Solana ETF debuts in the U.S. – Evaluating its impact on SOL prices

- The first-ever SOL ETF tracking Futures will debut on 20th March.

- Bloomberg’s analyst Eric Balchunas cautioned that spot ETF approval could affect the Futures ETFs.

The first-ever U.S.-based Solana [SOL] ETF (exchange-traded funds) is set to be launched via the Nasdaq exchange on the 20th of March, further bolstering the odds of spot ETF approval.

According to a Bloomberg report, Volatility Shares LLC plans to launch two funds tracking SOL Futures markets.

The first fund, Volatility Shares Solana ETF (SOLZ), will track SOL Futures, while Volatility Shares 2X Solana ETF (SOLT) will offer a twice-leveraged exposure to the crypto asset.

Futures markets allow participants to speculate on SOL’s future price without owning the physical SOL asset.

Is spot Solana ETF next?

Here, it is worth noting that Bitcoin [BTC] and Ethereum [ETH] followed the Futures market pathway before being approved for spot ETF. However, Bloomberg senior analyst Eric Balchunas cautioned that the products could face ‘some issues’ if spot ETFs are approved.

“It’s the first altcoin after Ether to be approved. But history has shown that ETF investors crave holding the physical asset as much as possible…It could have some issues when spot is approved.”

For his part, Nate Geraci noted that spot SOL ETF could launch soon, drawing a comparison to the ETH ETF pathway.

“Less than a year ago, pretty much *everyone* thought spot ETH ETFs were a pipe dream. Now, we’ll have SOL futures ETFs. Spot SOL ETFs won’t be far behind IMO.”

According to the prediction site Polymarket, the market priced in an 88% chance of spot SOL ETF approval in 2025. Simply put, the market was highly positive of the outcome this year.

That said, SOL wasn’t the only altcoin ETF with high market speculation. Potential issuers have filed for various ETFs, including Cardano, HBAR, Polkadot, Aptos, and Sui.

In fact, on the 17th of March, Canary Capital filed a registration statement with the SEC for an SUI ETF. Put differently, the altcoin ETF race has heated up under the Trump-era SEC.

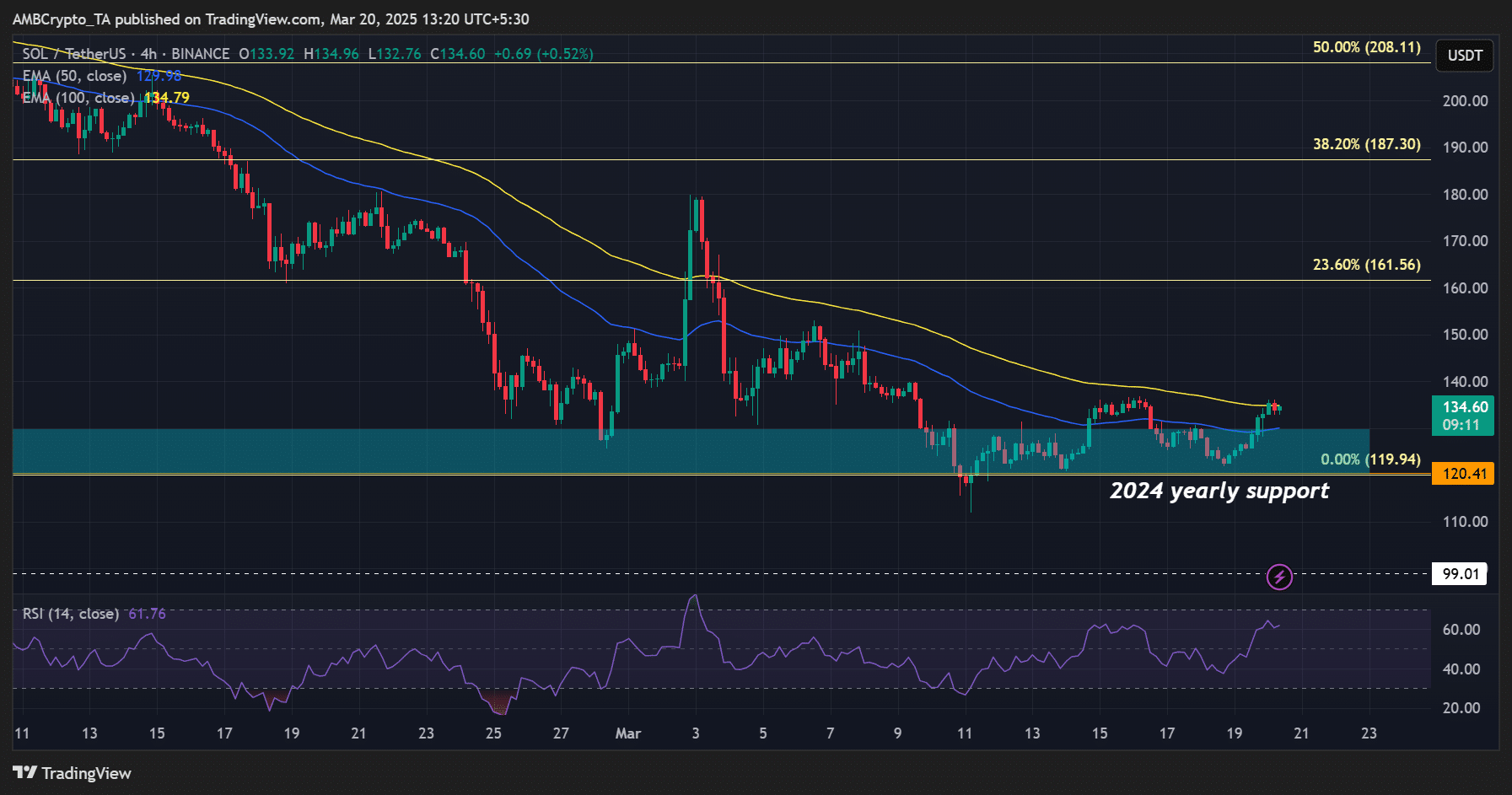

That said, SOL was up 10% in the past 24 hours but consolidated on the 4-hour chart’s 100- Exponential Moving Average (EMA) in yellow, at the time of writing.

Only a firm reclaim above the Moving Average could reinforce the edge for SOL’s extended recovery.