Solana breaks past $200: Should you cash in, or wait some more?

- Solana continued to show bullish strength.

- Trying to catch the exact top could be counterproductive for traders.

Solana [SOL] bulls refused to bow down to the bearish pressure. Even when Bitcoin [BTC] fell below the $70k level on the 15th of March, SOL was trending higher. It breached the $180 mark on that day.

Data from DefiLlama showed that Solana’s total value locked (TVL) has surged by over 80% in the last month. It also logged the highest DEX volume for the second straight day, overshadowing Ethereum [ETH].

Should investors fear a pullback, or look to ride the trend?

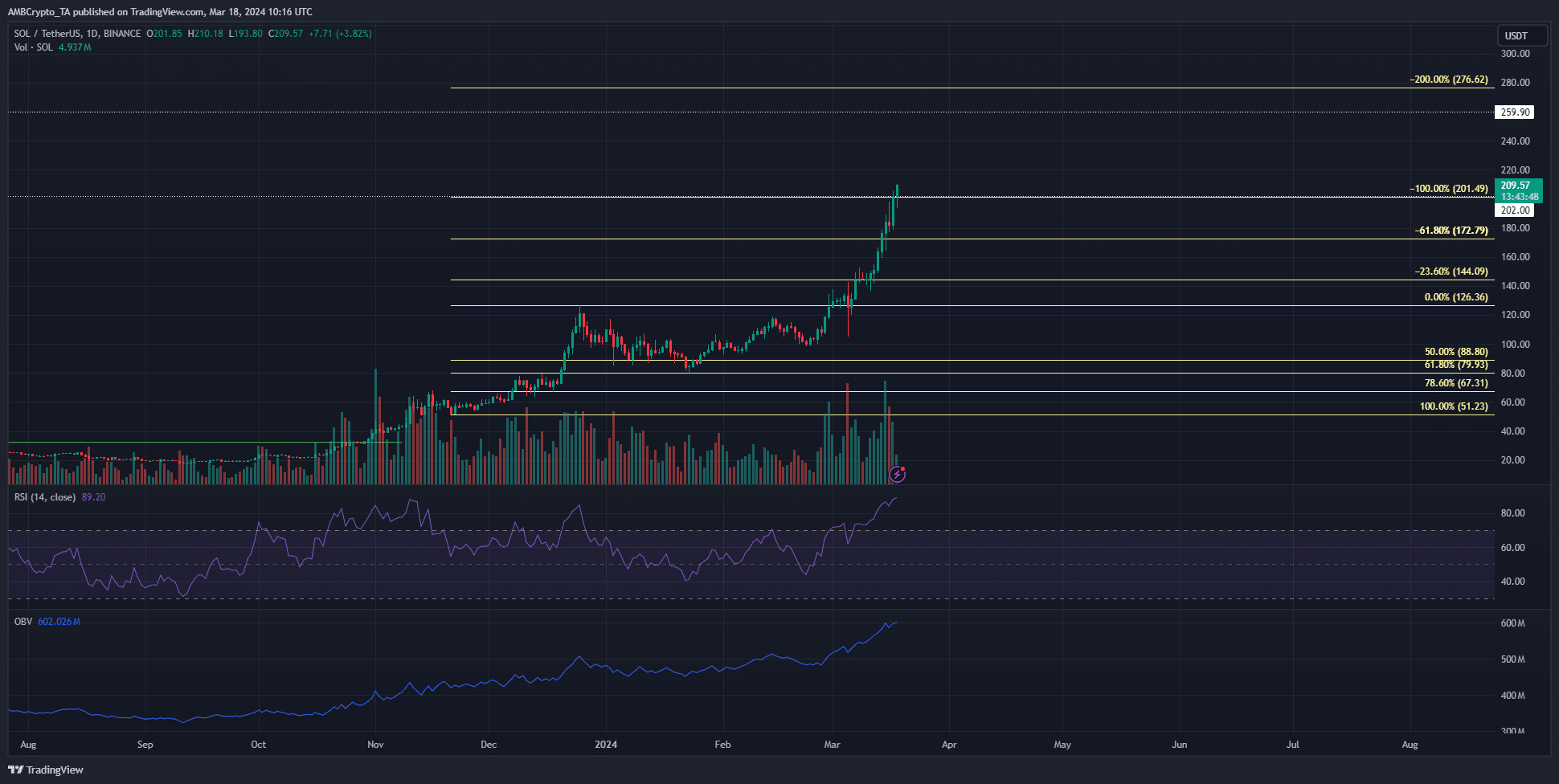

Solana’s major retracement has simply not occurred after the January drop to $79. The RSI on the daily chart was at 88, deep in the overbought territory.

