Solana: Assessing whether SOL can cross $200 in May

- Investors’ sentiment around SOL turned bearish in the last 24 hours.

- A few metrics suggested that SOL’s price might increase in the coming days.

Solana’s [SOL] price tumbled in the past day, sparking fear about a further dip. However, there were chances of a trend reversal. If that happens, then investors might witness SOL reclaim $200 soon.

Solana’s latest fall

The last 24 hours were not in investors’ favor, as Solana’s value fell by more than 6%.

According to CoinMarketCap, at the time of writing, SOL was trading at $134.70 with a market capitalization of over $60.2 billion. The considerable price drop had an impact on SOL’s social metrics.

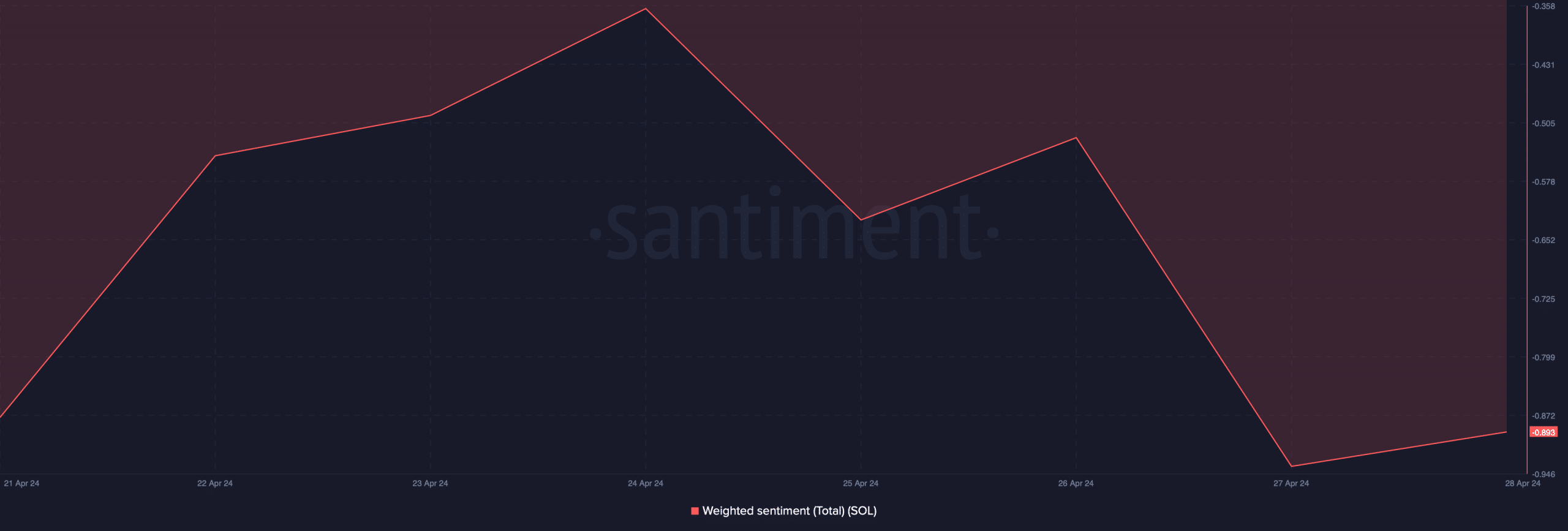

Its Weighted Sentiment dipped sharply, meaning that bearish sentiment around the token became dominant in the market.

