Solana flips Ethereum, and that means SOL prices will now…

- Solana’s price momentum is approaching key resistance levels as whale accumulation intensifies.

- Rising open interest and significant liquidations suggest increased market volatility ahead for Solana.

Solana [SOL] has flipped Ethereum in a stunning development, taking the top spot in 7-day DEX (Decentralized Exchange) volume with $11.8 billion compared to Ethereum’s $9.2 billion. This surge has many wondering whether Solana is gearing up for a major bull run.

Consequently, a deeper look into Solana’s price action, whale activity, liquidation data, and open interest levels is necessary to understand if this could be a defining moment in the crypto market.

Can Solana break resistance and rally?

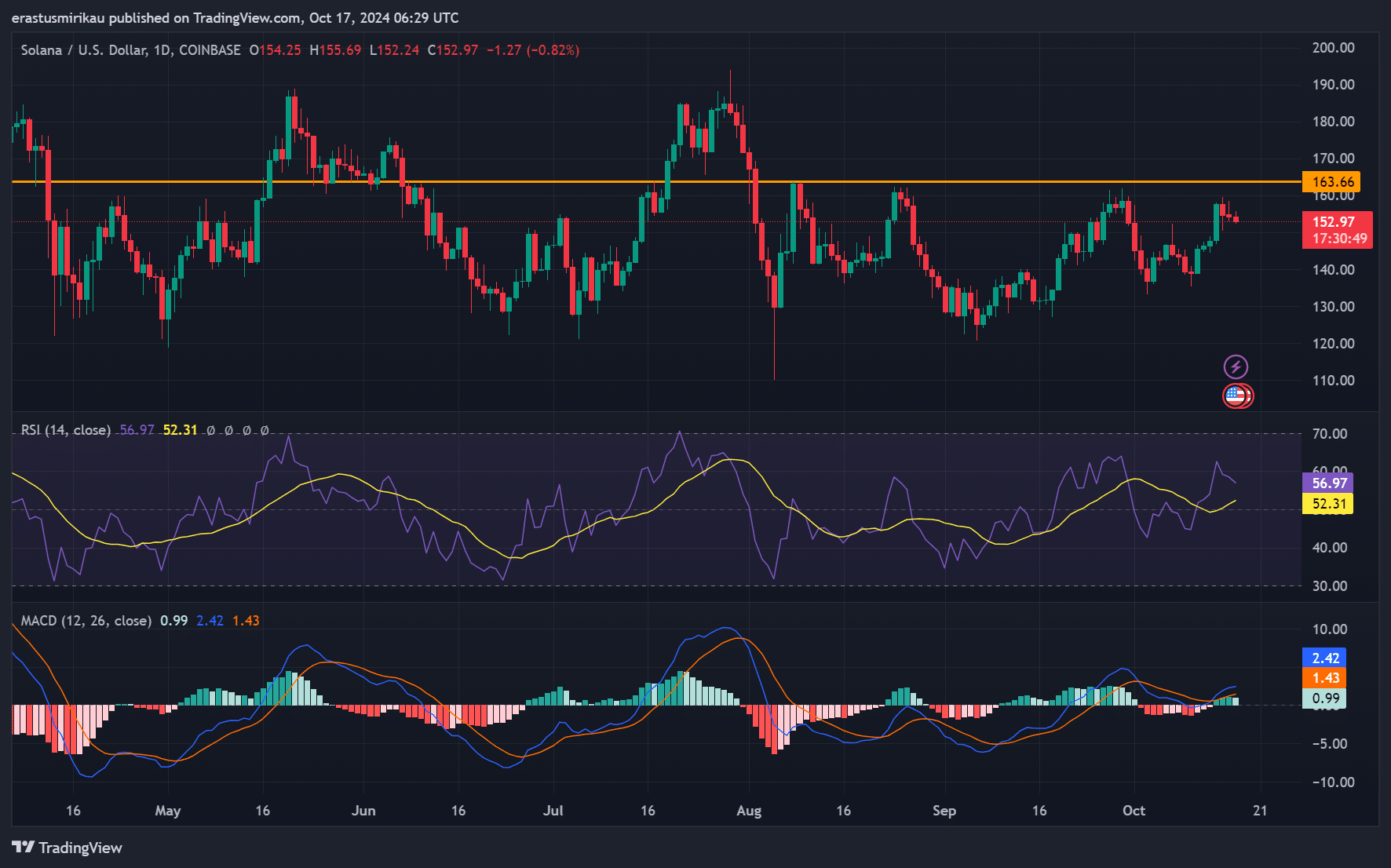

At press time, SOL was trading at $153.09, reflecting a 0.99% decline over the past day. However, despite the minor drop, the price remains on an upward trajectory.

