Solana gains spotlight as Ethereum ETF countdown begins

- Ethereum ETF set to launch on 23rd July, paving way for Solana.

- VanEck’s filing signals growing institutional interest.

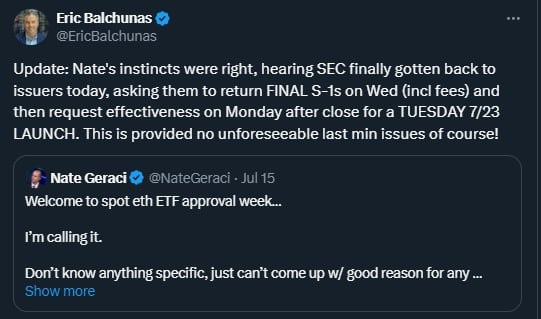

The crypto world is on edge as Ethereum ETF launch approaches. The Ethereum [ETH] launch is set for 23rd July, according to a renowned crypto analyst. This milestone comes after Bitcoin’s ETF success.

Amidst these developments, VanEck’s recent filing for a Solana ETF has intensified market anticipation.

Solana in the Spotlight

As Ethereum takes center stage, Solana [SOL] emerges as the next potential ETF candidate. Known for its speed and low costs, Solana could be the third major crypto to secure an ETF.

This prospect has already boosted Solana’s market position and investor interest.

Eric Balchunas, a senior ETF analyst for Bloomberg, recently replied to an ETF approval week tweet and added more fuel to the Ethereum ETF launch speculations. In the tweet, he stated that the the launch could be on 23rd July.

Social buzz and whale activity

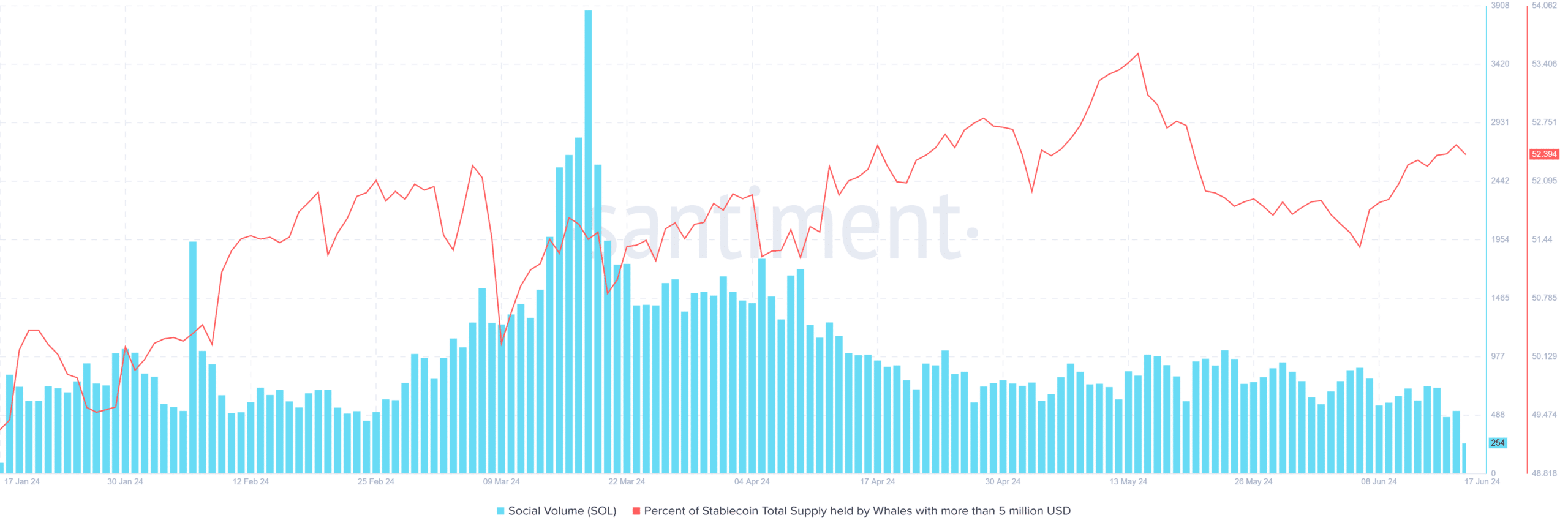

AMBCrypto’s analysis of Solana’s social volume data shows recent stability with a slight downward trend.

