Shiba Inu’s network surges: Sustained growth or temporary hype?

- Siba Inu saw a spike in network growth.

- SHIB has seen consecutive declines since then.

Shiba Inu [SHIB] has witnessed a notable increase in network growth, sparking discussions about its impact on the token’s price trajectory.

With metrics such as daily active addresses, transaction volume, and price movement painting a compelling picture, what could this recent activity mean for SHIB?

Explosive network growth and active participation

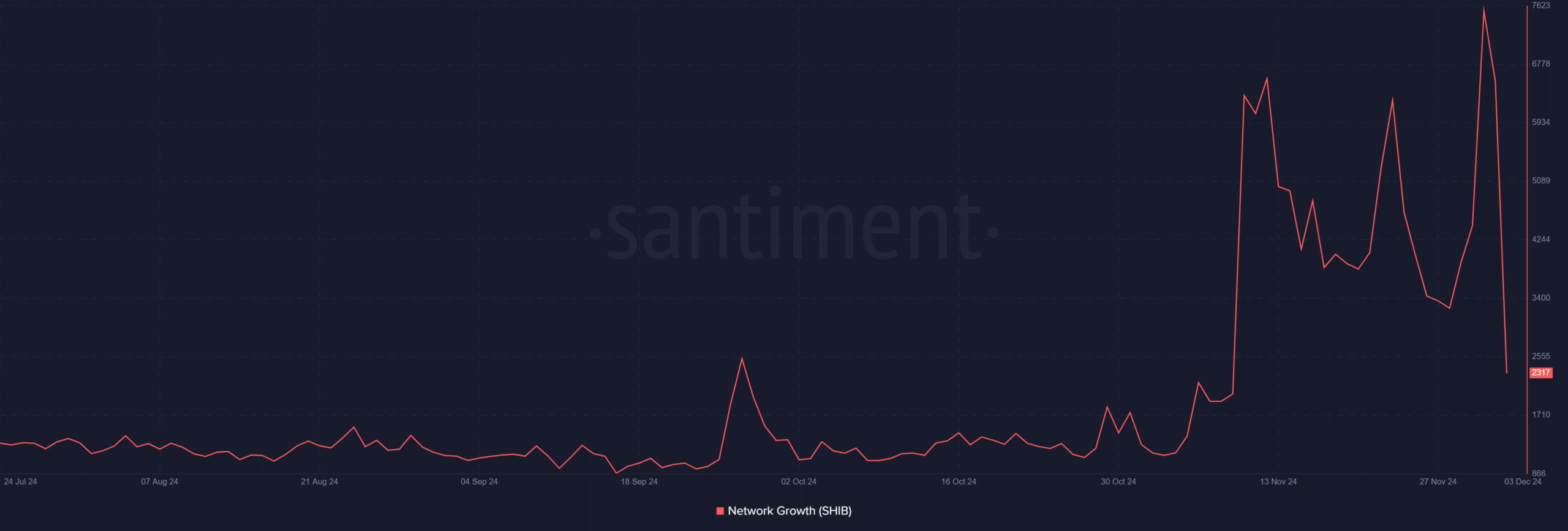

Analysis showed a notable spike in Shiba Inu’s new wallet addresses. The data showed that the network recorded over 7,600 new addresses, indicating a significant influx of new participants.

This growth is often associated with increased speculative interest or broader adoption, both of which can act as catalysts for price appreciation.