More importantly, the $163.66 level stands as a major resistance point. If Solana breaks through this level, a rally could follow.

Additionally, the RSI reading of 52.31 shows neutral momentum, while the MACD hints at potential bullish strength building. Therefore, all eyes are on whether Solana can maintain its momentum and push higher.

SOL whale accumulation signals potential surge

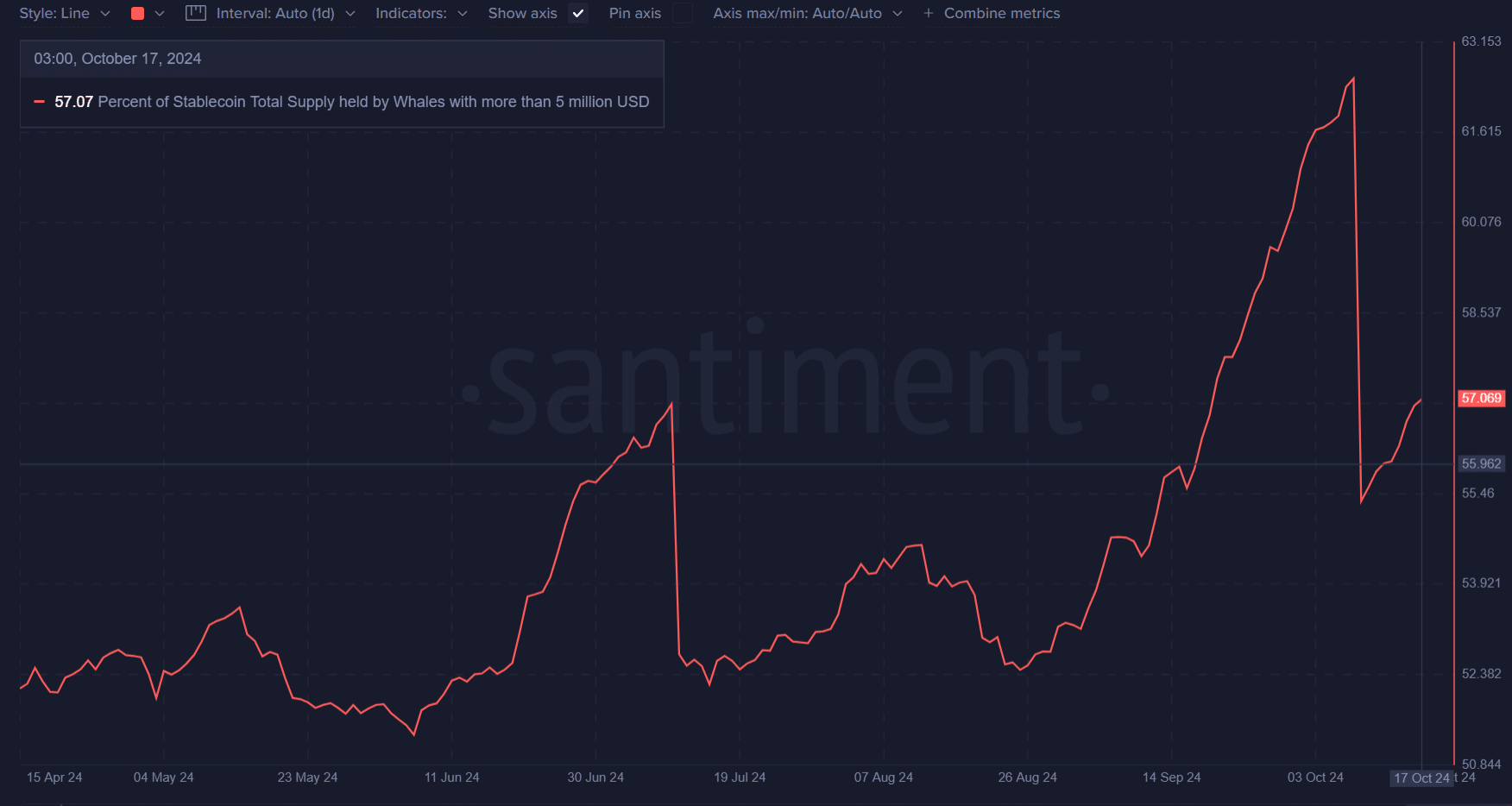

Interestingly, Solana’s top holders—whales with more than $5 million—now control 57.07% of the stablecoin supply. This rise in whale concentration suggests strategic accumulation. Historically, such behavior from large holders has often preceded price increases.

Consequently, this buildup raises expectations that SOL could soon see significant upward movement. The whales are likely positioning themselves for a strong push, indicating confidence in the long-term outlook of Solana.

Are SOL liquidations setting up for more volatility?

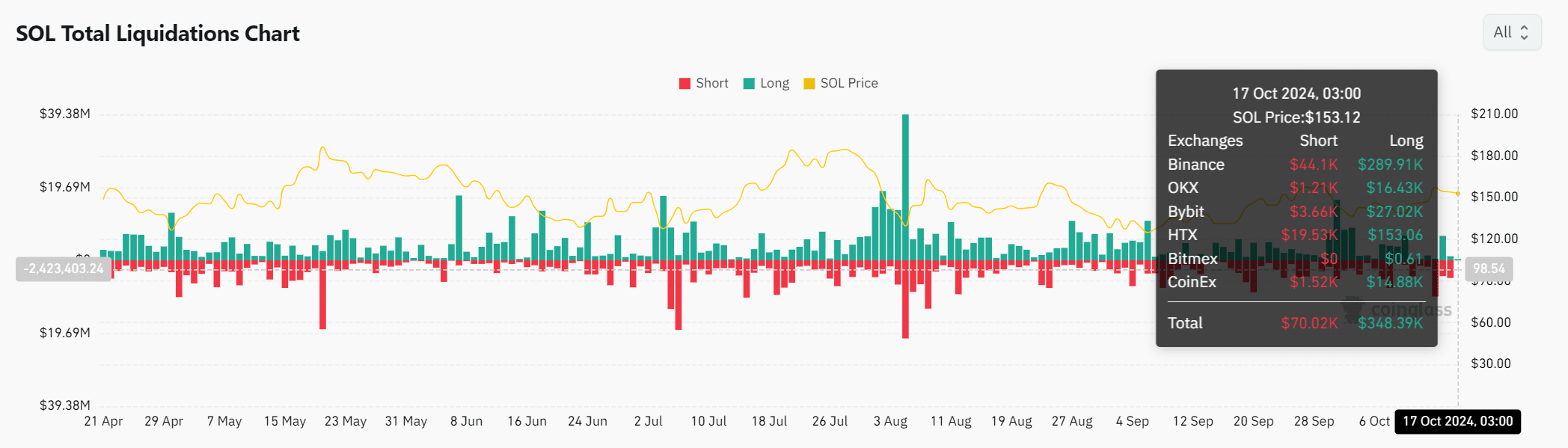

Liquidation data reveals that $348.39K worth of long positions were liquidated in the last 24 hours, alongside $70.02K in shorts. This high level of liquidation in long positions points to traders betting on a continued rise.

However, it also indicates a high level of leverage in the market, which could backfire if key resistance levels fail to hold. As a result, further price swings could occur if the market moves against overextended traders.

Rising open interest hints at market optimism

Open interest in SOL has increased by 2.26%, reaching $2.45 billion. This rise signals growing trader interest and an expectation of heightened volatility in the near future.

Moreover, with Solana dominating DEX volume, traders are betting on its potential to outperform the broader market.

Is your portfolio green? Check out the Solana Profit Calculator

Given SOL’s strong performance and whale accumulation, the potential for a bull run is undeniable. If the price breaks through resistance and avoids further liquidations, the market could see a rapid surge.

However, traders should proceed cautiously due to liquidation risks. Nonetheless, Solana is well-positioned to lead the next major crypto rally.