SHIB’s Golden Cross hits a roadblock – Time to worry, traders?

- Shiba Inu’s Golden Cross remains an uncertainty in the short term

- Binance’s top traders and large funds continue to be bullish about the altcoin

Shiba Inu [SHIB] traders betting on a huge windfall based on a potential SHIB golden cross could be forced to wait a little longer.

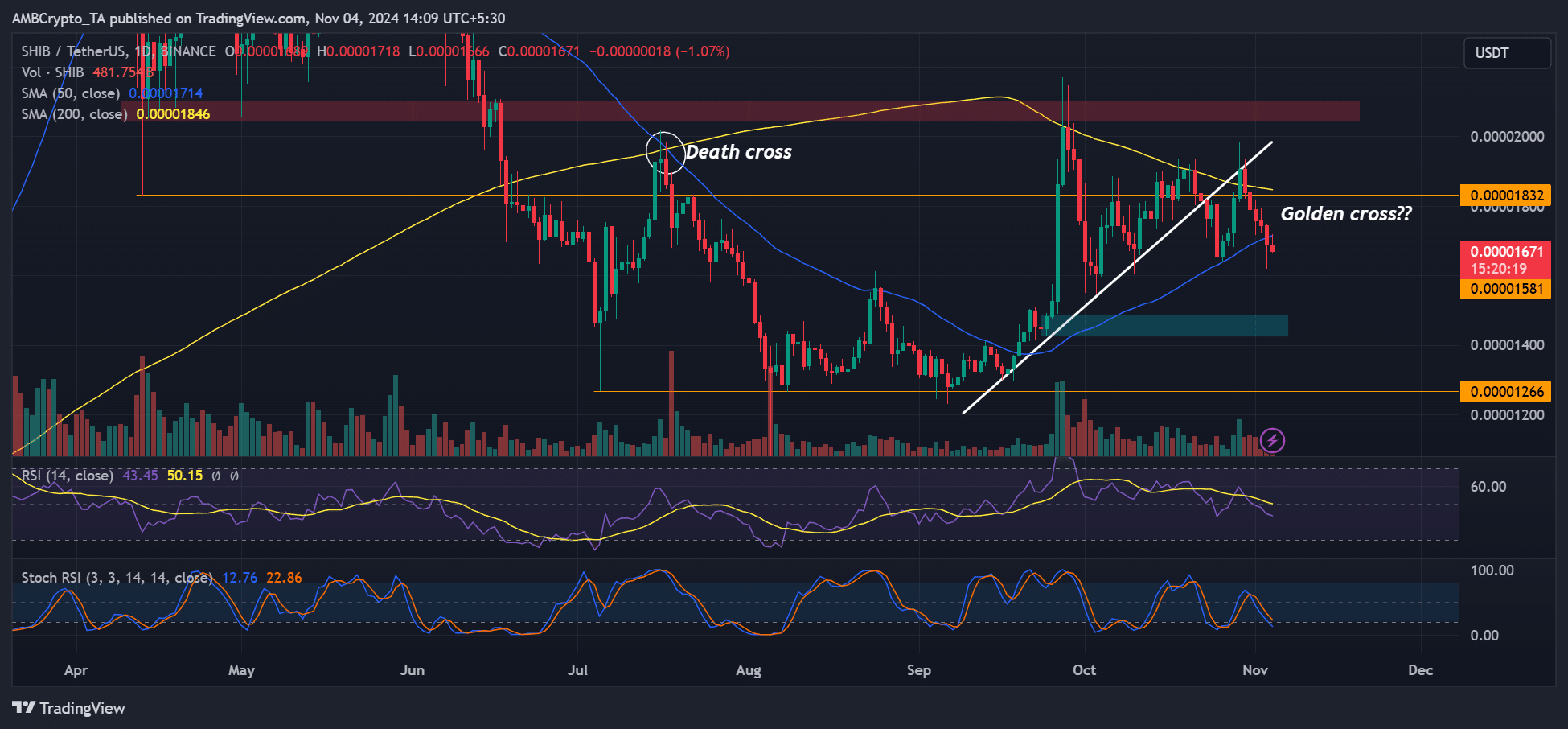

Towards the end of October, the golden cross, a bullish cue for traders, was on the cards. It happens when a 50-day simple moving average (MA) crosses a long-term moving average (100 or 200-day) from below. However, the bullish outlook was not present on the charts at press time.

Delay in SHIB’s golden cross?

U.S election jitters have acted as spoilers for SHIB bulls, at least in the short term. After cracking below its key long-term trendline support, SHIB’s dump was stopped at the 50-day SMA (blue line).

The recovery that followed teased the possibility of a 50-day SMA (blue line) crossing of the 200-day SMA (yellow line) to trigger the much-awaited golden cross. However, the recovery faded at the confluence between the trendline resistance and the 200-day SMA.

The price rejection pushed SHIB 12% lower, cracking the 50-day SMA as of press time. From a trader’s perspective, this didn’t look good. By dropping below the 50-day SMA, it signaled short-term SHIB weakness. In short, the Golden Cross prospect suffered another challenge.

That being said, the lower supports at $0.000015 and $0.000014 were key levels to watch in the short term. In a rebound scenario, the bullish targets would be the 50-day and 200-day SMA.

