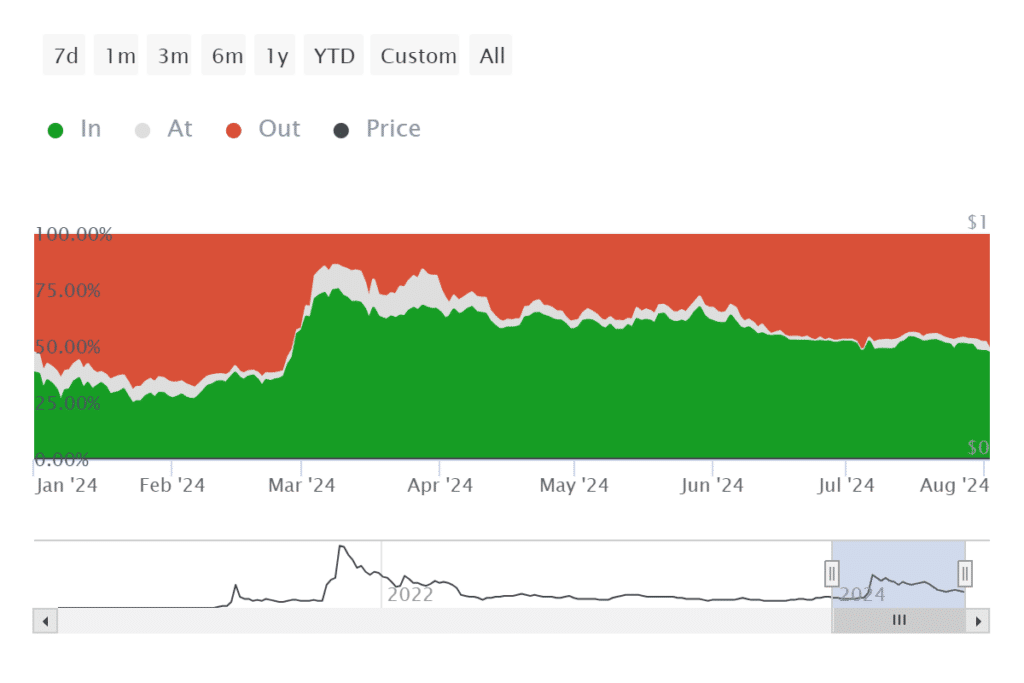

SHIB’s profitability data also revealed that most holders were at a loss at the memecoin’s press time price level. There were just over 700,000 addresses at a loss on 2 August – Roughly 51% of the total addresses.

Meanwhile, over 632,000 addresses or 46.93% were in profit. These are likely addresses that bought in early March or before.

Are whales buying?

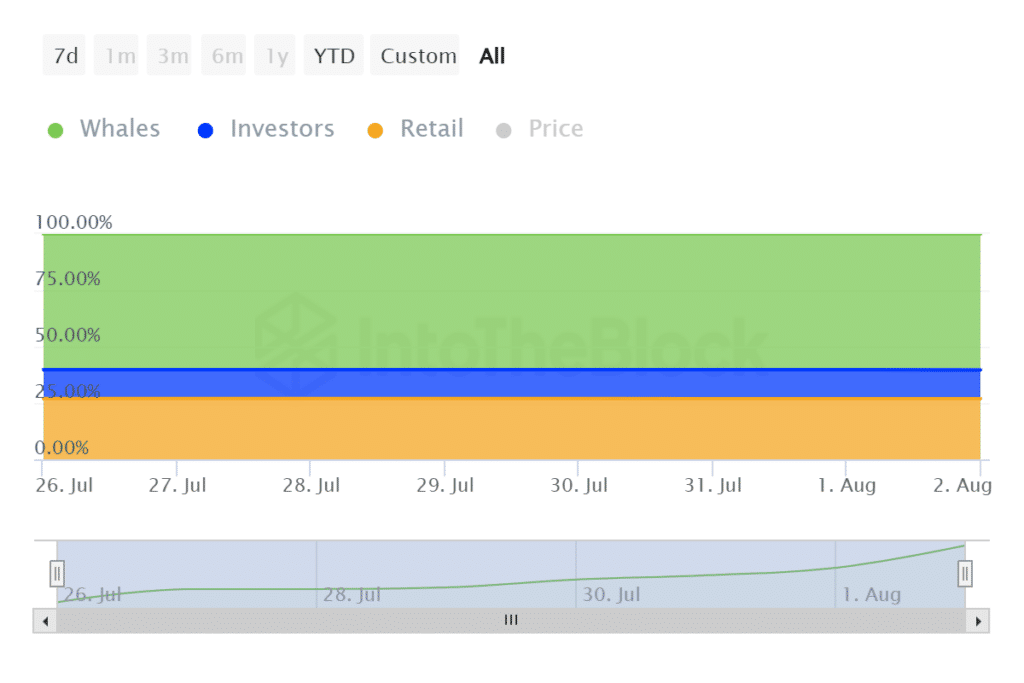

Our analysis also explored what has been happening with holders lately.

Data revealed that Shiba Inu whale addresses grew from 589.86 trillion SHIB (60.26%) to 590.01 trillion SHIB (60.28%) by the start of August.

Retail holdings dropped from 263.91 trillion SHIB (26.96%) to 263.49 trillion SHIB (26.92%) in the last 30 days too.

Together, these signs indicate that whales are gradually accumulating at the discounted prices while retail holders might be panic selling.

We will keep an eye out on this data to establish whether the rate of accumulation or selling will change. The outcome may offer insights into demand levels and what to expect in the next few weeks.