Solana explains outage as SOL continues to pump

- The bug was the cause of a Devnet outage seen in the previous week.

- SOL has risen 17% since the incident on the 6th of February.

The recent outage that halted transactions on the Solana [SOL] mainnet for five hours was due to a known bug identified by developers last week, Solana Labs admitted in an elaborate root cause report.

The bug was the cause of a Devnet outage seen previously. While developers issued a fix for one of the triggers of the bug, the fix for the other trigger was supposed to go into the version 1.18 cycle. The fix for the latter was eventually released as part of version 1.17.20.

Solana stated in the report that a “more complete fix” would be released in the future and align with the regular release cycle.

Solana’s goal: Speed + Stability

Solana, which prides itself on its lightning fast transaction speeds, theoretically up to 50,000–65,000 transactions per second (TPS), has often received brickbats over its lack of stability and network glitches.

In fact, co-founder Anatoly Yakovenko went to the extent of terming network outages as “Solana’s curse” in one of his older interviews.

Having said that, the recent disruption was the first in a year since the 20-hour network jam recorded in February 2023. In between these incidents, the Solana network maintained a 100% uptime, according to AMBCrypto’s examination of Solana network status.

SOL shrugs off FUD in style

The disturbance impacted native token SOL in the immediate aftermath, causing a 2.1% drop in market value, as per CoinMarketCap. However, as the network came back up and FUD started to subside, these losses were reversed.

In fact, the fifth-largest cryptocurrency has risen 17% since the incident on the 6th of Febdruary, indicating significant investor support.

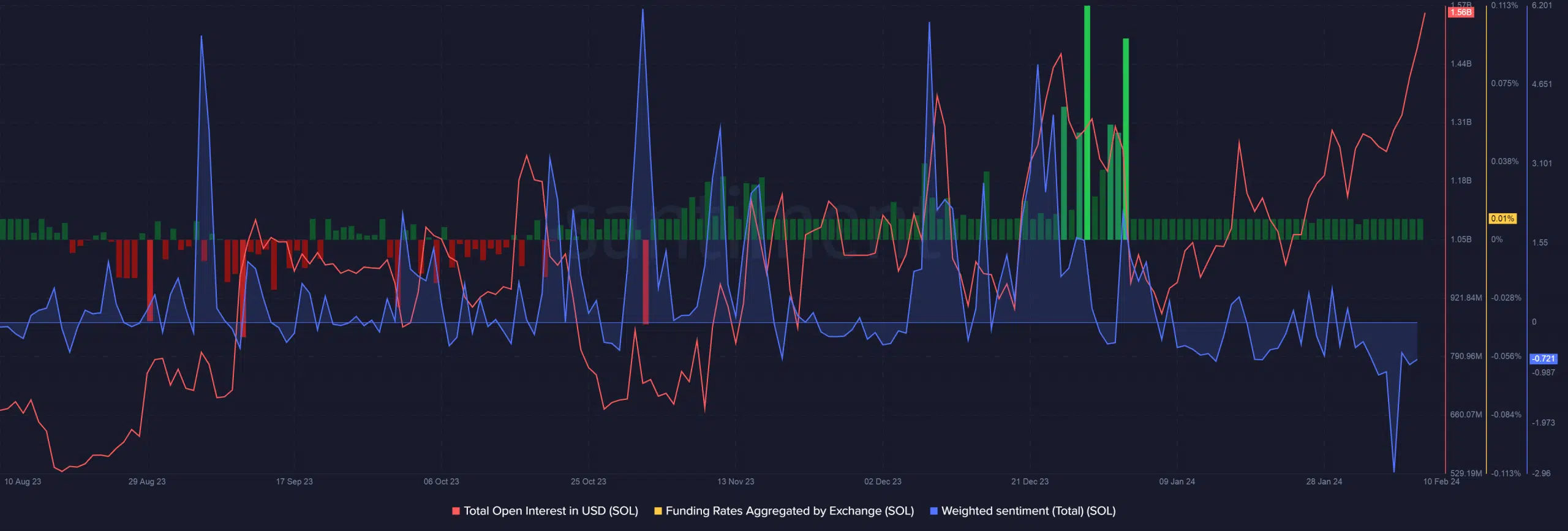

As the prices surged, so did speculative bets on SOL. According to AMBCrypto’s analysis of Santiment data, the money invested into SOL futures market jumped by 20% in the last four days.

How much are 1,10,100 SOLs worth today?

Additionally, SOL’s funding rate on Binance continued to be positive, suggesting the dominance of bullish-leveraged traders.

However, to much surprise, weighted sentiment was still in the negative territory. This implied that the broader market was still pessimistic about SOL’s prospects.