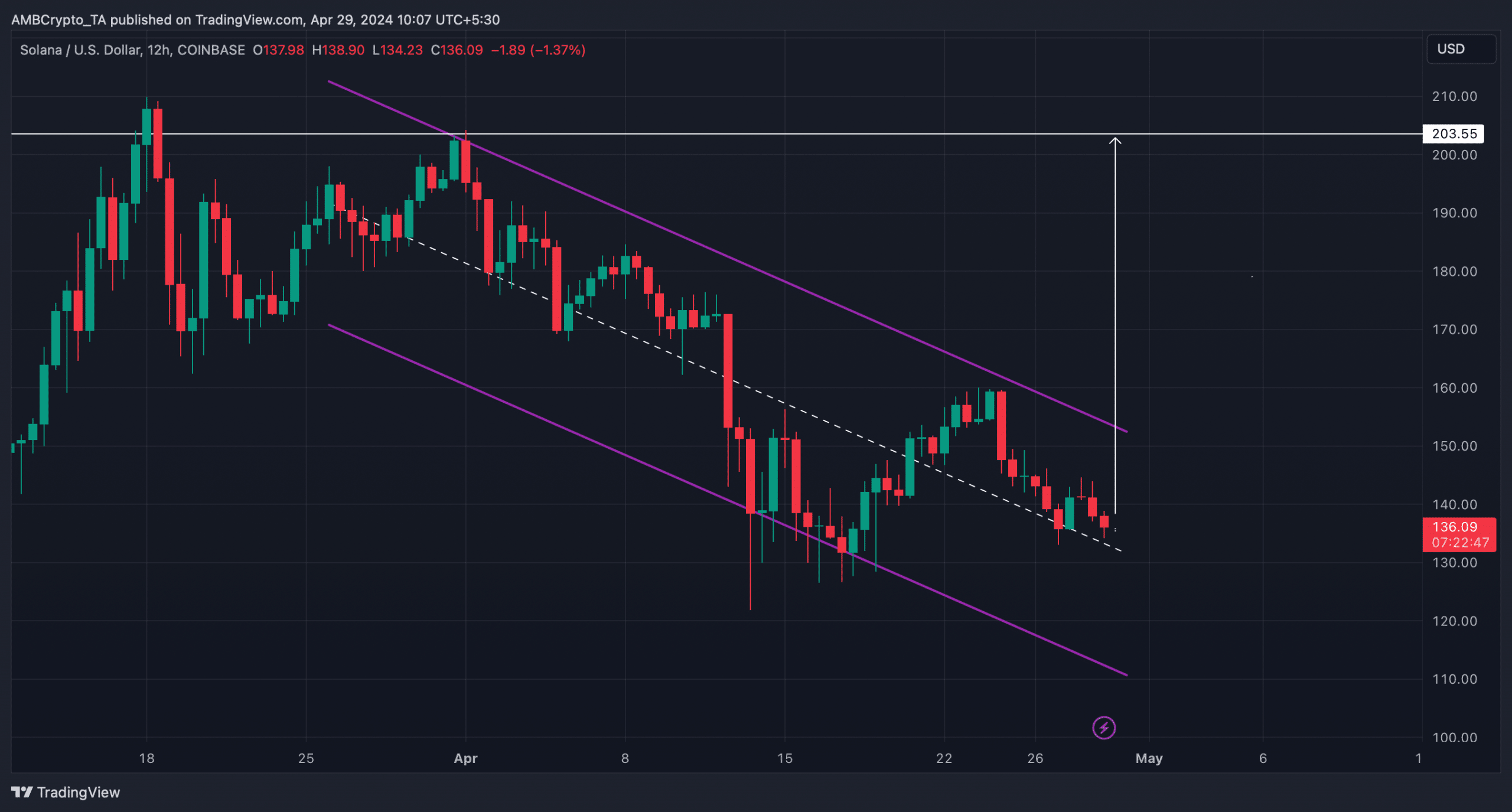

However, there was more to the story than just this. AMBCrypto found that SOL’s price was moving in a descending channel on its 12-hour chart.

If Solana manages to test that pattern and register a breakout, then things might get bullish in the coming days or weeks. In fact, it might as well allow SOL to recover and reclaim the $200 mark too.

