SOL, AVAX AI tokens and other cryptos star in analyst picks as InQubeta capitalizes on trend With $12M raise

The crypto market is going through a harsh pre-halving correction, with most major altcoins down over 10% in the last 24 hours while Bitcoin and Ether are down 7% and 6% respectively.

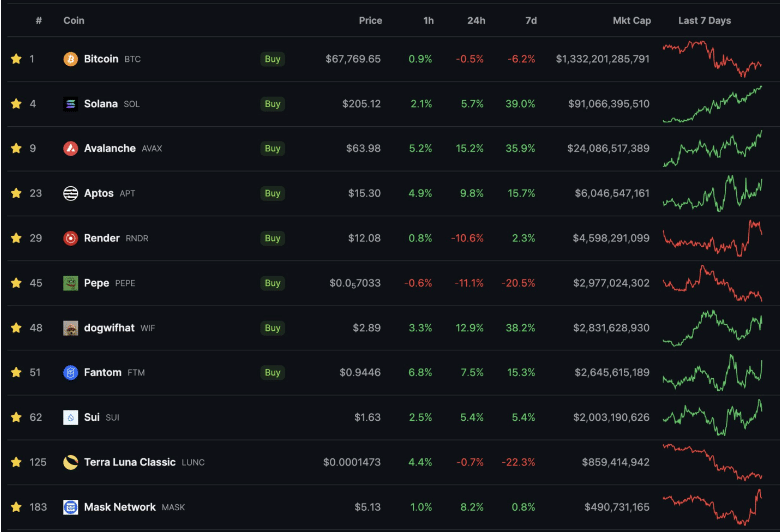

However, “correction time” can be a good opportunity to accumulate some of your favorite altcoins. Miles Deutscher, one of the most popular crypto analysts globally, shared his weekly token and narrative watchlist.

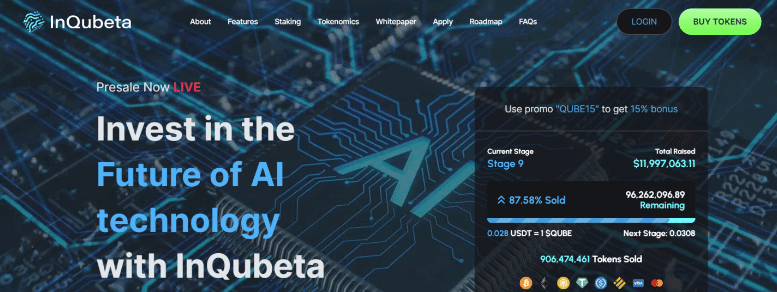

Meanwhile, one project that looks to capitalize on the hot AI narrative is InQubeta, raising over $12 million in its crypto presale today.

Deutscher Shares his Weekly Token + Narrative Watchlist

Deutscher’s weekly report covers a range of tokens and narratives he is watching closely. On the meme coin front, he highlights WIF and PEPE, noting the recent slew of new meme coin launches on Solana like SLERF, with capital rotating from the leaders into these more speculative trades. However, he cautions that “meme coin rotations happen quickly, and generally end up funneling back into the leaders.”

Solana itself (SOL) is on Deutscher’s radar, having “blasted through its previous ATH in market cap terms” with the analyst looking for a new price all-time high next. He views SOL as “essentially the currency of the Solana casino” required for participating in meme coin presales and other activities.

Among other Layer 1 blockchain, Deutscher is accumulating Sui (SUI) which “benefits from the recent SOL rally” and has an upcoming gaming summit with rumors of big announcements. Aptos (APT) is also on his list, with the community coining the term “Aptos April” amidst hints of major partnerships from executives.

The resurging Fantom (FTM) gets a mention too, with Deutscher long on the project as its “Sonic upgrade is getting closer and closer” while developer Andre Cronje is back pushing FTM hard.

For Bitcoin, Deutscher is “interested to see how [it] reacts to these major macro events, given it’s been running in isolation recently” referring to this week’s Federal Reserve interest rate decision. He ponders whether, given crypto’s increasing legitimacy with the Bitcoin ETF approval, the decision could impact BTC flows.

