Analysis

SOL take a cue from Bitcoin’s sideway structure – Here are the levels to watch out for

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SOL was almost in a neutral structure at press time on the 4-hour chart

- It registered greater NFT trade volumes and development activity over the past few days

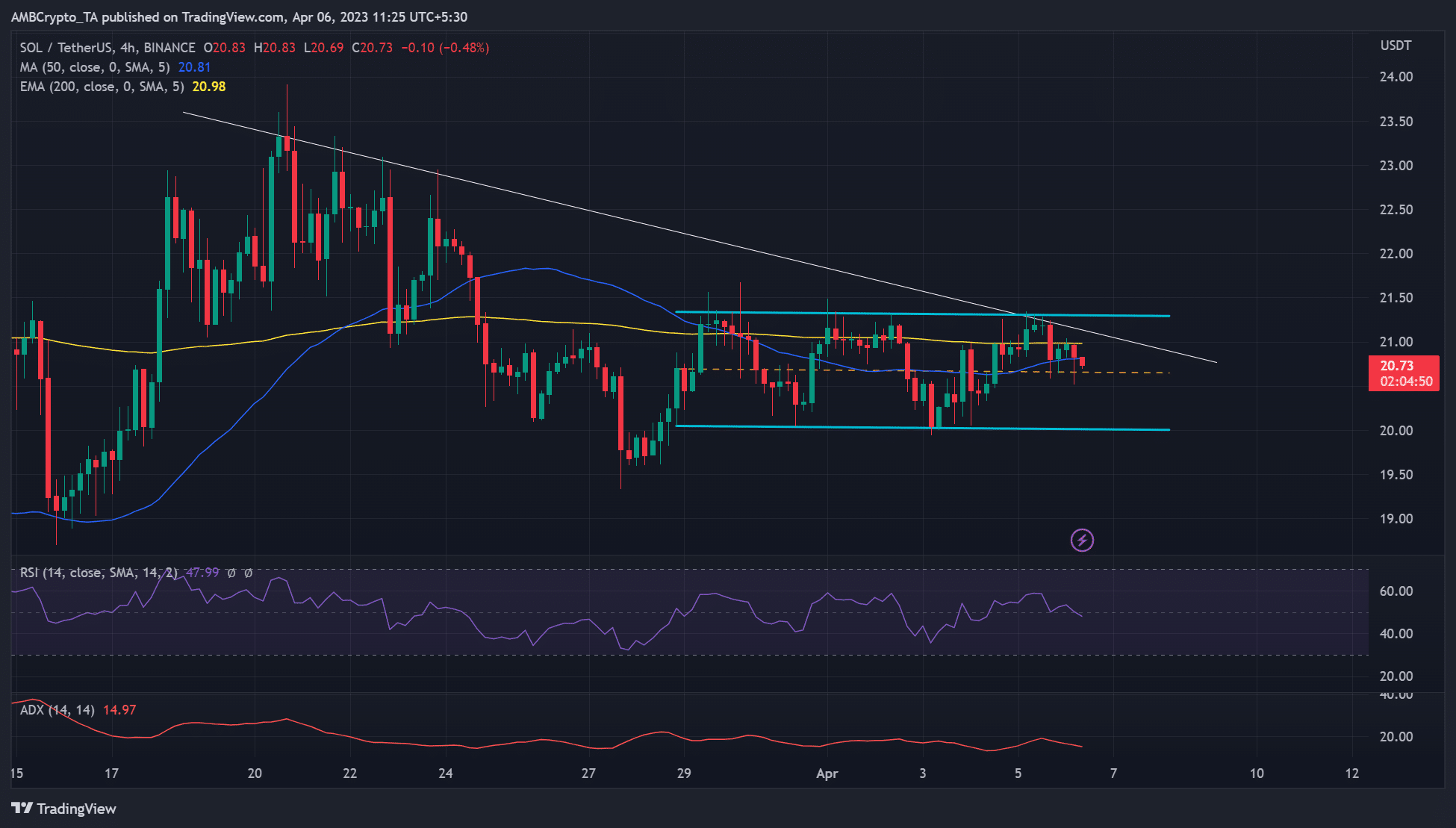

Solana [SOL] has aggressively defended the $20-support for the past few days. However, the price action hasn’t moved beyond $21.50 since the end of March, setting into a consolidation range below a multi-week descending line.

Read Solana [SOL] Price Prediction 2023-24

At press time,

Bitcoin [BTC] also oscillating between $26.8K and $28.8K. Since SOL has taken a cue from BTC’s sideways structure, an extended BTC consolidation could also tip SOL’s range trading to persist.Retracement or extended consolidation for SOL?

At the time of writing, near-term bears seemed determined to clear the 50 MA (Moving Average) of $20.81, which could lead to increased sell pressure in the short term. On the other hand, the price action was below the 200 EMA (yellow line), which has been moving in a straight line for the past few days. It revealed a likely extended consolidation phase in the mid/long term.

The declining ADX (Average Directional Index) further reinforced the consolidation thesis, which suggests a possible consolidation or retracement. However, the RSI (Relative Strength Index) was slightly below the 50-mark – A neutral position which underlined that the price could go in either direction.

Therefore, SOL could breach below the channel’s middle level of $20.65, especially if BTC drops below $28K and moves back to the $27K-zone. The channel’s lower boundary of $20 could check the drop and offer potential new buying opportunities if the support is retested.

However, a BTC surge above $28K could set SOL to target the channel’s upper boundary of $21.31. However, bulls must deal with a handful of barriers at the 50 MA, 200 EMA, and the descending line to hit the target.

SOL sees greater NFT trade volumes

Despite the recent cut-throat competition on the NFT front, the Solana network saw greater NFT trade volumes in the first week of April. Total NFT trade volumes rose from $7.8M on March 31 to $12.7M on April 5. Similarly, the development activity increased over the same period, which could bode well with investors. The same was supplemented by a hike in weighted sentiment too.

Is your portfolio green? Check SOL Profit Calculator

While improved investor sentiment could boost bulls’ efforts, BTC’s sideway structure can undermine any strong uptrend. As such, investors should track Bitcoin while targeting the channel’s boundaries for gains in the short term.