Odds of SOL touching $200

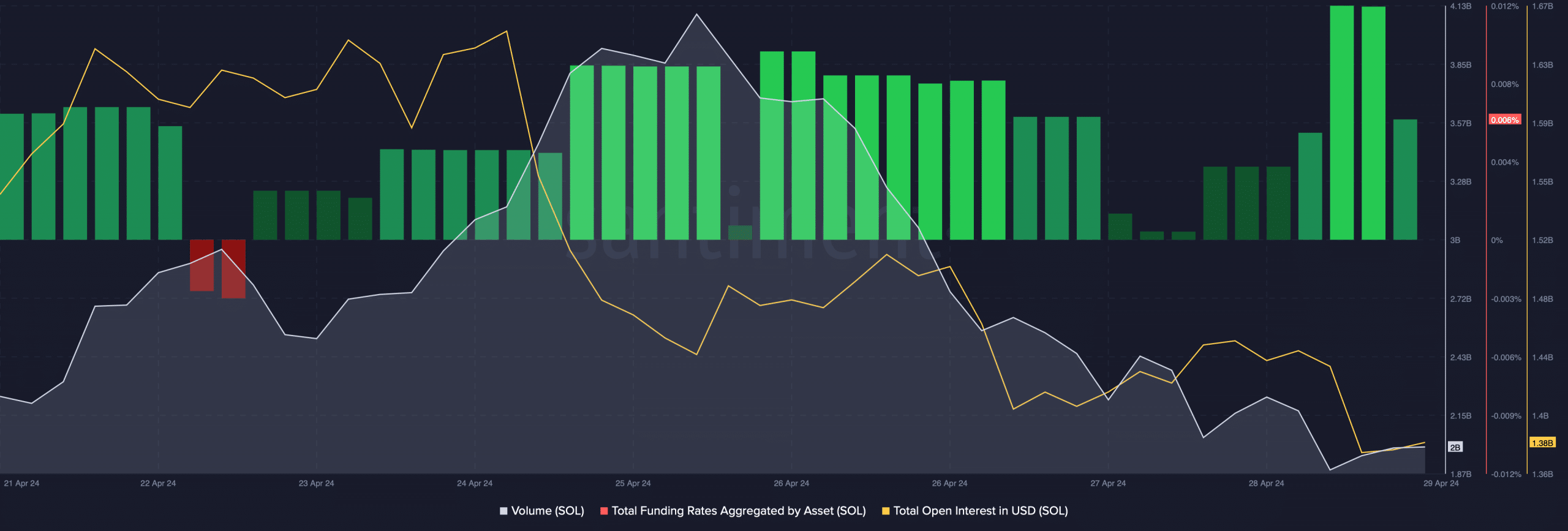

AMBCrypto then analyzed SOL’s on-chain data to find out whether the token would manage to break out of the pattern. As per our analysis of Santiment’s data, SOL’s volume plummeted sharply along with its price.

This suggested that the bearish price trend might not last long.

Its Open Interest also followed a similar declining trend, further hinting at a trend reversal soon. However, its Funding Rate remained high, which can be inferred as a bearish signal.

