Short sellers target XRP: What will happen to the struggling altcoin?

- Short positions taken against XRP grew significantly over the last few days.

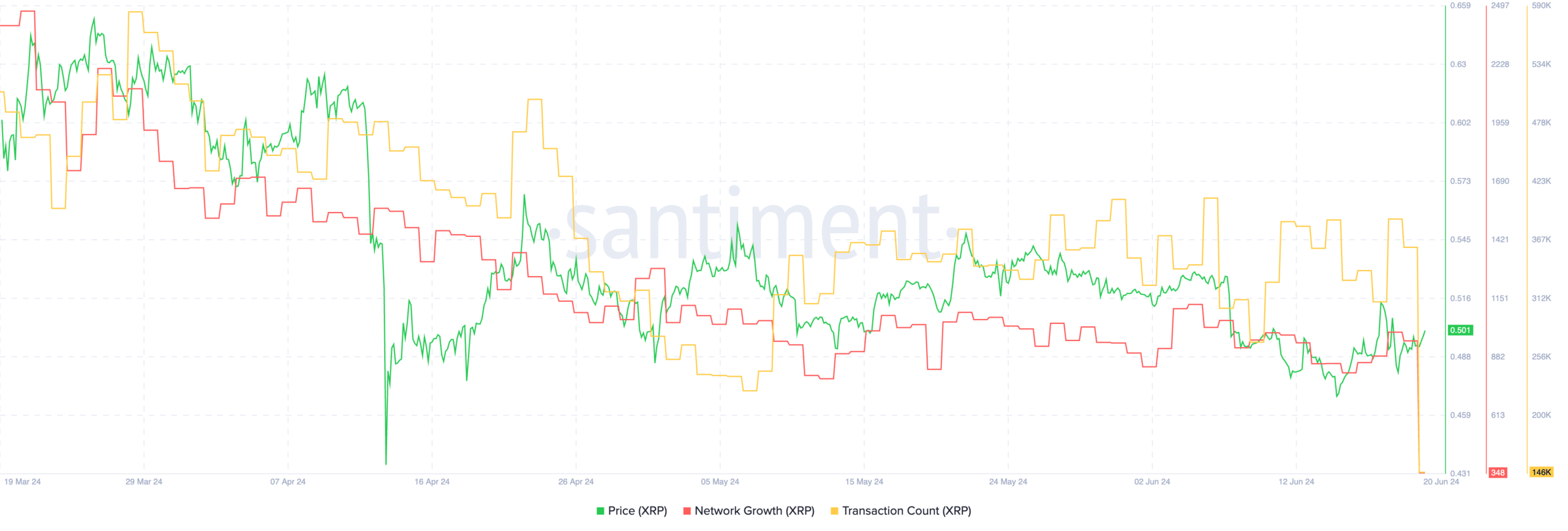

- Network Growth and Transaction Count declined significantly as well.

Despite the bullish run seen by the crypto space, XRP failed to garner similar levels of attention from traders and investors alike.

Due to these factors, the sentiment around XRP turned bearish.

XRP bears get hungry

According to recent data provided by Santiment, there was high amount of short positions taken against XRP at the time of writing.

Even though a high number of short positions indicated that most traders were expecting a decline in price, there was some silver lining for the bulls.

Liquidation of these short positions, often triggered by unexpected price surges, can actually help with momentum, propelling XRP even higher.

So, for patient investors with a long-term perspective, this shorting frenzy might be a sign to buckle up for a potential rally.