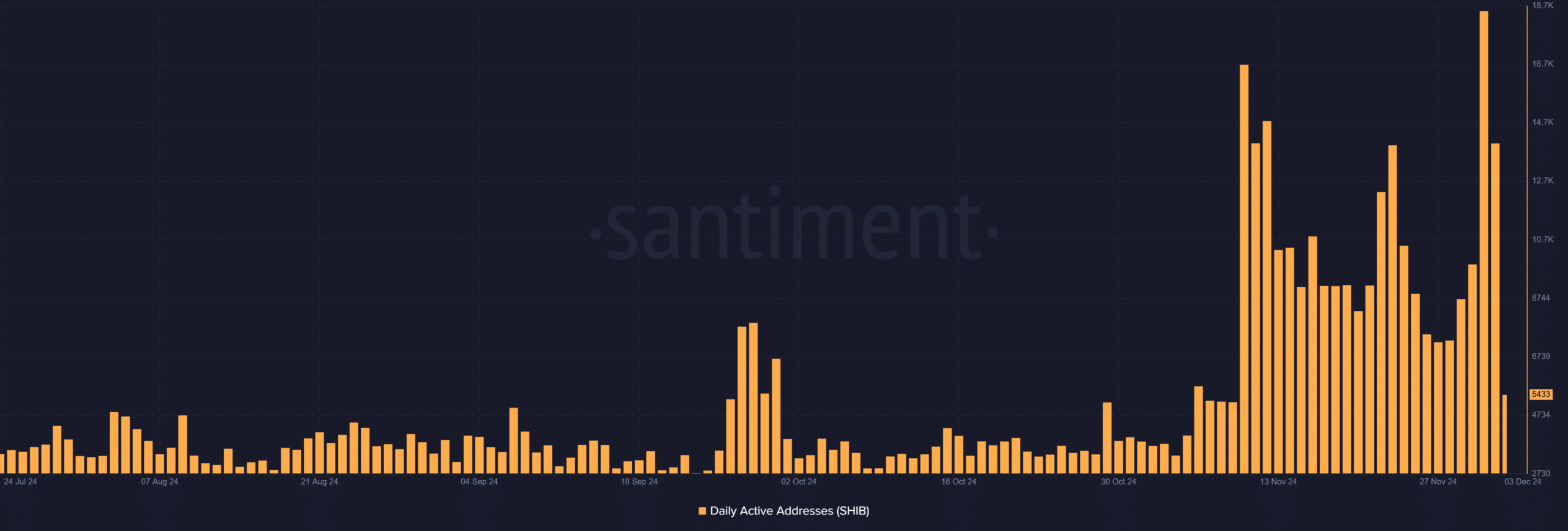

When correlated with the daily active addresses chart, a similar trend emerges. Daily active addresses surged to over 18,000 during the same period, representing one of the highest activity levels for SHIB this year.

The combination of these metrics signals that not only are new users entering the ecosystem, but existing holders are increasingly engaging in transactions.

This alignment between network growth and active addresses is crucial. Historically, such synergy precedes strong price rallies, reflecting growing utility and confidence in the asset.

However, the sharp dip in network growth after the spike raises questions about whether the momentum is sustainable or merely a short-term reaction to market events.

Shiba Inu transaction volume reflects mixed sentiment

The transaction volume chart provides further context. During the peak period of network growth and daily activity, Shiba Inu’s transaction volume exceeded $857 million, underscoring significant trading interest.

However, the current decline to $176.94 million suggested cooling enthusiasm, which could signal profit-taking or market consolidation.

While high transaction volumes during spikes indicate rising demand, the sustainability of these levels is critical.

If transaction volumes continue to decrease alongside network growth, SHIB might struggle to maintain its recent bullish momentum.

Can SHIB sustain its rally?

AMBCrypto’s analysis shows that Shiba Inu recently rallied to test resistance at $0.00002937, significantly recovering from earlier lows.

The formation of a golden cross, where the 50-day moving average crosses above the 200-day moving average, is a bullish signal. However, the RSI was 66.44, suggesting the token was approaching overbought territory.

Is your portfolio green? Check out the SHIB Profit Calculator

For SHIB to sustain its rally, it must maintain its position above key support levels at $0.000029.

Additionally, renewed network growth and transaction volume spikes would bolster confidence in further price gains. Without these, the token risks entering a consolidation phase or retracement.