Solana

Solana, BNB vie for top spot: What SOL’s lead will mean for the market

SOL and BNB are battling for rank #4. While SOL currently holds the edge, a new ATH above $260 could cement its lead.

- SOL followed BTC’s lead, jumping over 15% to flip BNB and become the fourth-largest cryptocurrency.

- A new ATH could be within reach if SOL holds above the $180 mark.

The crypto market is buzzing, up 3% after the US elections, with Solana [SOL] stealing the spotlight, surging 15.8% and flipping Binance Coin [BNB] to become the fourth-largest cryptocurrency.

With SOL breaking out above $180, analysts are eyeing a potential run towards $250. Having posted a 30.5% monthly tear, is it the one to keep an eye on?

There is more to it than SOL flipping BNB

Interestingly, SOL has not only dethroned BNB but has also emerged as the top performer among the top 5 altcoins, capturing significant liquidity from Bitcoin.

This marks the second consecutive time Solana has been seen as one of the strongest cryptocurrencies. During Q3’s market retraces, SOL held above its breakout levels while most altcoins struggled.

Additionally, SOL posted a daily gain of over 11%, slightly outperforming BTC on the day of the election results, while Ethereum posted a 4% surge.

Thus, a market shift is deepening. Once the top coin attracting the most capital as BTC moved bullishly, Solana is now slowly overshadowing Ethereum.

Flipping BNB was a solid confirmation of this shift. If this trend holds in the long term, SOL could soon hit $100 billion in market cap, potentially targeting ETH’s position next.

What are the odds?

SOL’s breakout above the $180 mark represents a breakout from an 8-month consolidation range that started after SOL hit its yearly high of $202, coinciding with BTC hitting $73K.

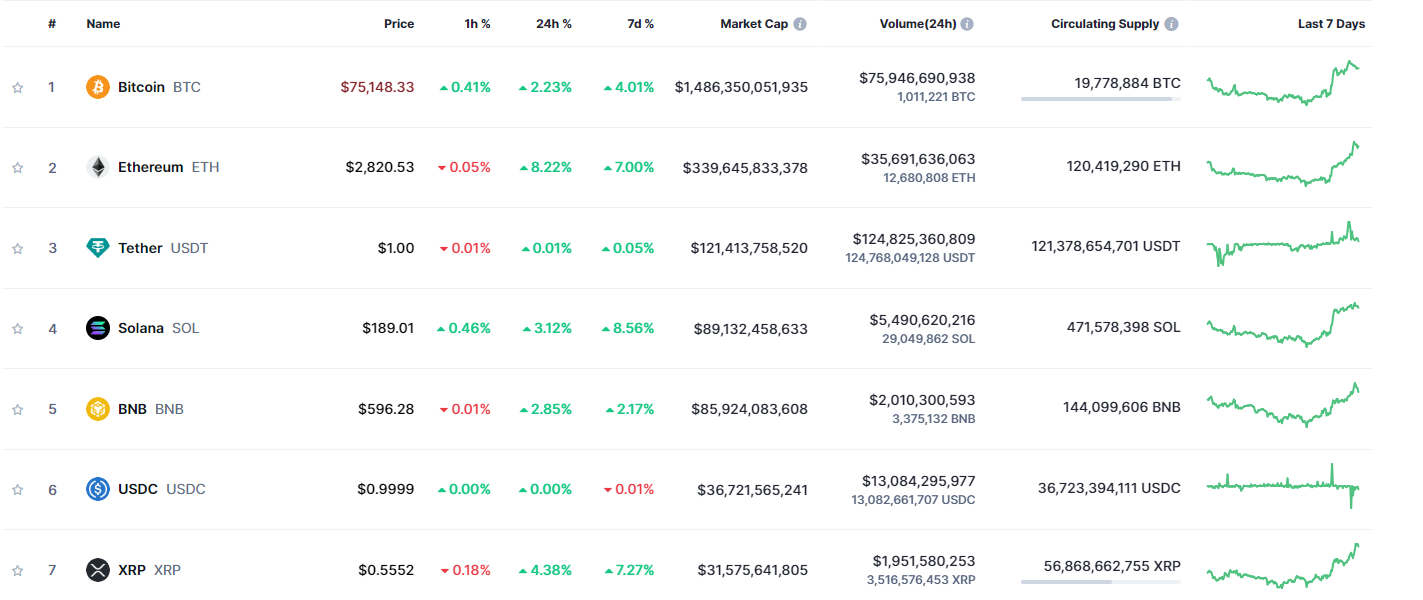

In the last 24 hours, SOL’s daily trading activity has surged by 210%, reaching $10.7 billion. Additionally, its market cap has risen by 14.66%, reaching $88.1 billion.

As a result, SOL has flipped BNB, with its $85 billion market cap, to become the fourth-largest cryptocurrency by this metric.

With a bullish MACD crossover on the daily chart, the odds of SOL testing above its yearly high are strong.

A reclaim of the $200 mark, which hasn’t been seen since March, could propel SOL beyond its previous ATH of $260 in the coming weeks.

If this momentum continues, SOL’s market cap could potentially reach $100 billion. However, for this to materialize, BNB would likely need to underperform.

A neck-and-neck race for dominance

As BNB approaches a key resistance level at $600, it will be important to monitor its performance in the coming days.

A recent report from AMBCrypto noted a short-term bullish outlook for BNB, suggesting it is likely to consolidate within a specified range unless strong accumulation takes place.

Interestingly, this could open up an opportunity for Solana bulls to keep SOL in the fourth spot, a position that may be crucial for attracting capital amid rising market volatility.

While the current momentum is fueled by Bitcoin hitting an ATH alongside a pro-crypto majority in Congress, SOL could see a pullback if it fails to hold its support level, potentially slipping back below BNB.

Read Solana’s [SOL] Price Prediction 2024–2025

In short, Solana has achieved several key milestones this quarter, establishing itself as the go-to high-cap token for stability as BTC enters a high-risk zone.

While the odds presently favor SOL over BNB, a push to a new ATH above $260 would further solidify this trend.