Shiba Inu’s latest hard fork – Identifying its potential price impact

- After the hard fork was released, SHIB’s burn rate rose sharply

- While SHIB’s price action was bearish, a metric suggested that it may be undervalued

Shiba Inu’s [SHIB] Shibarium recently underwent a hard fork that was aimed at improving the overall ecosystem. In fact, the latest upgrade was an effort to further strengthen the ecosystem’s deflationary characteristics too.

Let’s have a closer look at the hard fork and its possible impact on SHIB’s price on the charts.

Shiba Inu’s new hard fork

Shiba Inu’s official X handle revealed that they have launched a hard fork with the new Bor version. The upgrade happened on 9 August and introduced a burn mechanism to enhance the Shiba Inu ecosystem. The burn mechanism is directly tied to transaction fees.

With this update, 70% of all base transaction fees collected on the network will be automatically converted to SHIB tokens and permanently removed from circulation through burning.

The remaining 30% of the fees will be allocated to platform maintenance, development, and ecosystem growth initiatives. By progressively lowering the overall supply of SHIB, this deflationary strategy aims to eventually raise the token’s value.

Notably, at press time, SHIBBURN’s data revealed that the token’s burn rate had already risen by more than 4430% in the last 24 hours.

Here, it’s also worth taking a look at Shibarium’s stats post the hard fork.

According to Shibariumscan.io, the L2’s total transactions touched 418 million, with a total of over 1.8 million wallets.

How is SHIB doing?

While the upgrade was released successfully, SHIB’s price action remained bearish as it dropped by over 5% in the last seven days. At the time of writing, Shiba Inu was trading at $0.00001407 with a market capitalization of over $8.2 billion, making it the 13th largest crypto.

