Solana among top searched projects, but metrics flash mixed signals

- Solana ranked fifth in top searches on 9 July.

- SOL’s price was currently undergoing a corrective phase as it trades around $20.7.

Solana [SOL] recently captured significant attention, soaring high among the most searched topics. While this accomplishment made the network’s position firm among the crypto community, the question remains: Did this surge in popularity have any tangible impact on its metrics?

Read Solana’s [SOL] Price Prediction 2023-24

Solana features in the top searches

Lunar Crush’s recent release of the top searches on its platform unveiled Solana’s noteworthy presence. Among various cryptocurrency projects capturing the interest of the crypto community, Solana secured an impressive fifth place in the ranking. This positioning signifies its prominence among projects that are currently garnering substantial attention.

?Top 10 trending searches on https://t.co/Ye6YvohFao.

1️⃣ $prez

2️⃣ $pepe

3️⃣ $lunc

4️⃣ $inj

5️⃣ $sol

6️⃣ $lunr

7️⃣ $bone

8️⃣ $bnb

9️⃣ $matic

? $arb pic.twitter.com/JBH0uLI2oD— LunarCrush (@LunarCrush) July 9, 2023

Solana metrics look the other way

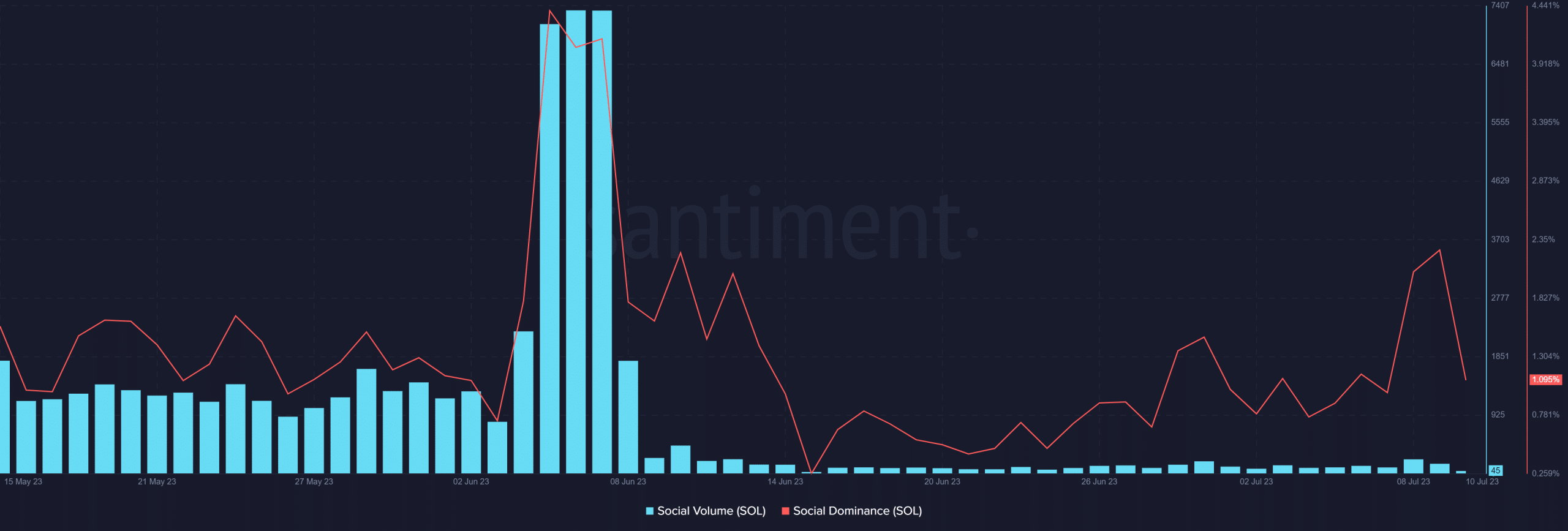

While Solana made waves in the trending searches on 9 July, this heightened visibility had yet to translate into significant influence within the crypto space. Analyzing its social volume and dominance on Santiment revealed relatively low activity surrounding the chain.

The social dominance metric was over 2% on 8 July, indicating that Solana accounted for over 2% of discussions within the crypto community. However, this metric had declined to approximately 1% as of this writing, suggesting a shift in the community’s focus away from Solana.

Source:Santiment

Furthermore, a closer look at the social volume metric indicated no notable spike, with the current volume hovering around 36. This lack of significant activity further emphasized the diminished discussion surrounding Solana in the crypto community.

