Altcoin

Shiba Inu’s [SHIB] slump may continue despite increased demand: Here’s why

![Shiba Inu's [SHIB] slump may continue despite increased demand: Here's why](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-23T115134.127-1000x600.png)

- SHIB network growth has stalled for about three weeks

- Although long-term holders chose to be resolute, the ecosystem lacked liquid input

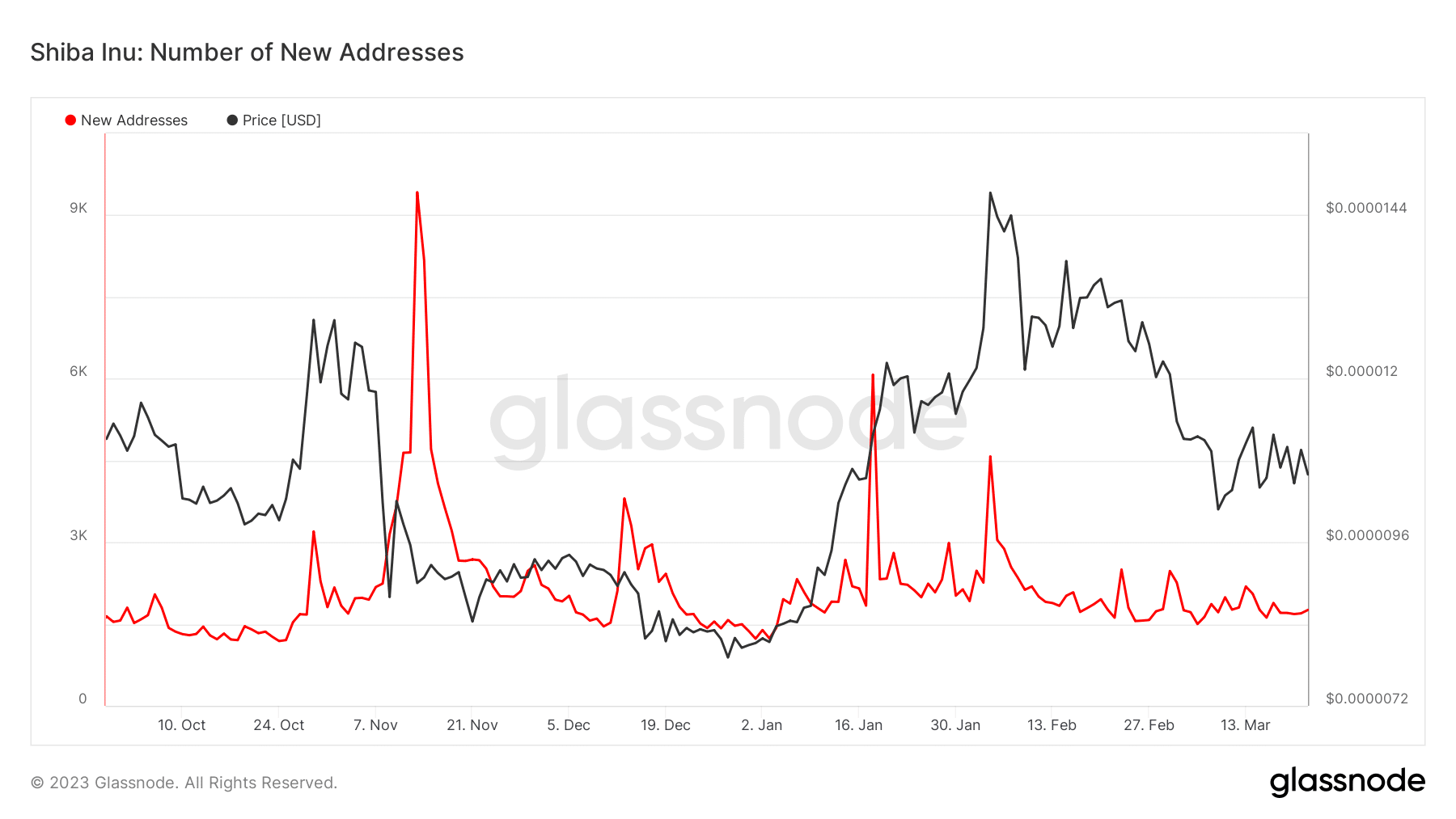

According to Glassnode, new addresses on the Shiba Inu [SHIB] ecosystem have trended on the downside since the first week in March. At press time, the number of new addresses was 1,759 — a notable decline from the 4,575 recorded in February.

Is your portfolio green? Check the Shiba Inu Profit Calculator

The drop means that first-time transactions on the network were relatively absent, as new investors did not consider SHIB worthy of addition.

Shibarium: Unable to save the day

The press time situation of the token was one that the crypto community met with surprise. Just a few weeks ago, the meme community was agog about the Shibarium beta launch. But all that hype has been quenched even though the final ecosystem has been set in motion.

However, the SHIB’s activities on exchanges have been quite odd. According to Santiment, only a few occasions have ended in an inflow and outflow spike since September 2022.

But as of 23 March, the SHIB exchange inflow reached 2.18 trillion. Such a high value indicated increased selling pressure and possible volatility for derivative traders. On the other hand, the exchange outflow seems to have neutralized the effect even before the aforementioned data.

On 20 March, the exchange outflow was 24.96 trillion. Three days later, it repeated a similar feat at 19.92 trillion. As opposed to the exchange inflow, the outflow reflects decreasing sell pressure.

Though both had reduced in the interim, the outflow surpassed the inflow at press time. This means that more SHIB investors were willing to hold instead of letting go of the tokens. However, that is no guarantee that it to keep

SHIB from falling further.SHIB is not liquid enough

The new addresses were not the only starved metric on the Shiba Inu network. A deep dive into the on-chain data showed that active addresses have also been lagging. The metric describes the number of participants in successful transactions on a network.

Realistic or not, here’s SHIB’s market cap in ETH’S terms

At press time, the 30-day active addresses were down to 106,000. This implied that SHIB users had avoided transacting

with the token. This could be due to SHIB’s underperformance, which has resulted in an a18.65% fall within the same timeframe.In addition, the Mean Dollar Invested Age over the last 90 days reached its lowest. With a value of 22.52, it implied that the average amount of money invested into SHIB was not encouraging. This confirmed that either on the fence or entirely unimpressed by the SHIB position.