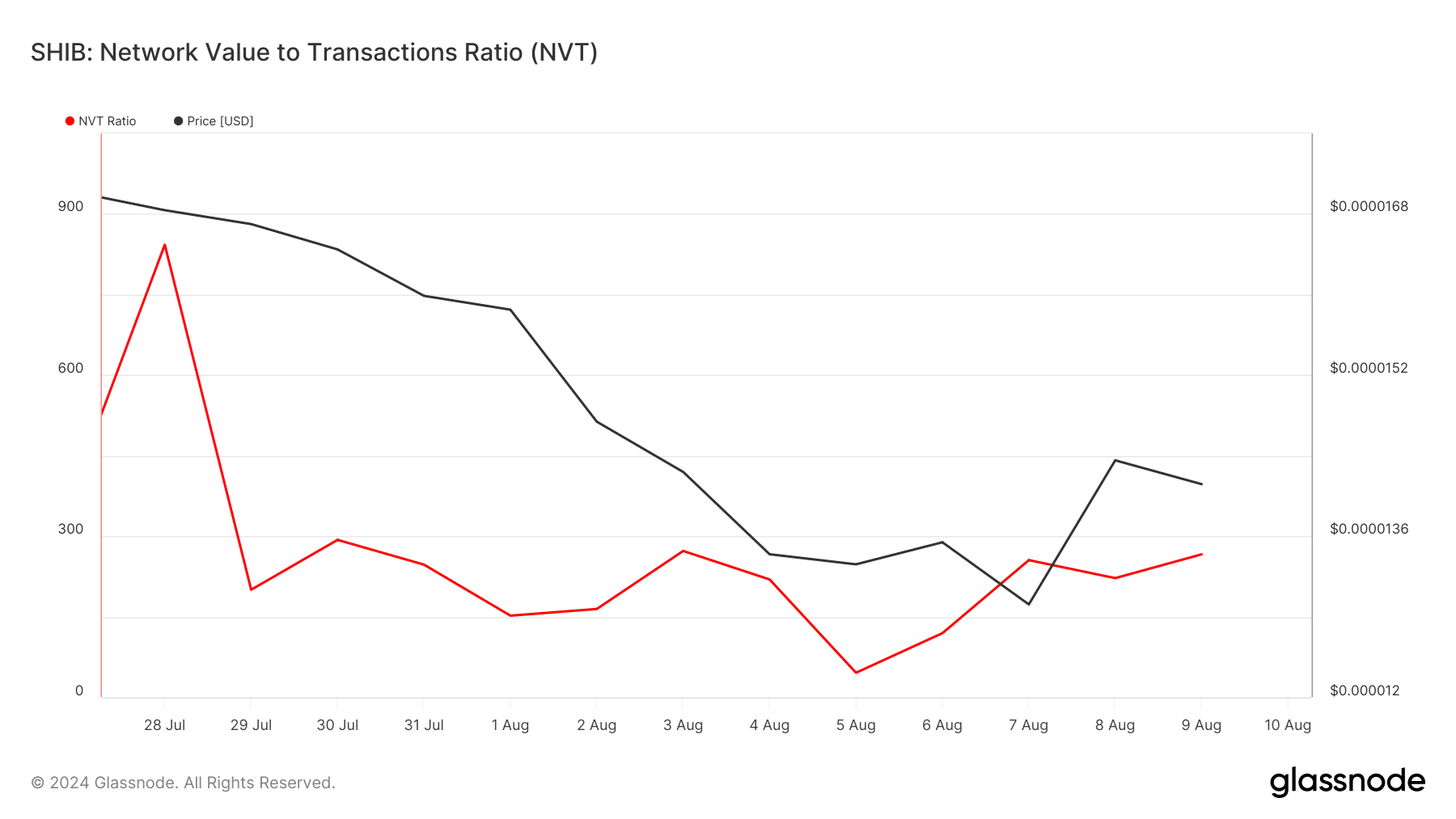

AMBCrypto’s assessment of Glassnode’s data revealed that SHIB’s NVT ratio dropped sharply over the past 2 weeks. A dip in the metric means that an asset is undervalued, indicating a possible price hike soon.

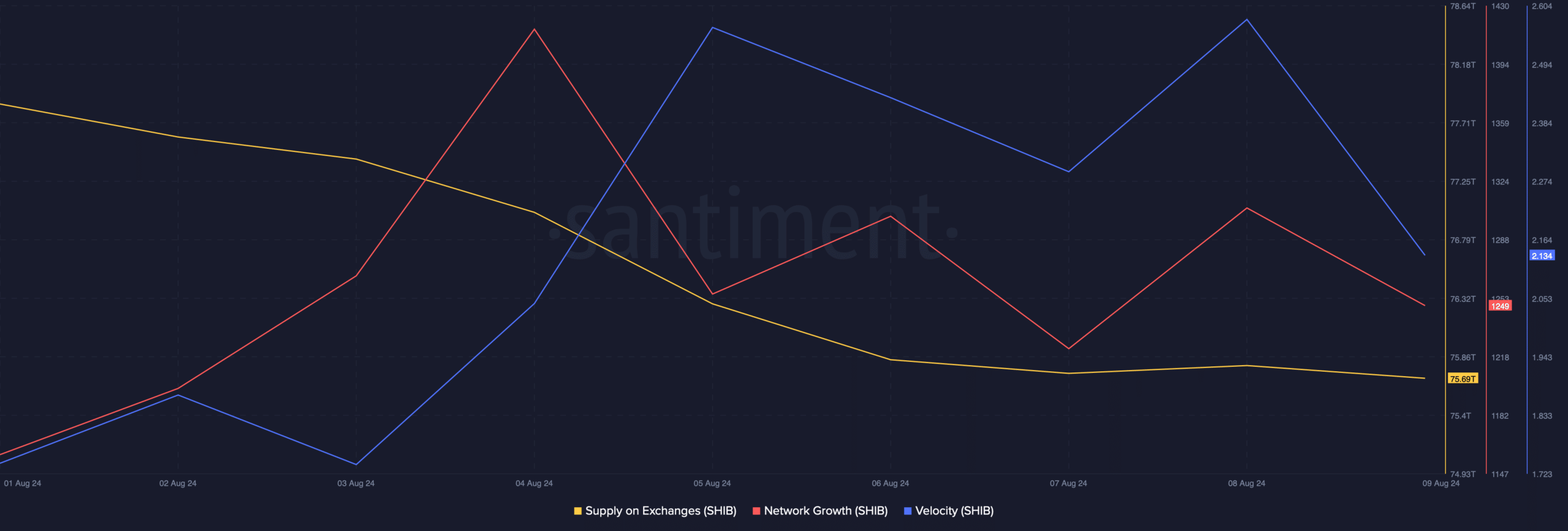

Its supply on exchanges dropped along with its price. This meant that buying pressure on the memecoin was rising.