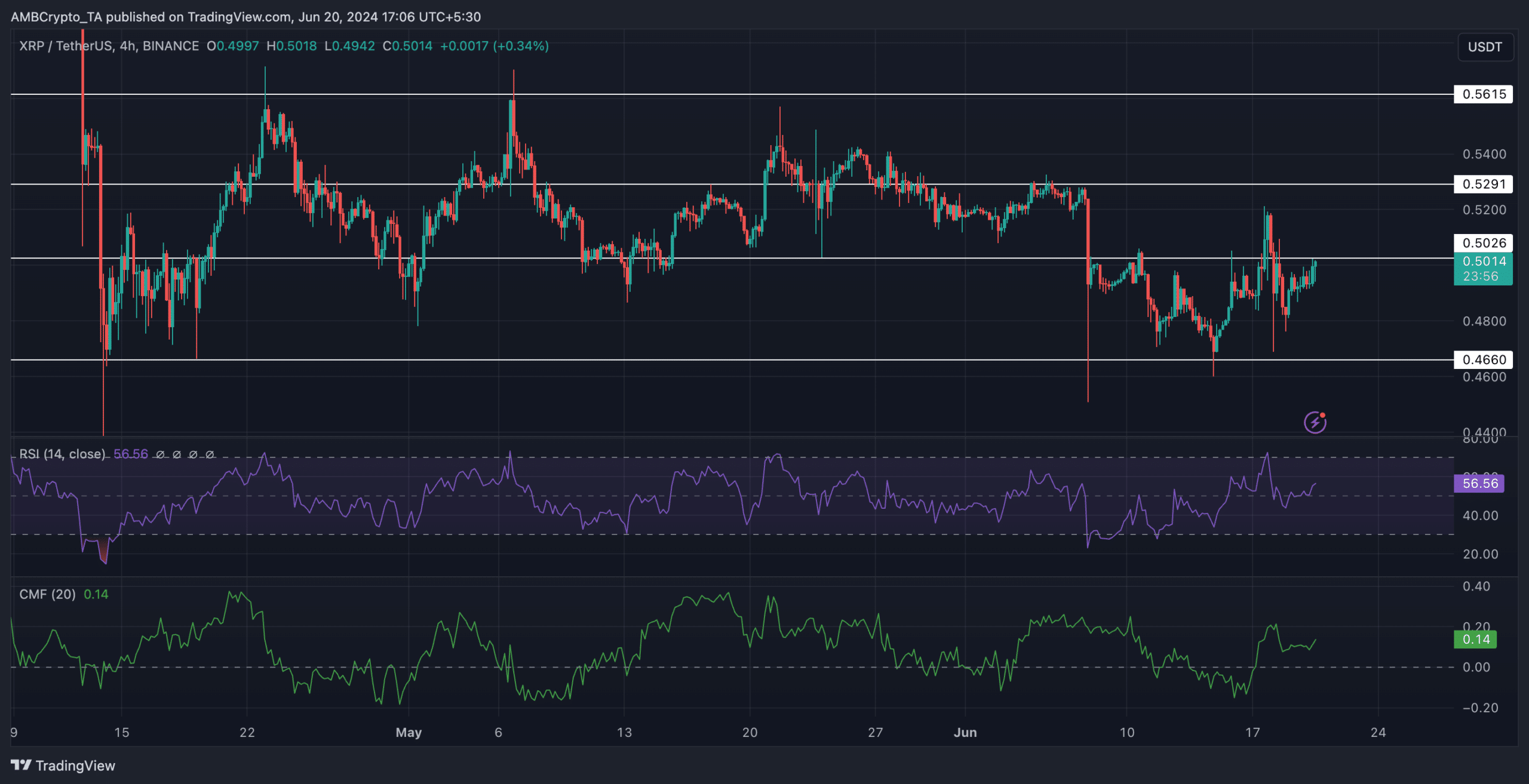

At press time, XRP was trading at $0.4996. In the last 24 hours, its price had grown by 1.29%. Despite the recent surge in price, XRP wasn’t able to make any significant change to its already established trend.

Since the 21st of May, its price had fallen, and exhibited multiple lower lows and lower highs. After this, the altcoin consolidated between $0.529 and $0.4660 level and moved sideways during this period.

The RSI (Relative Strength Index) grew materially, indicating that the bullish momentum around the token had grown.

Moreover, the CMF (Chaikin Money Flow) had also grown, implying that there was a significant amount of money flowing into XRP.

If the bullish momentum persists, XRP could reach $0.5291 levels and may even test the $0.5615 level in the future.

A bearish outlook on-chain

However, on-chain metrics did not paint a positive picture. AMBCrypto’s analysis of Santiment’s data revealed that Network Growth had declined materially over the last few days.

Realistic or not, here’s XRP’s market cap in BTC terms

This decline suggested that the number of new addresses interacting with XRP had fallen materially.

The Transaction Count had also fallen, which could be bearish for the token in the long run.