Solana, a ‘typical ponzi scheme’? Uncovering the allegations

- Solana’s vote transactions make up 85% of activity, raising concerns over validator costs and network decentralization.

- Failed transactions cost users thousands in fees, while larger validators benefit from Solana’s voting system.

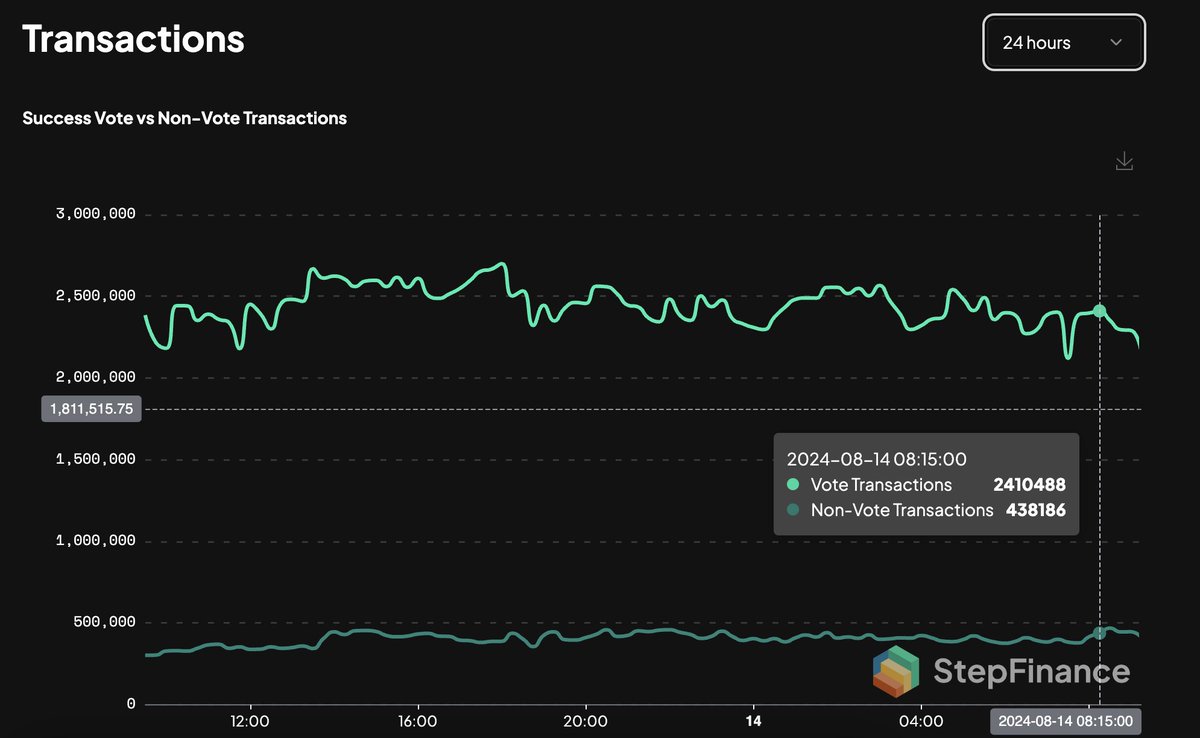

Recent data has brought attention to Solana’s [SOL] network, particularly regarding its transaction distribution and the challenges faced by validators.

An analysis shared by Dave, a Cardano development and decentralized exchange enthusiast, highlighted the overwhelming proportion of vote transactions on Solana and raised questions about the network’s fairness.

According to Dave, Solana processed approximately 2.4 million vote transactions, accounting for nearly 85% of the total transactions during this period.

The remaining 15%, around 438,000 transactions, were non-vote transactions.

This distribution sparked discussions about the nature of Solana’s transaction volume, with some observers questioning the actual user activity versus system-generated transactions.

Dave pointed out that vote transactions are essential for the blockchain’s functionality, but disproportionately benefit larger validators.

He compared this system to a “Ponzi-like” structure, where new validators are required to submit a high volume of votes, thereby generating fees that are mainly collected by more established validators.

He noted,

What I find really interesting is that, the voting mechanism in Solana bears similarities to a typical Ponzi scheme in that new validators are required to vote to participate in the network.

Dave further explained that,

“This dynamic contributes to the network’s long-standing super minority issue.”

He referenced the fact that only 17 validators currently control 33% of Solana’s staked assets.

“Rich get richer” phenomenon

Validators on Solana are expected to cast a large number of votes to ensure optimal performance.

According to Dave’s analysis, a perfectly functioning validator would need to submit approximately 216,000 votes daily, resulting in around 6.48 million votes per month.

Given that each vote transaction costs roughly 0.000005 SOL, this translates to a monthly expense of 32.4 SOL, equivalent to $4,728.29 at press time market rates.

This expense places a burden on smaller validators, while larger validators continue to benefit from the transaction fees, potentially consolidating their dominance in the network.

Critics argue that this creates a “rich get richer” dynamic, with newer and smaller validators struggling to compete due to the high operational costs.

In response to Dave’s tweet, DBCrypto noted that Solana counts various system-related operations, such as oracle calls and compute budgets, as transactions.

This, according to DBCrypto, inflates the network’s transaction volume.

He added that when these system-generated transactions are excluded, Solana’s effective transaction throughput might be significantly lower, with estimates ranging between 20 and 40 transactions per second (TPS).

Solana’s transaction failures and user fees

Another concern raised in the recent discussion revolves around transaction failures on Solana’s network.

The Jupiter Aggregator, a decentralized exchange aggregator, experienced an 83% failure rate over a recent 24-hour period.

Out of 10.31 million transactions processed, 8.56 million failed, leaving users to absorb fees despite their trades being unsuccessful.

Is your portfolio green? Check out the SOL Profit Calculator

Dave highlighted that users collectively paid $6,334.4 in fees for these failed transactions, raising questions about the reliability of Solana’s network for real-world applications.

This issue has led to increased scrutiny from the Solana community, with many pointing to the potential role of bots and validators in the high failure rate.