Silicon Valley Bank: Bitcoin investors in panic as market goes sideways

- BTC has logged negative funding rates for the first time this year.

- On-chain data shows increased selling as many exit trading positions.

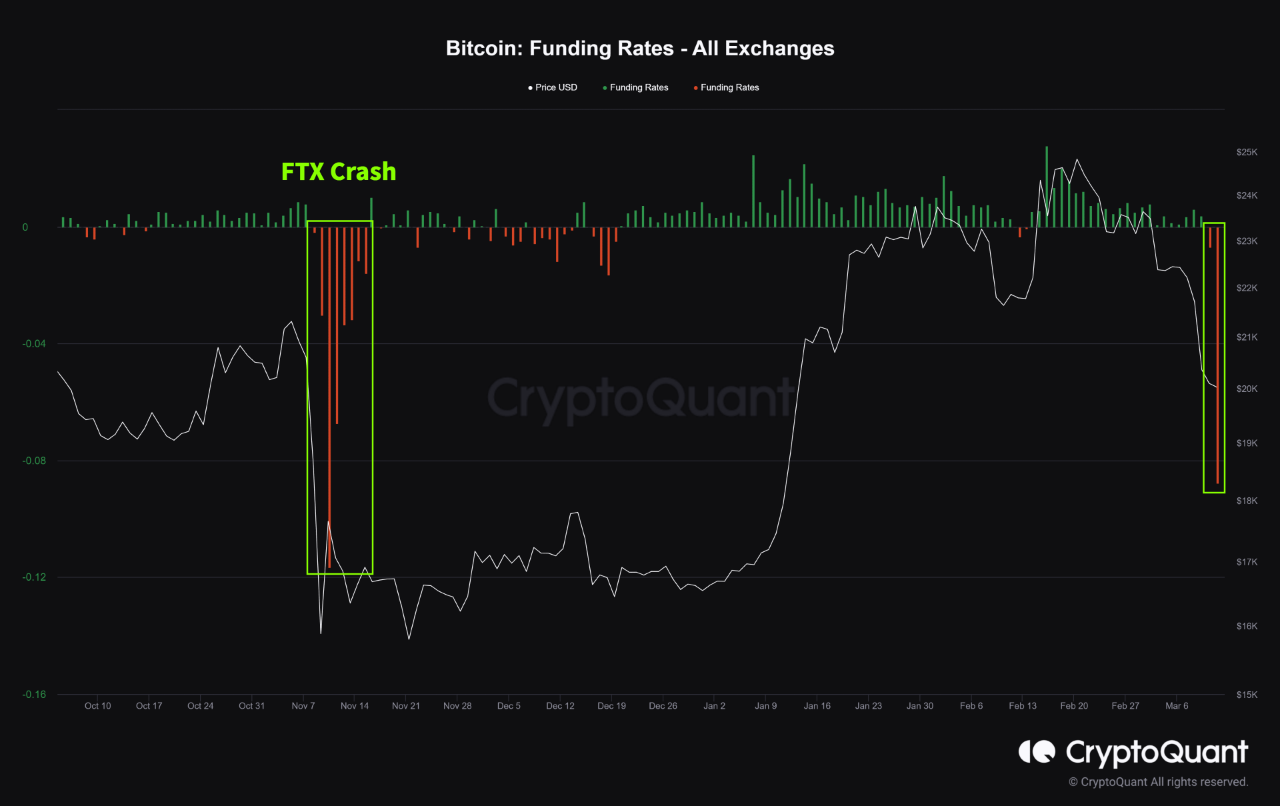

As the cryptocurrency market grapples with the uncertainty that lies ahead as banks resume operations on Monday, Bitcoin’s [BTC] funding rates turned negative for the first time since the year began, data from CryptoQuant revealed.

The BTC market has been hit by negative sentiments since the Silicon Valley Bank saga began, according to CryptoQuant’s Jay Bot. As a result, funding rates turned negative for the first time this year and have reached levels similar to those seen when FTX collapsed in November 2022.

Read Bitcoin [BTC] Price Prediction 2023-24

Funding rates are the fees traders pay to hold positions in futures markets. When the funding rate turns negative, traders are paying more to hold long positions than short positions.

