Solana defies the market, gains 8% in 24 hours: Will SOL’s rise continue?

- SOL continued to see positive trends, standing out as a top crypto asset.

- However, the trend of the altcoin remained bearish.

While the crypto market experienced a significant downturn in the last 24 hours, Solana [SOL] demonstrated resilience with a notable bounce back.

However, despite the price recovery, the response from traders in the derivatives market has been more restrained.

Solana sees a strong 24-hour outing

Solana has distinguished itself among the top five crypto assets by posting a significant gain in the last 24 hours. According to data from CoinMarketCap, Solana has risen by over 8% during this period.

This performance is particularly noteworthy when compared to the other leading cryptocurrencies. For instance, Ethereum [ETH], another major asset, only saw a modest increase of just over 1%.

Meanwhile, the rest of the top crypto assets experienced less than a 1% change. They fluctuated between minor gains and losses.

Solana trends positively

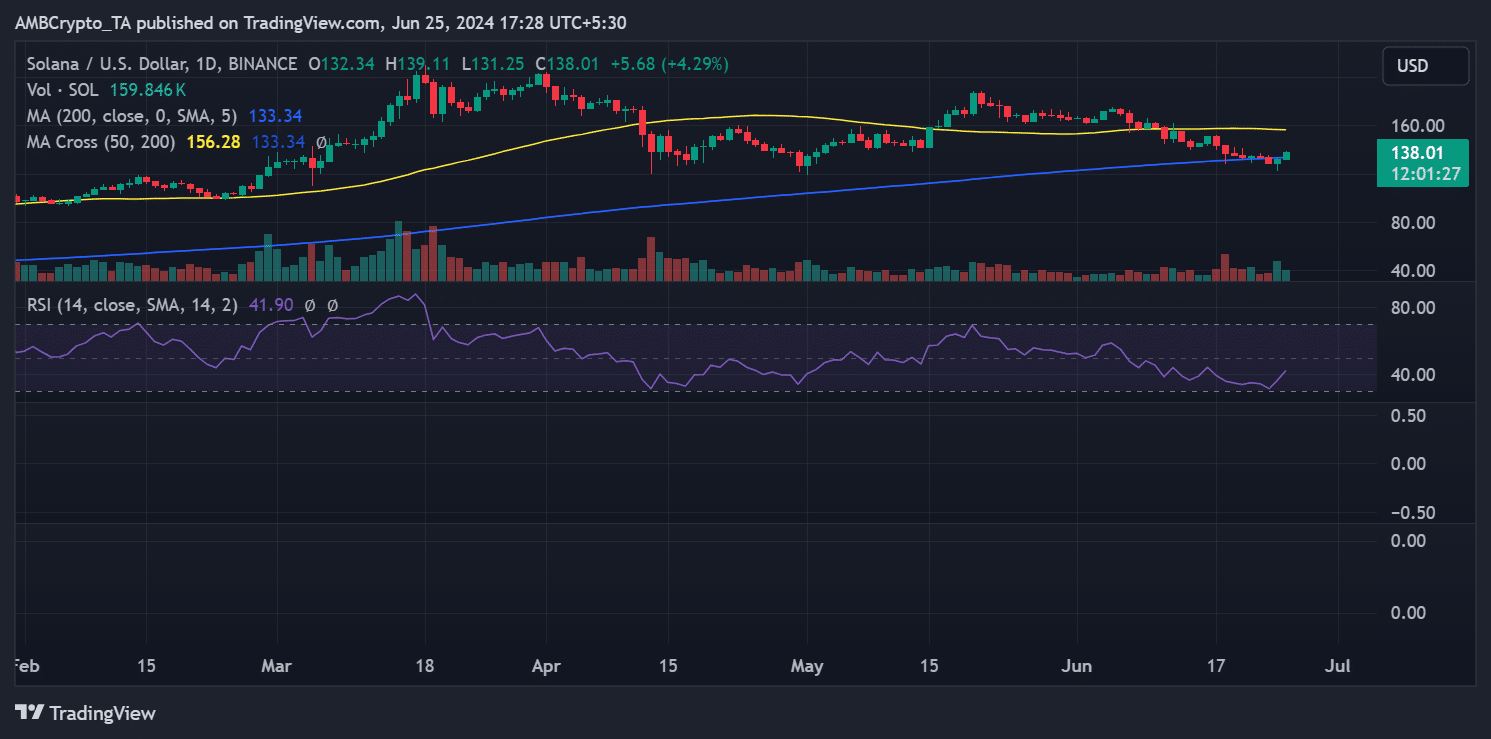

AMBCrypto’s look at the price trends of Solana on a daily timeframe provided a detailed snapshot of its recent market behavior.

