Analysis

Solana flashes mixed signals: Where will prices go?

Solana hit an overhead hurdle and could attract sellers. But here’s why sellers shouldn’t rush for re-entry.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SOL’s price pump hit a validated roadblock at $25.

- Sentiment was negative, but demand remained positive at press time.

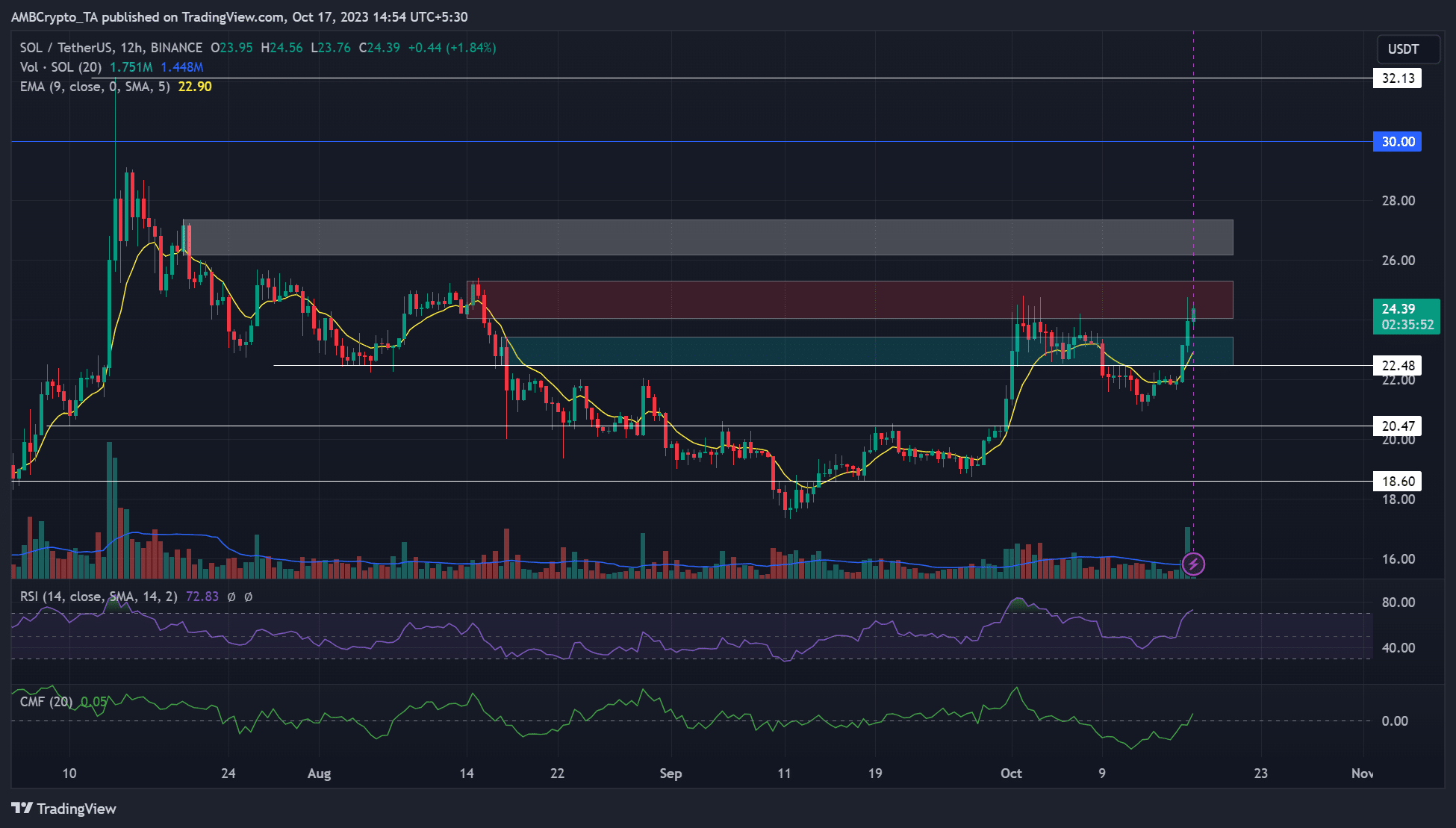

Solana’s [SOL] higher timeframe traders could be forced to be patient as price direction remained obscure at press time. Since 15 October, SOL pumped +10%, rallying from $21.6 to $24.75.

Read Solana’s [SOL] Price Prediction 2023-24

Although the rally hit a critical roadblock, a possible price reversal wasn’t clear at the time of writing.

AMBCryto previously explored how an extended drop could benefit traders after $22 support was flipped to resistance. But the recent price pump cleared the $22 hurdle and tipped SOL to hit the next hurdle at $25.

Will sellers seek re-entry at this hurdle?

The price chart indicators, RSI and CMF, were positive, with steady upticks that indicated an impressive recovery in buying pressure and capital inflows in the past few days.

But the price pump hit a familiar roadblock and daily bearish order block (OB) of $24.06 – $25.30 (red). The block was formed on 14 August and led to a reversal after a retest in early October.

A convincing flip of the hurdle into support will confirm extra bullish intent, with the next target at the marked white area near $27. Otherwise, another price reversal could be likely, given the RSI’s overbought condition and sticky hurdle at $25.

Solana’s Funding Rate was negative despite the pump

Another supporting evidence for a likely price reversal was the negative funding rates despite the price pump. It meant that market sentiment was negative regardless of the rally.

How much are 1,10,100 SOLs worth today?

However, Open Interest rates were positive and up 12% in the past 24 hours before press time. That showed that Futures market demand was still positive.

On the other hand, the gap between liquidated long and short positions closed steadily in the 1-hour timeframe. So, SOL’s $25 hurdle could attract more sellers, especially if BTC dropped below $28k. But the conflicting signals call for more patience for clear direction to materialize.