Jay Bot, however, opined:

“If bad news disappears and Bitcoin prices rebound, a short squeeze may occur as the overheated short positions are liquidated.”

BTC bears take control as market sentiment turns sour

An on-chain assessment of BTC’s performance so far this weekend confirmed the exit of trading positions by investors.

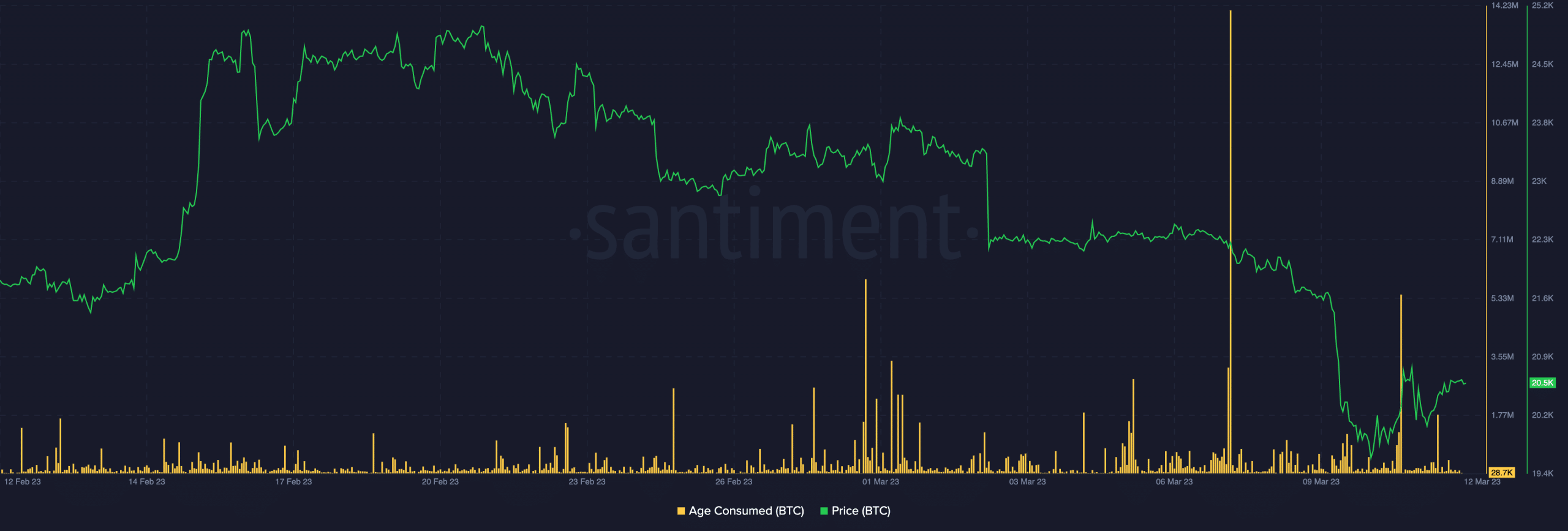

Data from Santiment revealed a spike in BTC’s Age Consumed metric in the early trading hours of 11 March. Investors’ confidence declined as the trading day progressed, causing the price of BTC to drop.

Is your portfolio green? Check out the Bitcoin Profit Calculator

A spike in an asset’s Age Consumed metric indicates that many previously idle tokens are now being transferred between addresses. This suggests that there has been a sudden and strong change in the behavior of long-term holders, who are typically known for making careful decisions.

HODLers and experienced traders are known for being deliberate in their actions, which is why the increased activity of dormant coins often coincides with major shifts in market conditions.

Moreso, a spike in Age Consumed followed by a price drawdown, as is the case here, marks the formation of a local top, which often marks the beginning of a period of price decline.

Furthermore, as BTC’s price dropped on 11 March, its Exchange Inflow rallied, per data from Santiment.

Generally, an increase in the number of coins moving to known exchange wallets just before a local top can indicate a widespread sell-off.

Sometimes, this sell-off may be too sudden and significant for the bulls to manage. However, this has been nothing out of the ordinary in BTC’s case.