The week started with a decline for SOL, with its price dropping by around 3.8% on the 23rd of June, closing at approximately $128.63.

Despite the general market downturn, particularly on the 24th of June when Bitcoin [BTC] and most altcoins dipped, Solana managed a notable recovery, closing the day around $132, marking an increase of over 2.8%.

As of this writing, Solana was trading at about $138, representing a further increase of over 4%. However, despite these positive strides, technical indicators suggest Solana remained in a bearish trend.

It was trading below its short moving average (yellow line), which often serves as a dynamic resistance level.

Additionally, the Relative Strength Index (RSI) remained below the neutral 50 mark, suggesting that overall momentum was still leaning towards the bearish side.

These indicators implied that while Solana has shown some bullish signals in the short term, it has yet to establish a strong enough rebound to shift the longer-term trend.

SOL positive sentiment wanes

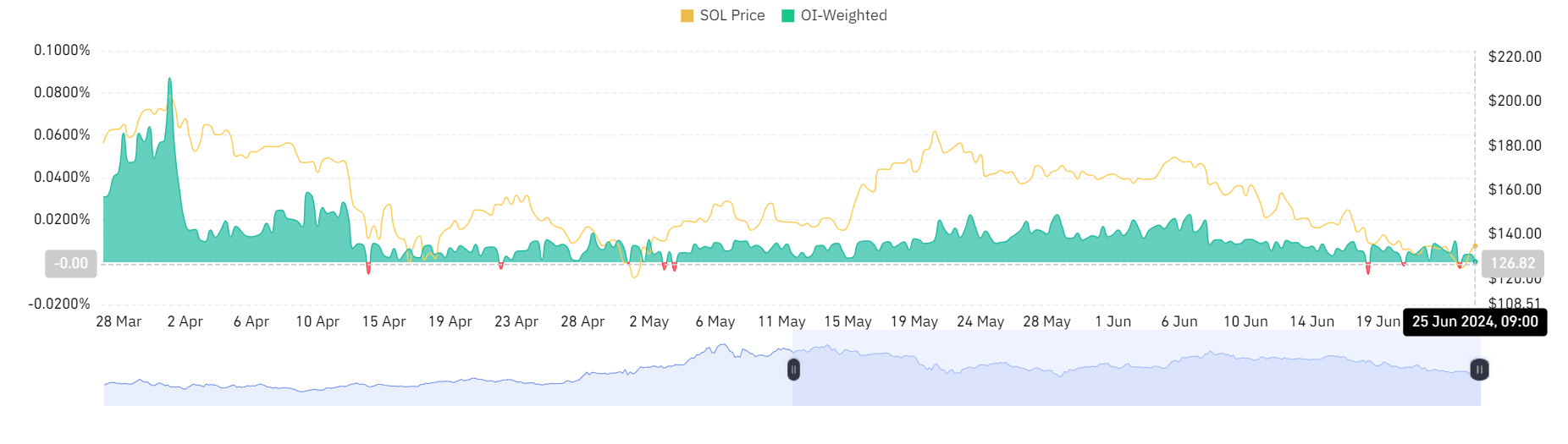

AMBCrypto’s look at Solana’s Weighted Funding Rate on Coinglass offered valuable insights into the current sentiment and positions of traders.

Is your portfolio green? Check out the SOL Profit Calculator

As of this writing, the Funding Rate was positive but declining and was currently around 0.0003%. The position showed that while buyers still dominated, their influence was waning.

This change suggested that traders were becoming more cautious. Traders were less willing to pay a premium to hold long positions, which could pave the way for sellers to gain more influence in the market.