Market sentiment and positioning

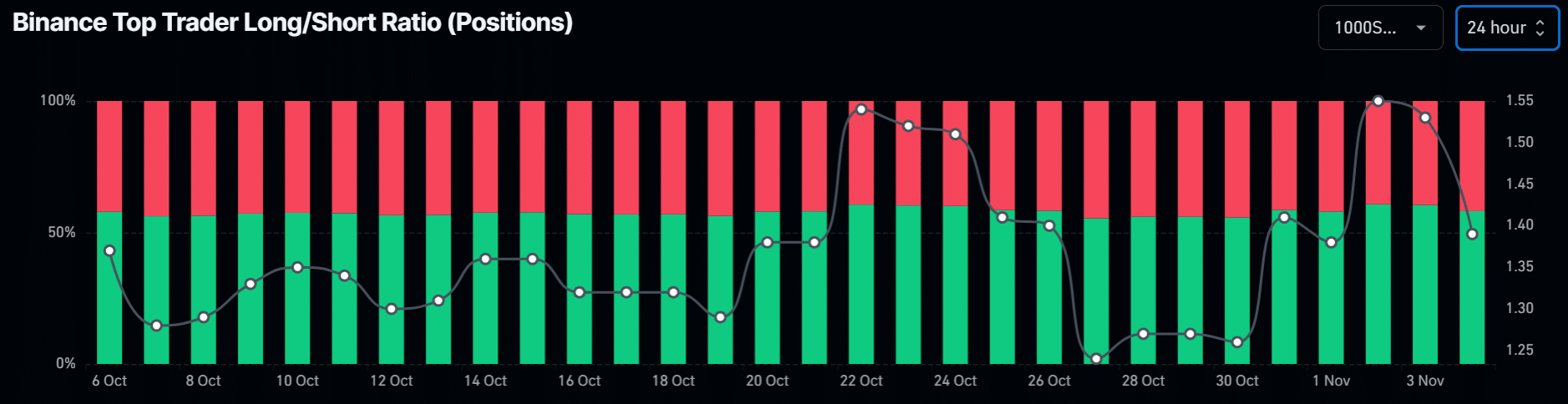

Over the past few days, overall positioning by top Binance traders has been bullish with net long positions dominating at 60%.

However, the long positions slightly dropped to 58% at press time. Similarly, the Open Interest (OI) rate slumped from $57 million to $38 million over the same period.

Simply puy, there seemed to be de-risking ahead of the U.S elections. And yet, speculators remained bullish despite the crypto’s 12% dump.

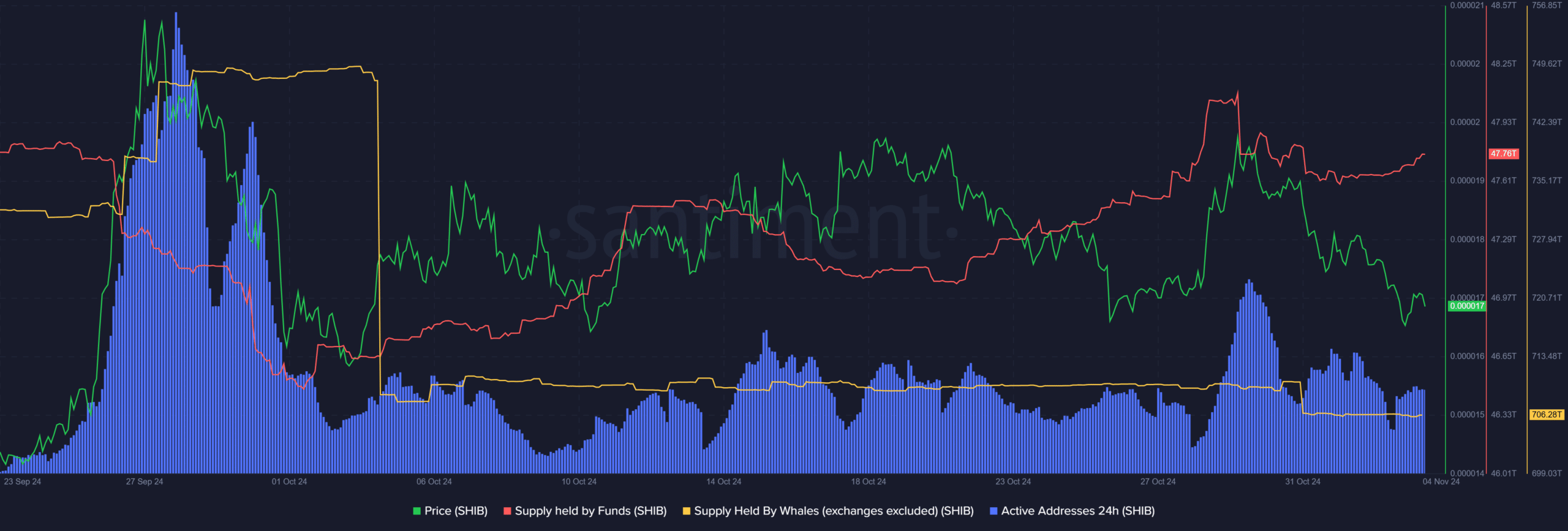

Finally, it’s worth pointing out that large funds have also been bullish on SHIB. This was evidenced by the steady ‘buy the dip’ trend (red line) during the crypto’s most recent bout of depreciation plunge.

These trends, alongside SHIB’s burn rates, can be seen as net positives for SHIB’s likely recovery.