Shiba Inu’s [SHIB] traders should be aware of these important breakout possibilities

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

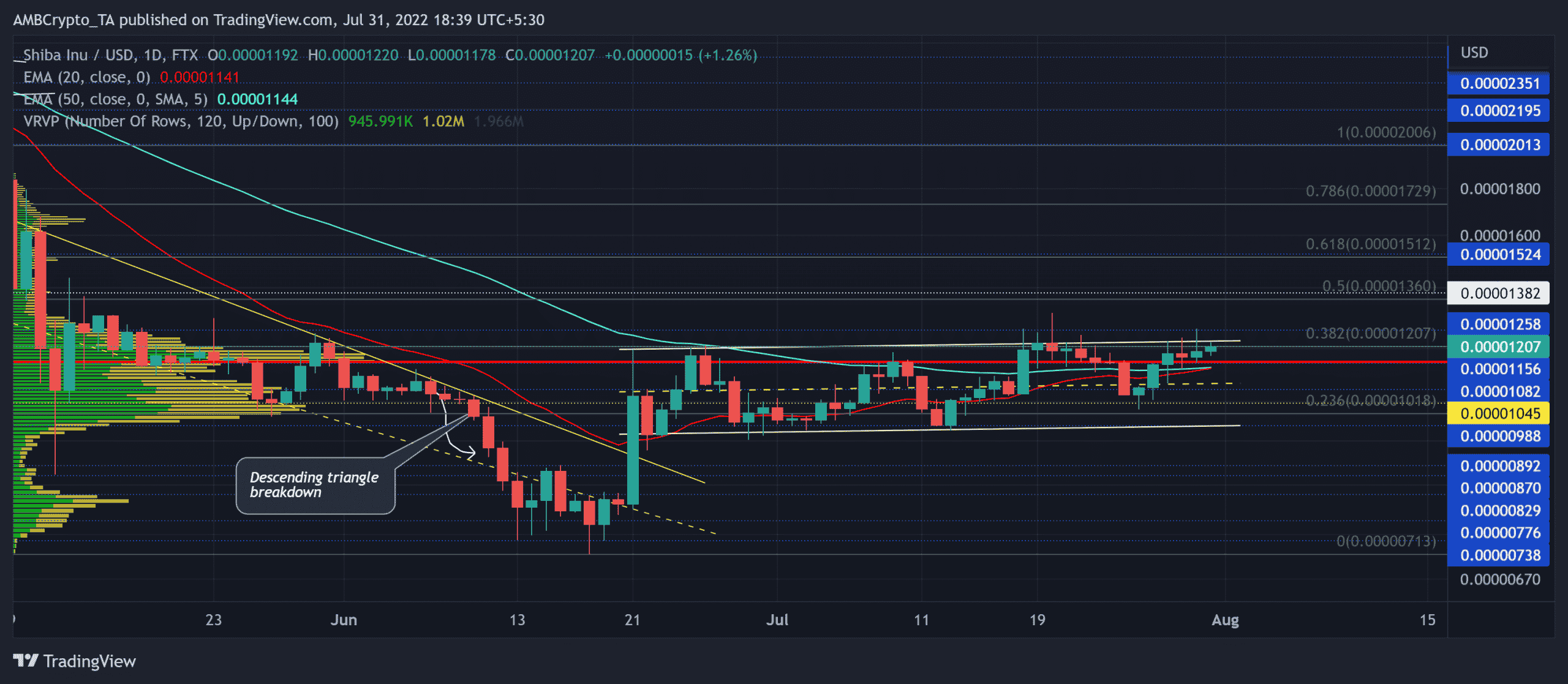

After plunging below the $0.020mark, Shiba Inu [SHIB] expedited its bearish break into a high volatility phase. The multi-monthly baseline around the $0.00738 region aided the buyers in recouping their forces.

The dog-themed coin’s recovery from this support zone has slammed into the 38.2% Fibonacci resistance multiple times over the past month.

Nonetheless, the current setup hinted at a gradual increase in buying vigor. Any bullish crossovers on the EMAs could help the alt find a break above the $0.012-level. (For brevity, SHIB prices are multiplied by 1,000 from here on).

At press time, SHIB was trading at $0.01207, down by 2.63% in the last 24 hours.

SHIB Daily Chart

SHIB’s drop below the $0.02-level saw an over 65% decline toward its eight-month low on 18 June. The symmetrical triangle setup alongside its previous downtrend fueled the alt’s patterned breakdown.

Nevertheless, the altcoin’s recent growth witnessed a fierce tussle between the buyers and sellers near the Point of Control (POC, red). This liquidity region, in conjunction with the 38.2% Fibonacci level, has created a stiff resistance.

Now, as the gap between the 20/50 EMA has significantly decreased, the buyers would be keen to break above the constraints of the $0.012-zone.

Looking at the altcoin’s extended compression phase over the past month, SHIB could enter a high volatility phase in the coming days. Should the buyers continue to ramp up their gradual edge, the crypto could see a further progression. A breach above the 38.2% level can help the alt test the $0.01382-zone.

On the flip side, any reversals would likely see a sustained patterned oscillation with support near the $0.01045-region.

Rationale

After hitting the 59-mark several times, the RSI flashed a slight bullish edge. However, to increase the chances of a potential breakout, the index must find a comfortable close beyond this resistance.

Also, the CMF ensured its zero-mark support and revealed a buying advantage. Its recent troughs bullishly diverged with the price.

Furthermore, the MACD line (blue) refrained from dropping below the signal line (orange). This trajectory resonated with the previous bullish narrative.

Conclusion

Considering the possibility of a bullish crossover on the near-term EMAs and the bullish edge on the indicators, SHIB could see a possible breakout. The targets would remain the same as discussed.

However, the alt shares an enormous 93% 30-day correlation with Bitcoin. Hence, keeping an eye on Bitcoin’s movement with the overall market sentiment would be essential for making a profitable move.