Solana CME Futures: Unable to beat BTC, ETH’s launch, what’s ahead for SOL?

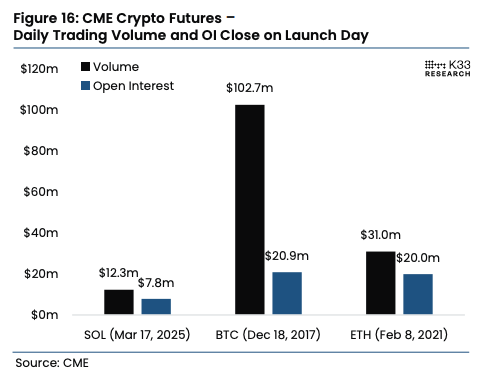

- Solana Futures recorded $12.1M in volume on day one, far lower than Bitcoin ($102.7M) and Ethereum ($31M).

- Regulated Futures have historically led to ETF approvals; Bloomberg Intelligence gives SOL a 70% chance of ETF approval by late 2025.

The launch of Solana [SOL] Futures on the Chicago Mercantile Exchange (CME) marked a significant step in the asset’s institutional adoption.

However, trading activity on the first day fell short when compared to previous futures debuts of Bitcoin [BTC] and Ethereum [ETH].

According to CME data, Solana Futures saw $12.1 million in trading volume on the 17th of March, with $7.8 million in Open Interest.

In comparison, Bitcoin Futures launched in December 2017 with $102.7 million in first-day volume and $20.9 million in Open Interest.

$12 million vs. $102 million

Ethereum Futures debuted in February 2021 with $31 million in trading volume and $20 million in Open Interest.