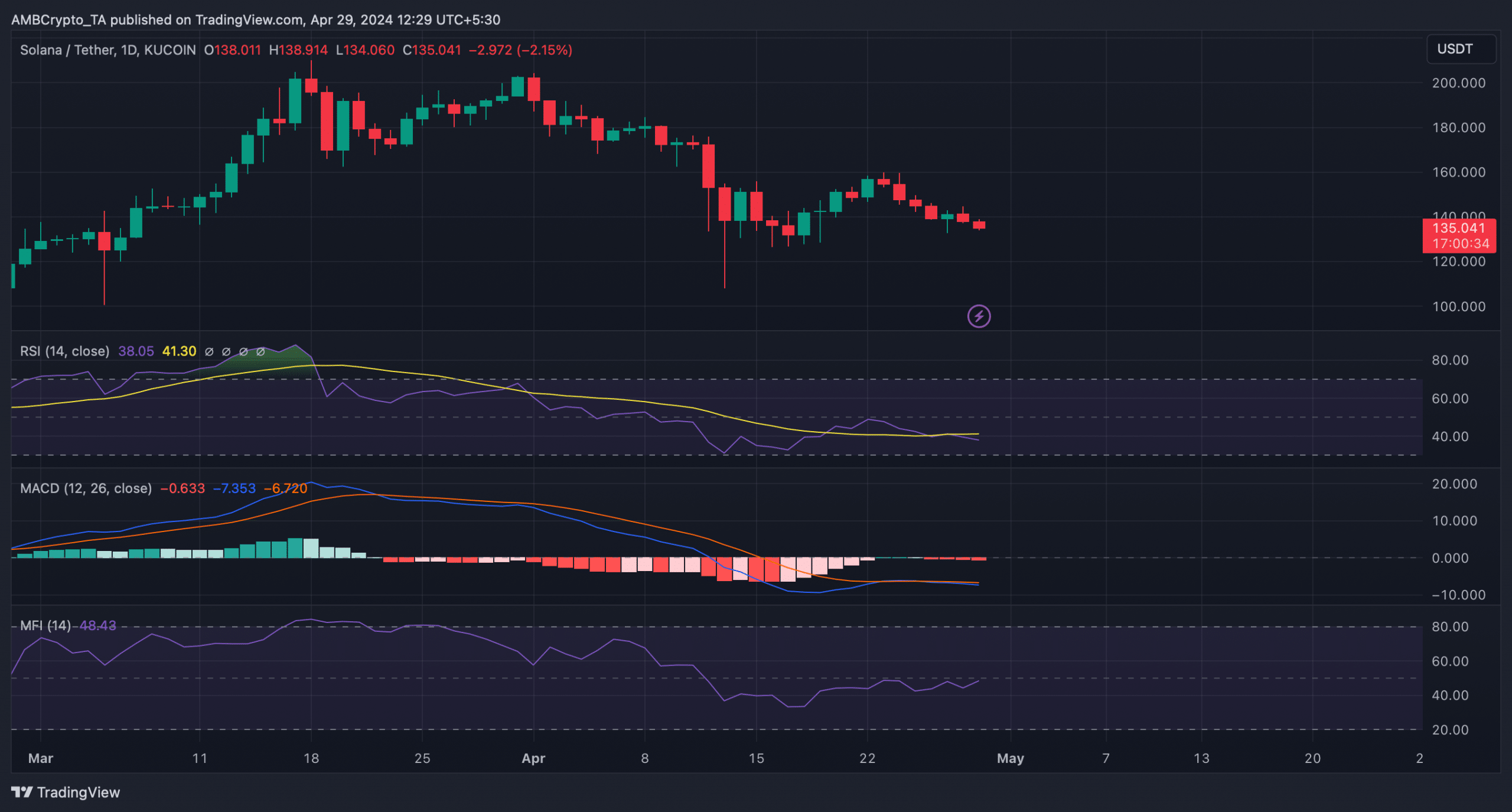

The technical indicator MACD supported the sellers as it displayed a bearish crossover. SOL’s Relative Strength Index (RSI) also registered a downtick, signaling that the price decline might continue.

As per the Bollinger Bands, SOL’s price was in a less volatile zone, which suggested that the chances of an unprecedented price uptick were low.

Nonetheless, the Money Flow Index (MFI) remained bullish as it moved northward.

Though there was a possibility for the bearish trend to persist, AMBCrypto checked Hyblock Capital’s data to find possible near-term resistance levels if a bull rally happens.

Read Solana’s [SOL] Price Prediction 2024-25

We found that SOL’s liquidation would rise near $146. Therefore, it’s crucial for SOL to go above that mark to sustain its bull rally. Going further north, the $160 is also a vital level, as liquidation would rise sharply.

A successful breakout above that would clear SOL’s path towards $200.