Sinking Bitcoin ETF flow has THIS impact on BTC’s move to $70K

- Bitcoin ETF flows have dropped heavily since the beginning of the week.

- Liquidity inventory ratio rose, meaning supply could support demand for long.

Bitcoin [BTC] has exhibited sideways movement over the last ten days, wobbling in the range between $61,ooo to $65,000, data from CoinMarketCap showed. Even the recent halving failed to exert a decisive upward thrust to its trajectory.

ETF demand stagnating?

Julio Moreno, Head of Research at on-chain analytics firm CryptoQuant, attributed this in part to diminishing inflows to U.S. spot ETFs.

Indeed, net outflows of $217 million were recorded as on the 25th of April, and the funds have bled nearly $147 million since the week began, AMBCrypto noted using SoSo Value data. The last week saw more than $200 million worth of Bitcoins getting drained out.

Note that since their launch in early January, these investment vehicles have been one of the key drivers of Bitcoin’s price movement. Net positive days have invariably pushed prices up and vice versa.

Available supply could meet demand for a longer period

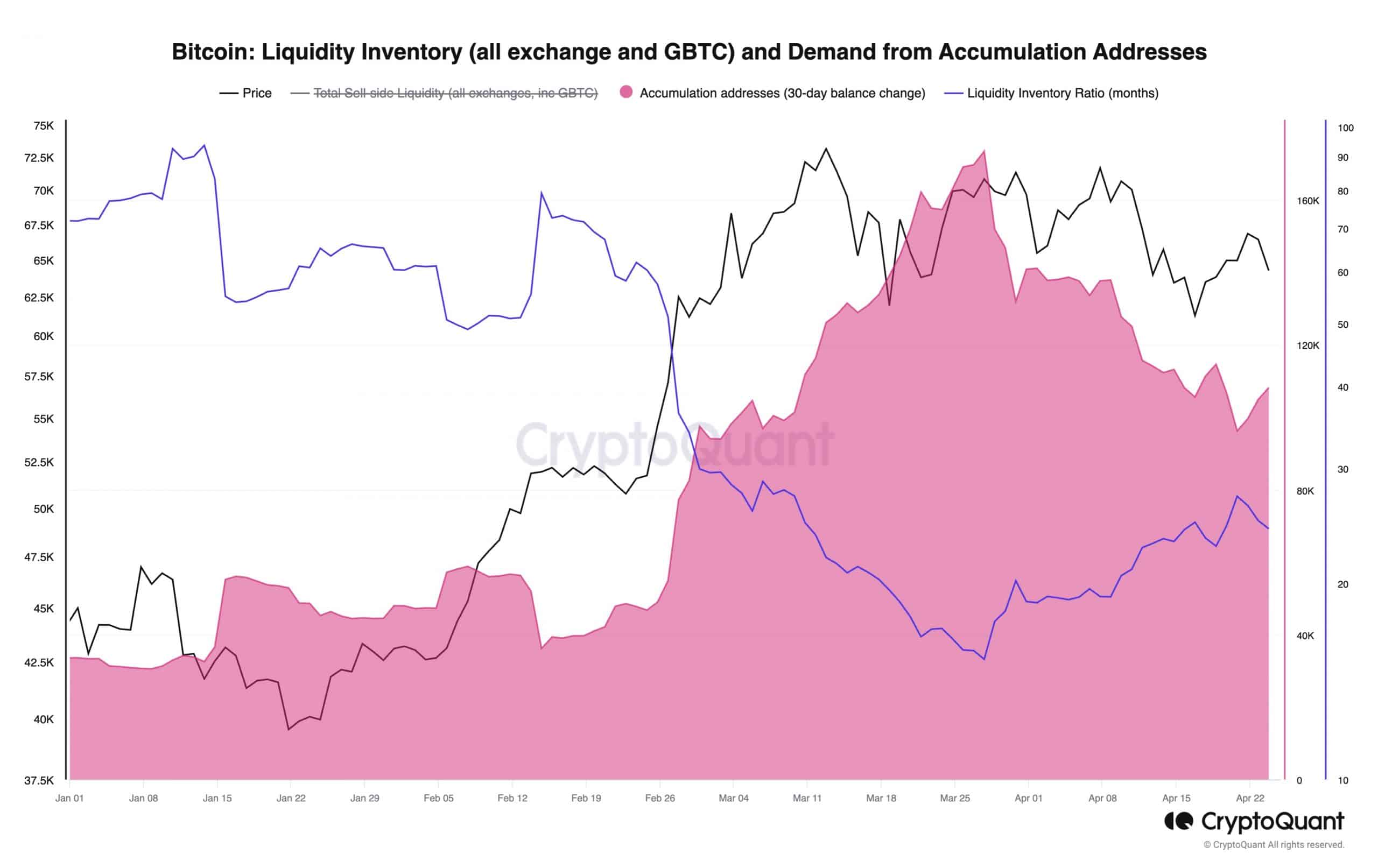

The declining demand was also apparent in the steep drop in accumulation addresses since late March. For the curious, accumulation addresses are those that have a history of only buying BTC but no history of selling.

ETFs, which absorb BTCs to back their shares, come under this category.

Consequently, the liquidity inventory ratio, which measures the sell-side liquidity of the asset against its demand, rose sharply from 15 months during late March to 24 months as of this writing.

What this meant in layman terms was that the available BTC supply would last longer given the thinning demand.

Source: CryptoQuant

Is your portfolio green? Check out the BTC Profit Calculator

Shivam Thakral, CEO of Indian cryptocurrency exchange BuyUcoin, predicted that the upcoming listing of Hong Kong’s spot ETFs might help galvanize demand for the king coin. In a statement shared with AMBCrypto, he said,

“After the Hong Kong ETF launch, we can expect a similar price momentum to that of January for Bitcoin, which could potentially push the largest crypto to a new ATH in the upcoming months.”