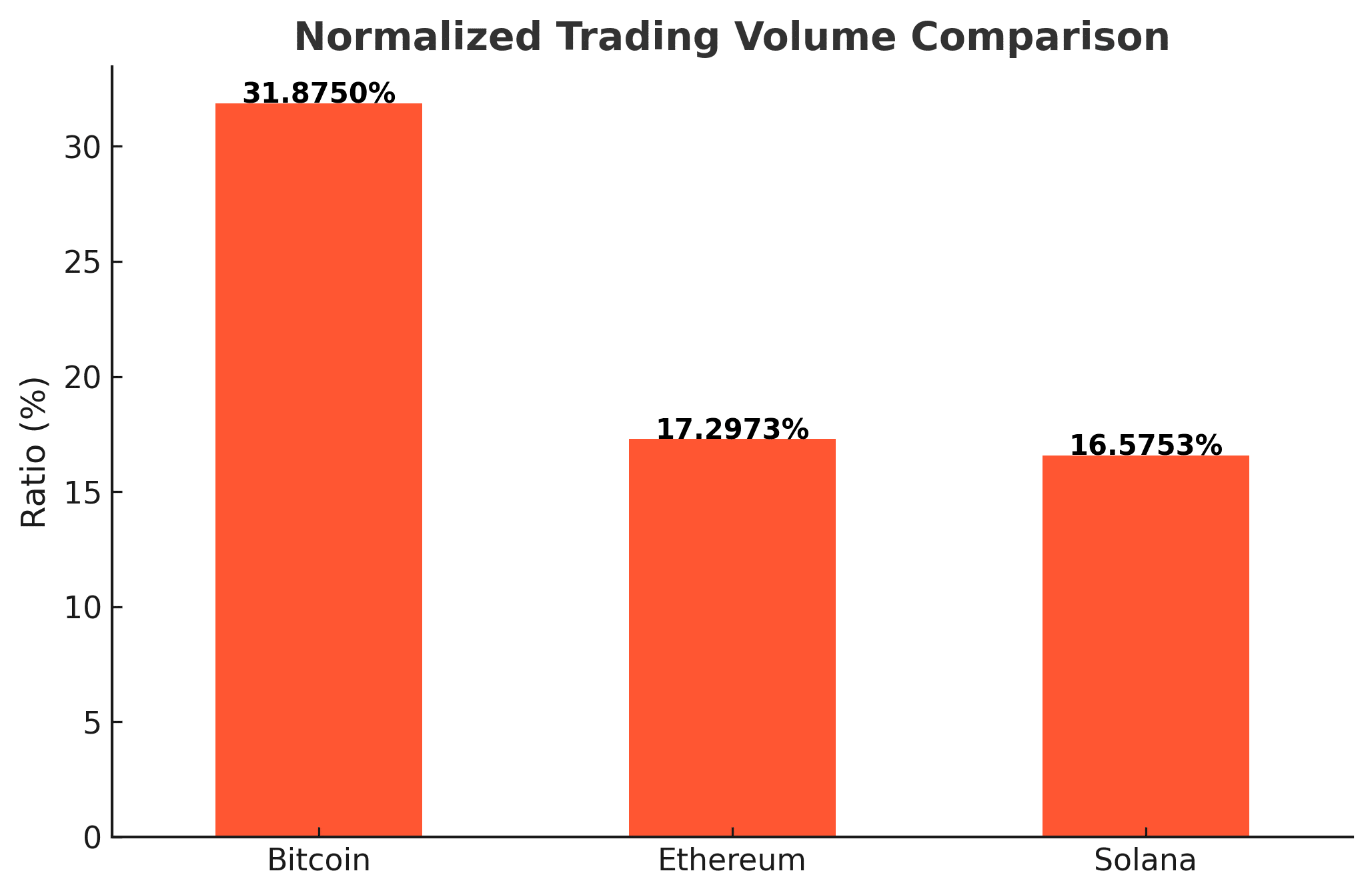

While Solana’s launch appears weaker, market cap adjustments place it closer to Ethereum’s debut.

Lower volumes reflect current risk-averse conditions and a broader market cooldown, probably why its Futures debut did not mirror the same explosive first-day activity as Bitcoin or Ethereum.