While it does not indicate a pullback is imminent, it highlights overheated conditions.

The OBV trended higher since late January. The buying volume has been phenomenal, and SOL has gained 26x since the 2022 low at $8. Above the$180 mark, resistance overhead was scant.

The $259 and $276 levels were areas of interest, as was the $202 region. However, this zone could be retested as support, since the market has been parabolic recently.

Analysis of the lower timeframes showed that the $178 and the $162 support levels would also be key.

A drop below these levels would indicate a bearish structure on the 1-hour timeframe and a potential shift in momentum on higher timeframes.

Speculative activity depicts manic bullishness

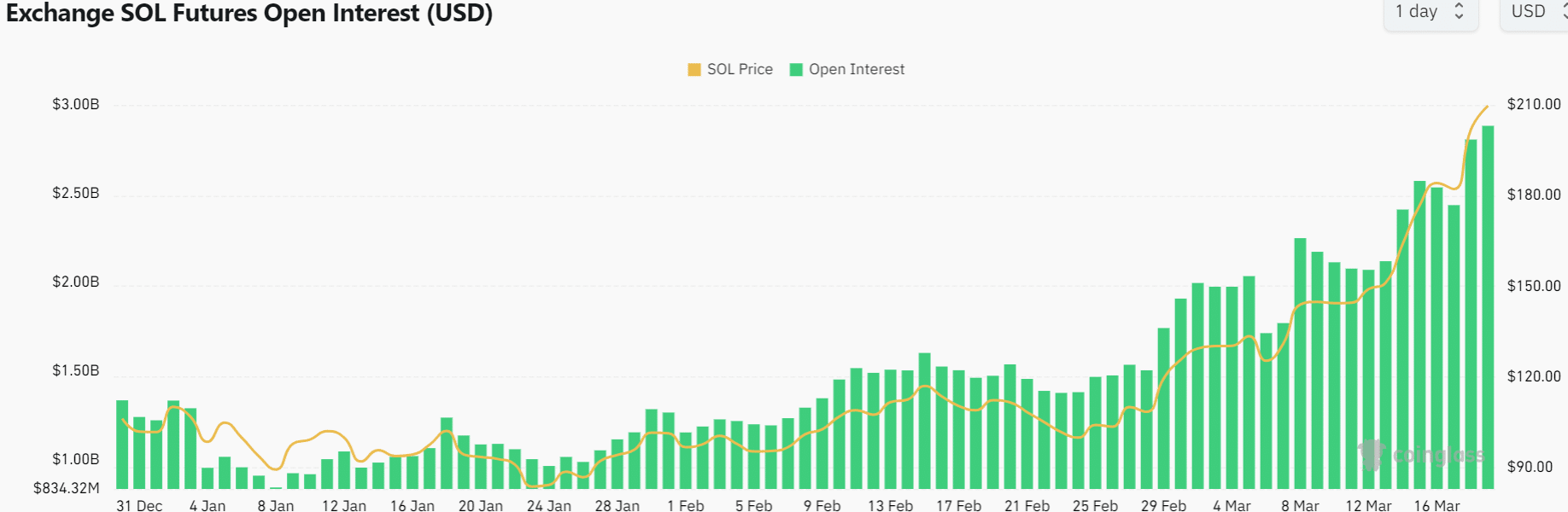

Source: Coinglass

The Open Interest chart showed no signs of slowing down. According to Coinglass data, the OI behind Solana reached highs never seen before. This comes alongside a price surge from $120 to $209 in just over a month.

Is your portfolio green? Check out the SOL Profit Calculator

The OI surged from $1.71 billion on the 6th of March to $2.88 billion at press time on the 18th of March. This phenomenal rise indicated extreme greed but did not encourage short-selling.

Nor does it guarantee that a pullback is imminent. The local top was not in yet.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.