Two tokens from the Terra ecosystem, LUNC and LUNA, are also on Deutscher’s volatility watchlist ahead of the start of Do Kwon’s trial next week, as “these tokens tend to be volatile around these events.”

Mask Network (MASK) gets a nod for its upcoming mask token staking program and recent $100 million ecosystem fund announcement, providing “lots of tailwinds.”

Avax (AVAX) continues performing strongly according to Deutscher, “following the L1 Solana ‘catch up’ trade chart wise” with improving on-chain metrics and a push into gaming with a new Maple Universe partnership.

Lastly, Deutscher covers AI tokens, highlighting the space is “at an interesting crossroads” after the recent NVIDIA AI conference hype catalyzed a rally. He wonders if the actual conference could be a “sell the news” event, providing a potential accumulation opportunity, or conversely drive further upside with major announcements.

InQubeta Hits $12M Milestone

Riding the wave of excitement around AI in crypto, the InQubeta platform reached a big milestone today by raising over $12 million through its ongoing QUBE token presale. With over 900 million QUBE tokens sold at a price of 0.028 USDT each, the presale will soon enter its next stage with an increased token price of 0.0308 USDT.

InQubeta aims to revolutionize how AI startups raise funding by leveraging crypto and NFT technology. Through its NFT marketplace, AI companies can launch crowdfunding campaigns where their startup is represented as a fractionalized NFT. This allows investors of all levels to participate by purchasing portions of the NFT using the QUBE utility token. Investors then receive a share of the startup’s profits disbursed in QUBE tokens.

The platform’s model enables both reward-based and equity crowdfunding for AI firms through these fractionalized startup NFTs. Investors can thoroughly research projects through community insights, expert analysis, and startup details provided by InQubeta before deciding to invest their QUBE tokens.

To incentivize holding and provide income, InQubeta charges a 2% buy and 5% sell tax on QUBE transfers, with proceeds distributed to token stakers as rewards. This gamified staking mechanism aims to foster long-term community involvement.

AI startups must meet criteria around growth potential, alignment with InQubeta’s principles, and credibility of their mission to get listed on the platform’s curated NFT marketplace.

As an ERC-20 token, QUBE has deflationary properties and serves as the backbone for investing in listed AI startup NFTs as well as participating in the project’s governance decisions through a DAO.

AI Narrative Heating Up

The popularity of AI narratives in the crypto space can be attributed to several factors, including the broader crypto market’s performance, the influence of AI news headlines, and the potential for decentralization to disrupt traditional AI pipelines. Despite the challenges and uncertainties, the intersection of AI and crypto has seen significant growth and interest, driven by the potential for innovation and the ongoing development of AI technologies.

AI tokens have shown strong performance, often outpacing Bitcoin, Ether, and major AI equities like Nvidia and Microsoft. This is partly due to the broader crypto market’s performance and the influence of AI news headlines. AI-focused tokens can experience price fluctuations even when Bitcoin prices fall, leading to upside volatility during Bitcoin drawdowns.

The crypto-AI space is also exploring how decentralized methods can disrupt traditional AI pipelines for computing, validation, identity, and more. While there are technical and regulatory challenges, the potential for crypto to offer decentralized solutions to AI’s centralized problems has attracted attention. This includes creating human-readable transactions, improving blockchain data analytics, and utilizing model outputs on-chain as part of permissionless protocols.

Despite the potential, there are significant challenges for crypto-AI projects, including the need for decentralized platforms to reach feature parity with centralized counterparts, the rapid pace of change in AI, and the competition from both centralized companies and open-source solutions. The future of the AI and crypto overlap is still uncertain, with the development of AI technologies and the broader AI sector likely to shape the landscape.

Conclusion

Even as the AI crypto narrative heats up and innovative projects like InQubeta emerge, caution must still be exercised in an uncertain and volatile market environment.

As seasoned analysts like Deutscher highlight, the road ahead for speculative altcoins – whether meme coins or AI tokens – is likely to remain turbulent. Investors should do their own research, manage risk carefully, and view the space with a long-term mindset.