SOL trends downward

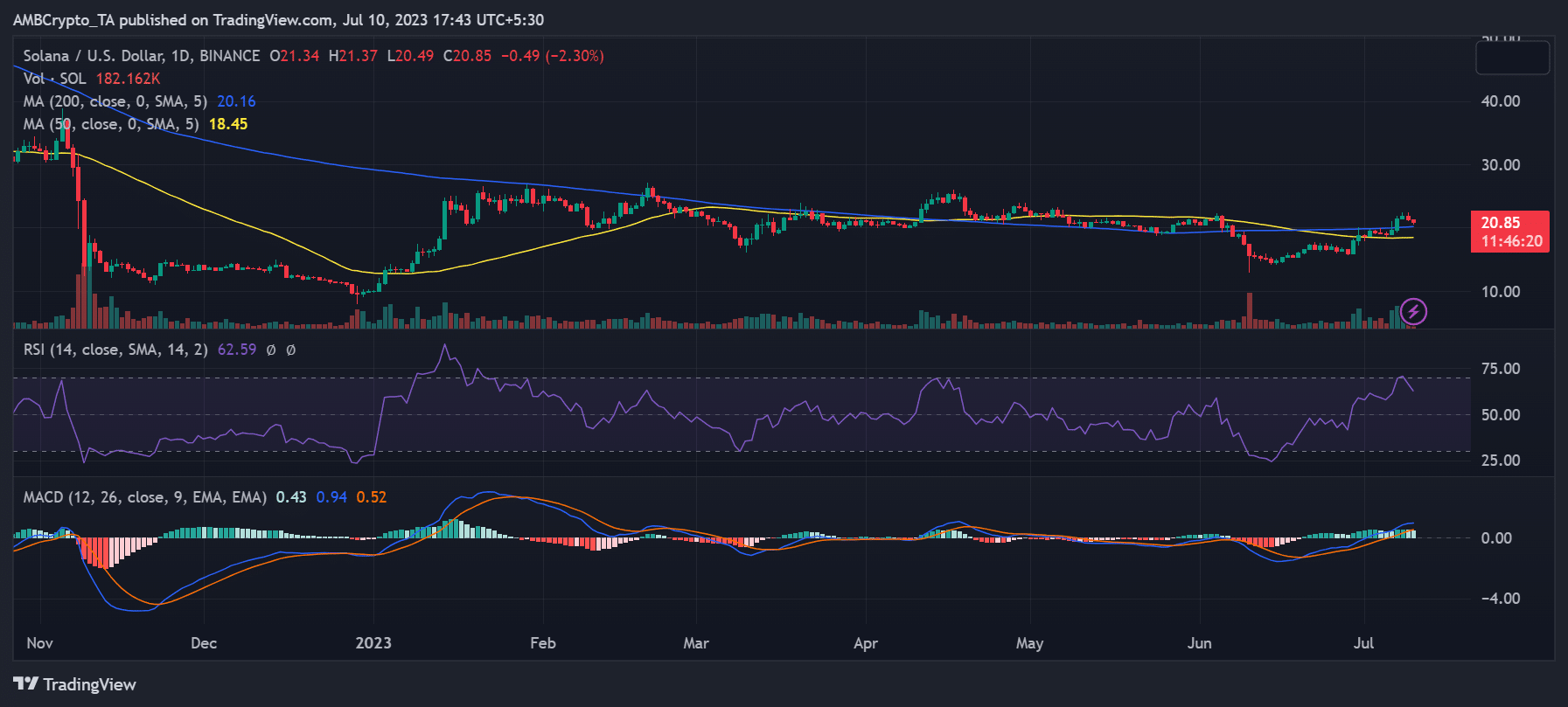

Solana’s recent developments have yet to impress social metrics and its price performance. Analyzing the daily price trend of SOL revealed a decline in value. By the close of trade on 8 July, SOL had experienced a loss of 2.24%. Unfortunately, this downward trajectory continued, as it was currently trading at around $20.7, reflecting a further loss of nearly 3%.

Source: TradingView

This downtrend could be a corrective phase following SOL’s entry into the overbought zone on the Relative Strength Index (RSI). Despite the correction, SOL remained in a strong bull trend, as indicated by its RSI value of over 60.

– How much are 1,10,100 SOLs worth today

Solana sentiment in flux

CoinGlass data revealed a market in flux, with conflicting funding rates reflecting uncertainty. On 9 July, the funding rate was negative, suggesting anticipation of a downtrend in price. However, as of this writing, the funding rate had shifted to a positive value, signaling the expectation of a future price increase.