A bullish sign? Solana’s on-chain activity surges

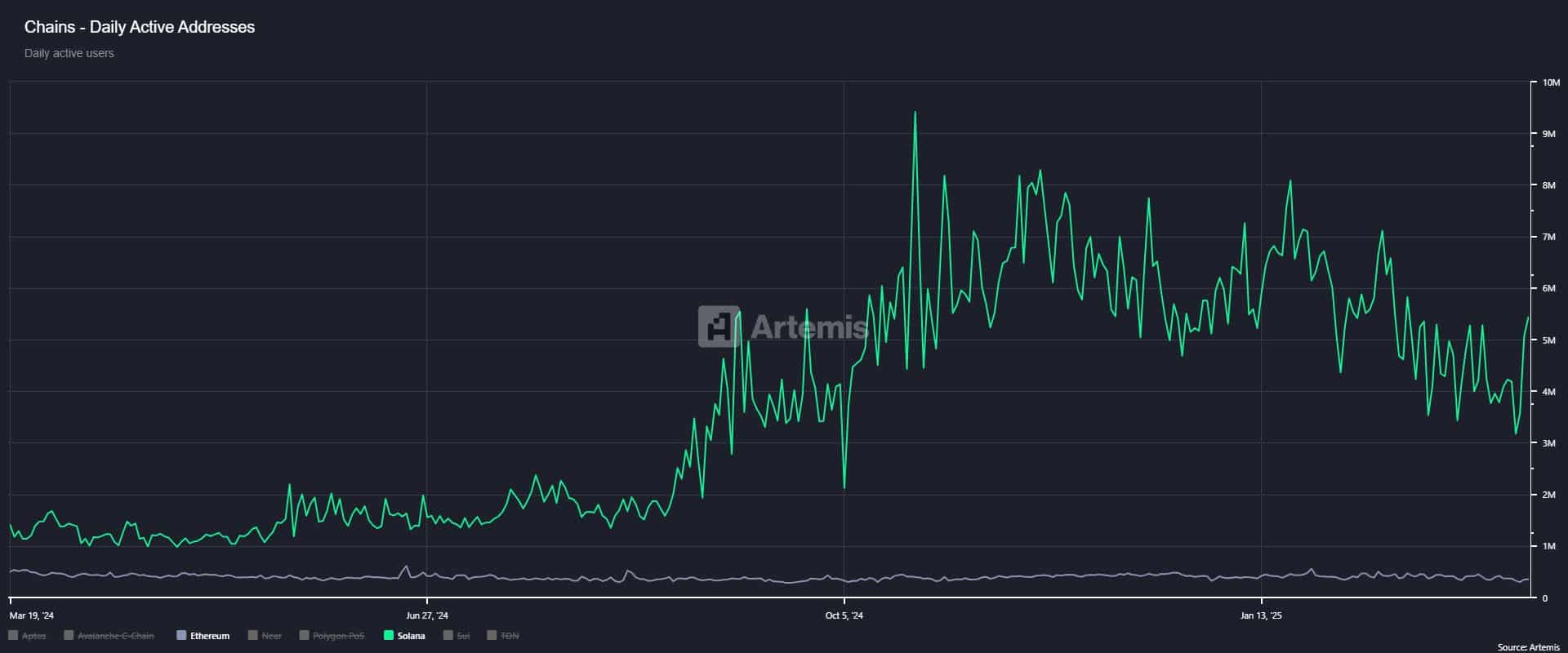

Beyond Futures trading volume, on-chain activity provides additional context for Solana’s current position in the market.

Data shows that Solana’s Daily Active Addresses (DAA) surged to 5.4 million on the 18th of March, marking its highest point in recent months.

However, this spike follows a decline in February 2025, when DAA fell to 4.4 million, despite SOL reaching its peak price of $231.65 on the 1st of February.

The misalignment between price action and on-chain activity suggests that speculative trading, rather than organic network growth, may have driven the price rally earlier in the year.

