Solana

Solana: Analyzing SOL’s bullish pattern as open interest spikes

Inflows to Solana investment products totaled $3.8 million last week, suggesting rising demand.

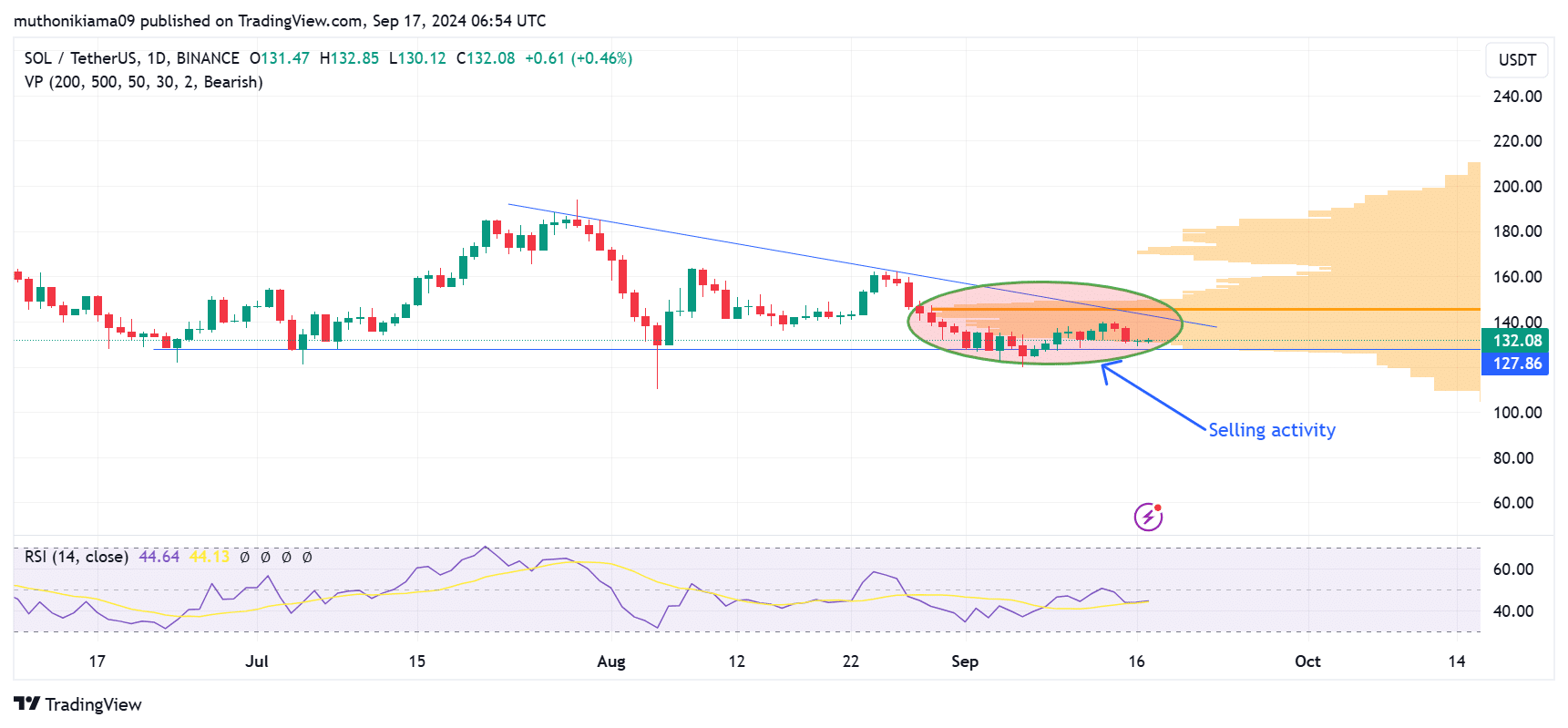

- Solana has traded within a falling wedge pattern for an extended period with the narrowing range suggesting waning selling momentum.

- A spike in open interest and fund flows could support a bullish breakout.

Solana [SOL] price showed mild volatility at press time as volumes across the crypto market cooled due to uncertainty around the impact of interest rate cuts later this week.

SOL was trading at $132 at the time of writing after a slight 0.5% gain. Volumes had also fizzled per CoinMarketCap, after dropping by 10% within 24 hours.

Solana has traded within a falling wedge pattern for an extended period without making a bullish breakout. However, the narrowing range of this pattern suggests that selling pressure is waning, and a breakout to the upside is likely.

Nevertheless, for this breakout to happen, SOL needs to overcome resistance at $139. As seen in the volume profile data, Solana has been rejected at this level severally because of an influx of sellers.

The high selling activity in the past as Solana approached $139 also shows that this price is acting as a distribution phase, where traders have exited positions due to a lack of confidence in the uptrend.

Buying momentum needs to return to support a bullish breakout above the upper trendline of the falling wedge. The Relative Strength Index (RSI) at 44 showed that buyers are fewer than sellers.

The RSI line has also converged with the signal line. Confirmation of a crossover is critical because if the RSI crosses above, it could indicate a buy signal. Conversely, a move below will present a sell signal that could see SOL drop to test critical support at $127.

Open interest and fund flows fuel optimism

Data from Coinglass showed a gradual rise in Solana’s open interest. At press time, the open interest was at $2.12 million, the highest level this month.

A rise in open interest suggests that derivative traders are opening and holding positions on Solana. This increases money flow to the asset, which could spur volatility and support a bullish momentum.

Additionally, a recent CoinShares report noted that traders are paying more attention to Solana investment products.

Last week, inflows to Solana investment products totaled $3.8M, while flows to Ethereum (ETH) came in negative with $19M in outflows. This data suggests that SOL products are attracting more demand than other altcoins.

Read Solana’s [SOL] Price Prediction 2024-25

This surge in demand could offset the selling momentum around Solana and set the stage for a rally.

Furthermore, the Solana network could also be a catalyst for SOL price growth. Per DappRadar, the Unique Active Wallets (UAWs) on Solana increased by more than 300% in 30 days suggesting rising blockchain usage.