Additionally, its velocity also spiked last week, suggesting that SHIB was used more often in transactions within a set timeframe. However, its network growth dropped, which can be inferred as a bearish signal.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

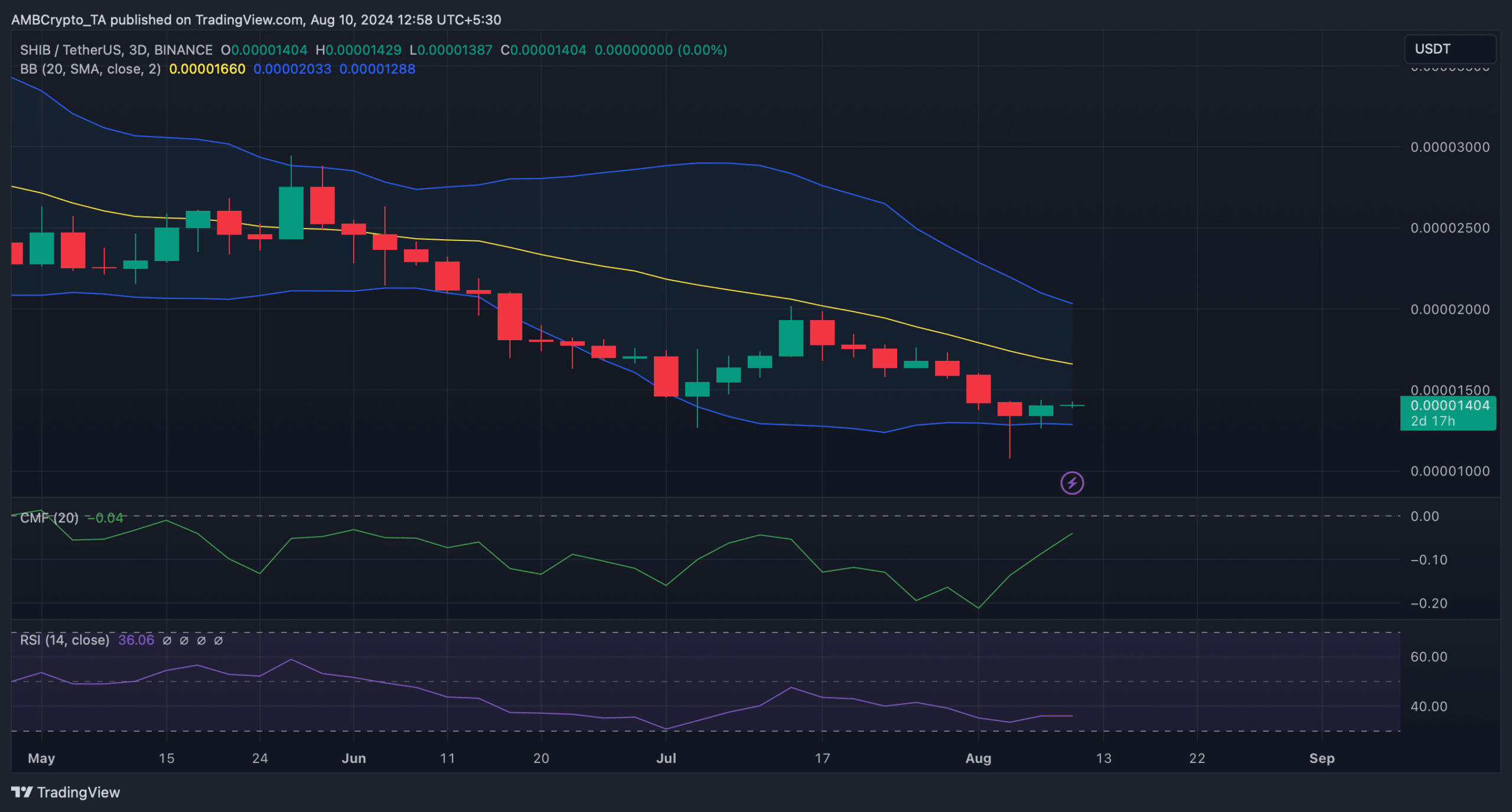

Finally, we checked Shiba Inu’s daily chart to see what signals the market indicators were flashing.

The memecoin’s Chaikin Money Flow (CMF) registered a sharp uptick. Additionally, SHIB’s price touched the lower limit of the Bollinger Bands, which often results in price upticks. Nonetheless, the Relative Strength Index (RSI) looked bearish as it had a value of 36.