SOL bulls try to conquer $10.15 but bearish momentum could take over. Here’s why

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Solana’s drop below $9.6 could trigger a state of panic in the market

- Solana’s Open Interest too flashed bearish signs

Bitcoin [BTC] dipped below the $16.6k support level once more but did not indicate a trend had developed. Solana [SOL] reclaimed an area of support that extended from $9.7 to $9.9. Furthermore, technical indicators showed some short-term bullish momentum.

An 86.33x hike on the cards IF SOL hits Bitcoin’s market cap?

A drop below $9.6 could trigger fear in the Solana market yet again, and induce another wave of selling in the coming days.

$10.16 and $9.68 are the short-term levels to watch out for

On 28 December, Solana crashed to test the $9.93 level as support. It was able to bounce to $10.16, and even reached as high as $10.38 on the same day. The price action on that day indicated that sellers were in control of the $10 area. Solana fell to $8 on 30 December.

Right after this drop, Solana buyers went ballistic after a Vitalik tweet and a large number of short positions got liquidated. In the past couple of days, the price hasn’t managed to breach the $10.16 mark.

Even though the Relative Strength Index (RSI) climbed above neutral 50, the inference was not a bullish revival, but rather some short-term upward momentum.

The On-Balance Volume (OBV) has also risen over the past couple of days. Solana faces huge selling pressure in the $10-$10.15 area, as well as the $10.76-$11.11 area. Lower timeframe traders can look to buy if $10.16 was flipped to support, targeting $10.75.

On the other hand, a move back below the $9.6-$9.7 area would likely see SOL drop to $8 or further over the next week.

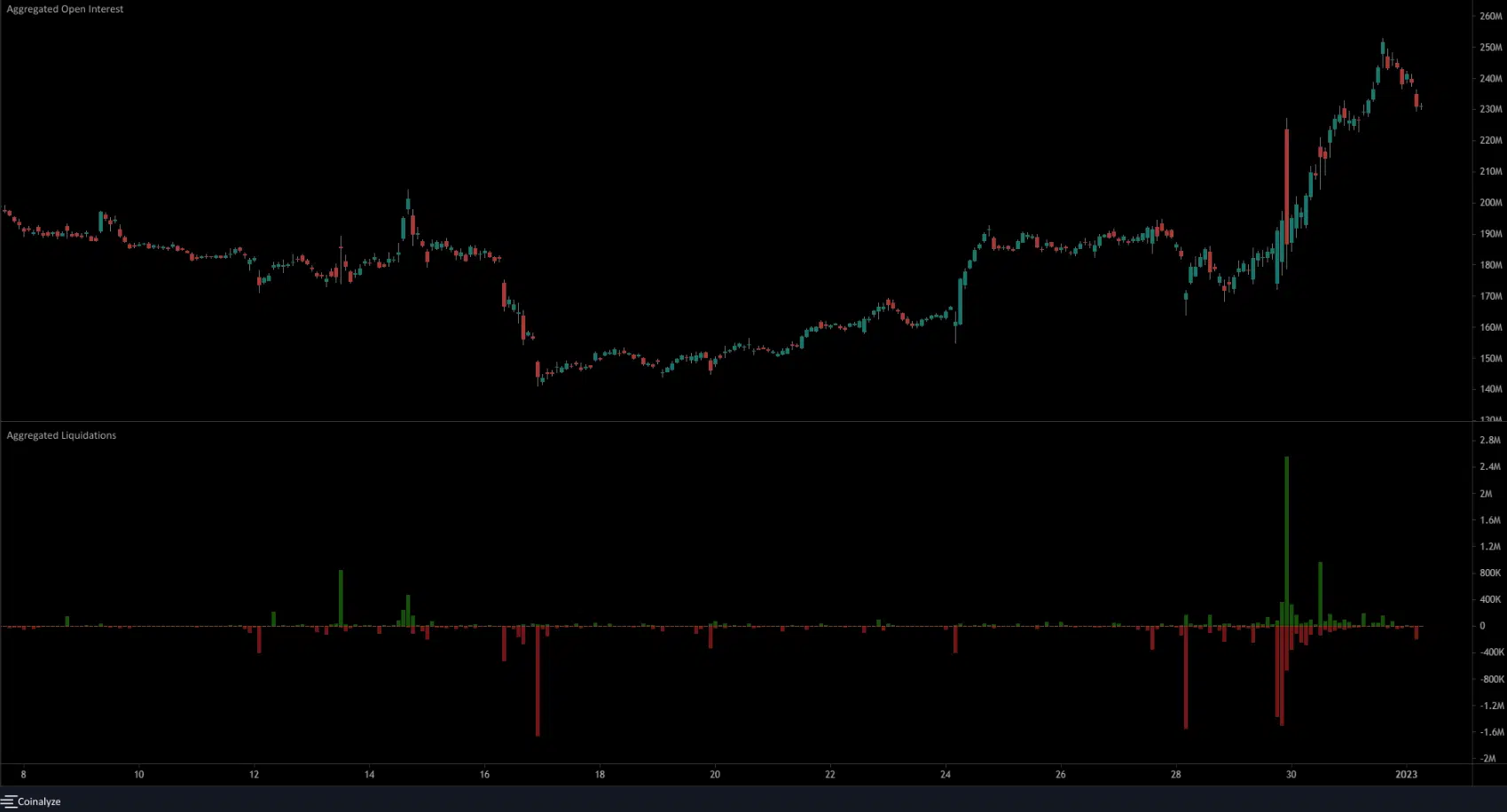

The rise in Open Interest suggested money was flowing into the market

Source: Coinalyze

The Open Interest began to rise after the price lost the $9.9 support level, which indicated strong bearish sentiment. The massive short squeeze that sent SOL back to $10.8 saw nearly $3 million worth of short positions liquidated in a single four-hour candle.

Are your SOL holdings flashing green? Check the Profit Calculator

After this event, the Open Interest climbed further higher while the price weakly crept up toward $10.15. It was unclear whether short positions were entering the market or whether the bulls had some sway.

The Long/Short ratio showed sellers had a minute advantage. A drop below $9.6 could discourage the bulls once more, forcing them to close long positions and adding to the selling pressure.