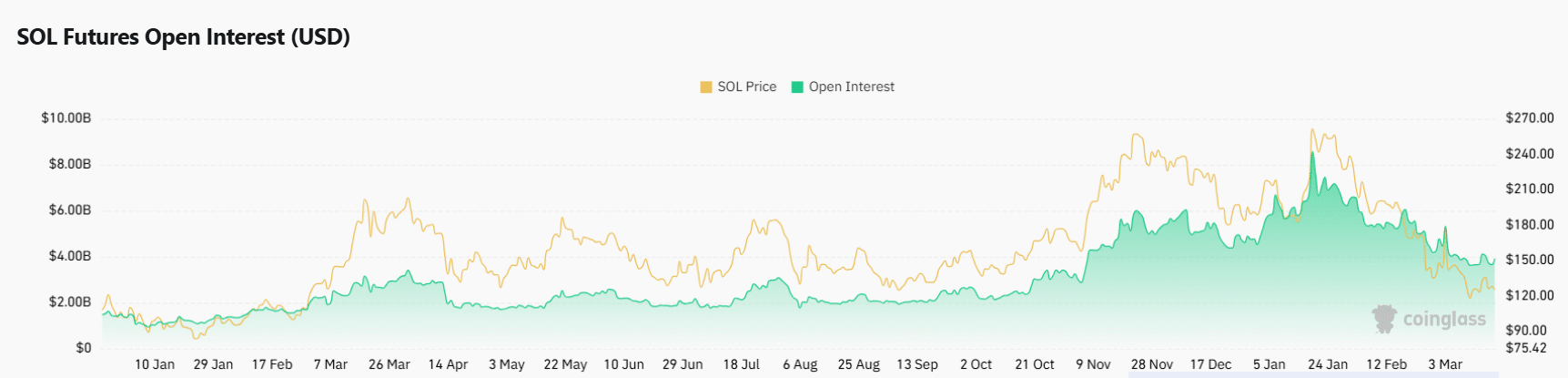

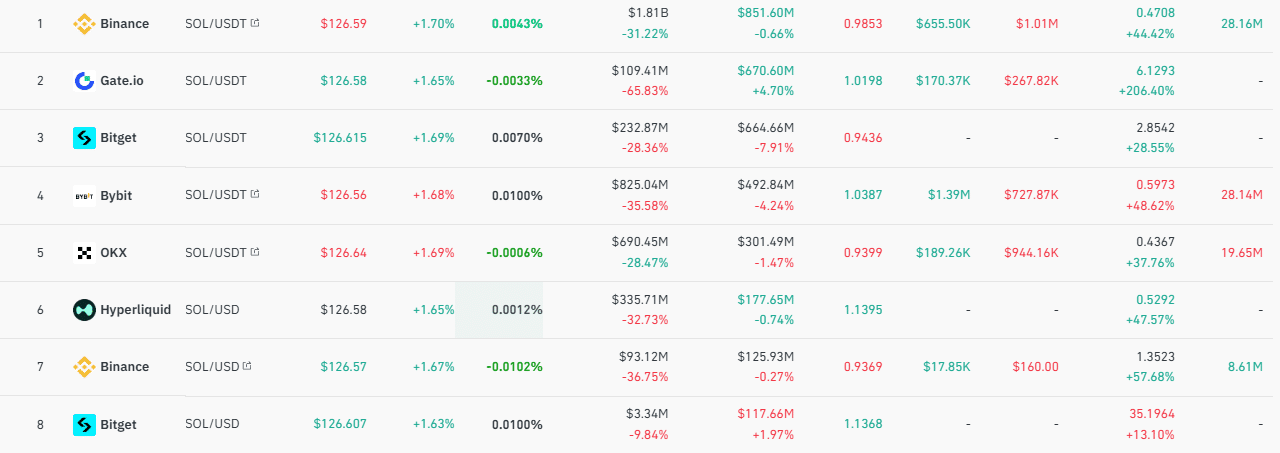

Solana’s Futures market has also exhibited mixed sentiment across exchanges.

For example, Binance recorded $851.6 million in Open Interest and $1.81 billion in daily trading volume.

Some exchanges favor long positions, while others see stronger short activity. Historically, the launch of regulated futures contracts has paved the way for spot ETF approvals.

Will history repeat? Futures today, ETFs tomorrow?

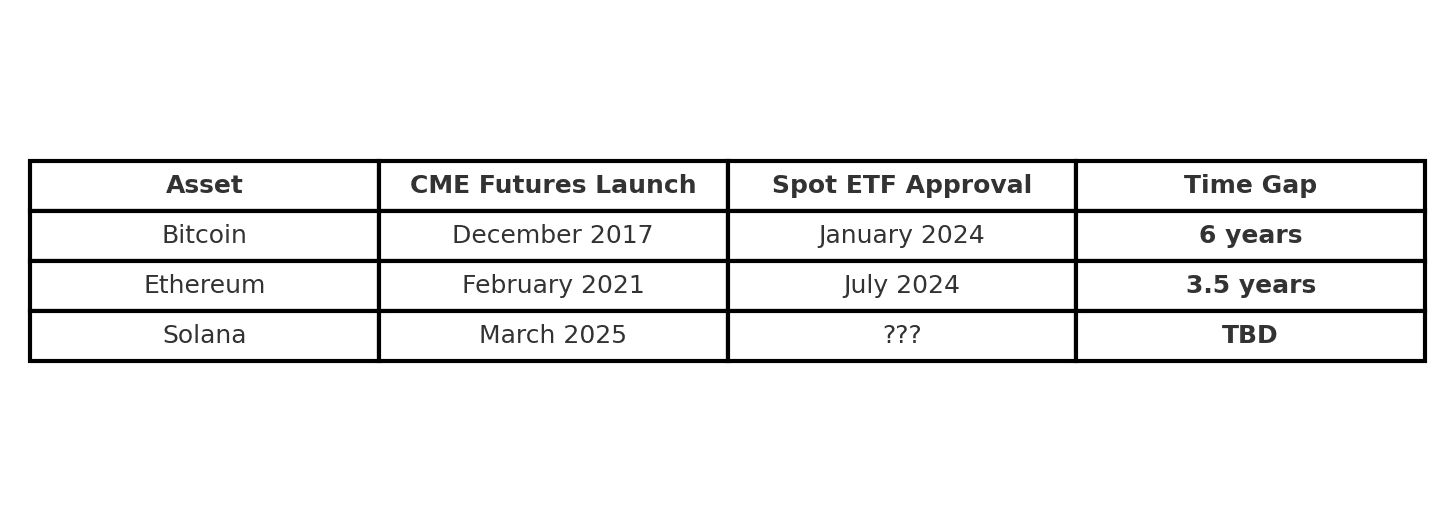

Per the chart below by AMBCrypto, the U.S. Securities and Exchange Commission (SEC) previously approved spot Bitcoin and Ethereum ETFs only after their respective Futures had established a regulated price discovery mechanism.

Bloomberg Intelligence analysts estimate a 70% chance of SOL ETF approval by year-end.

Solana’s Futures launch reflects cautious market sentiment, with mixed signals across exchanges.

On-chain activity shows volatility, while analysts see a fast-tracked ETF approval likely by late 2025, reinforcing its growing institutional appeal.