However, whale holdings have increased since January. The total supply held by whales stood at 42% of the total supply at press time.

This indicated strong institutional interest despite waning social volume trends, which may result from Ethereum stealing public attention.

Solana correlation insights

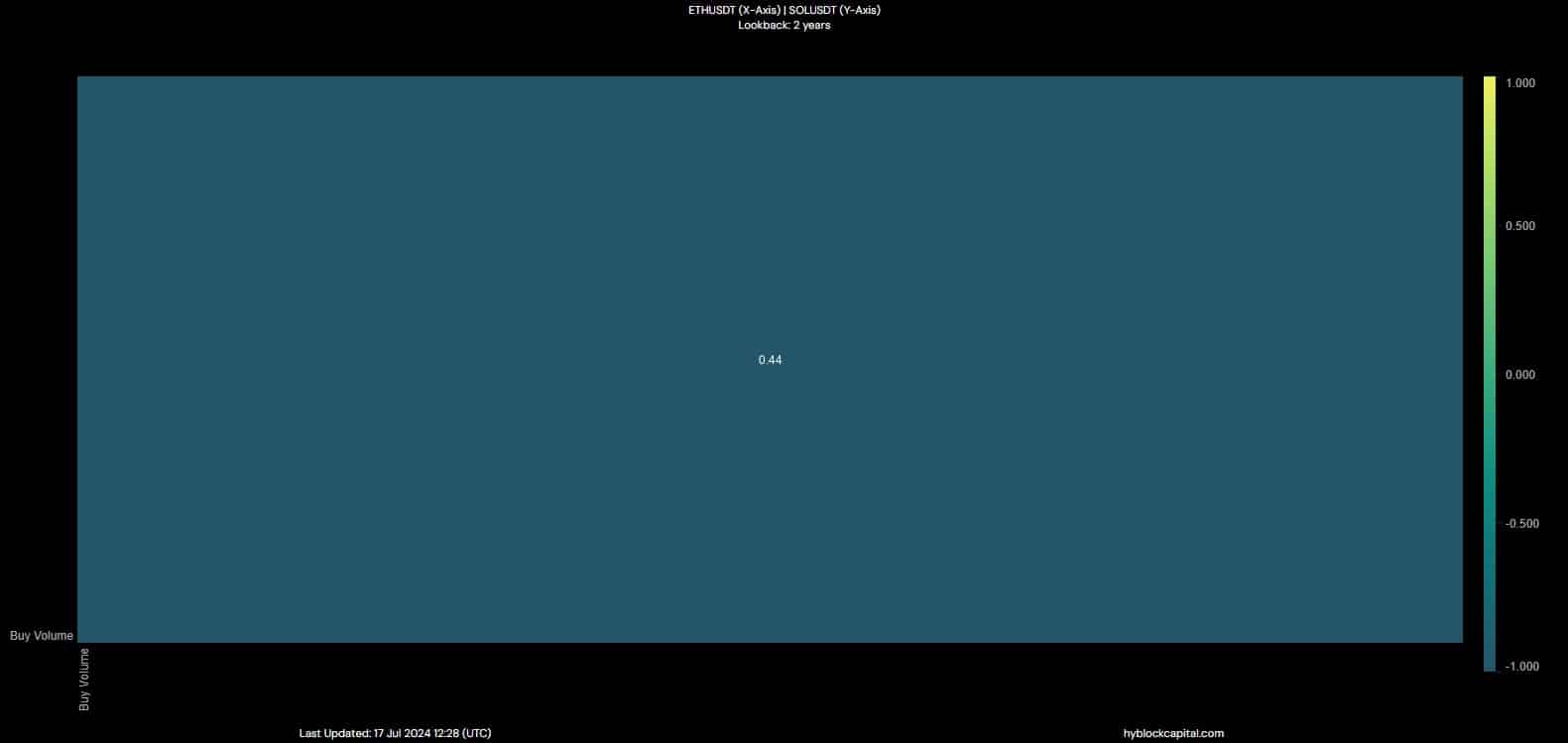

AMBCrypto’s analysis of the Hyblock buy volume in the last two years indicated that the correlation between Ethereum and Solana stood at 0.44. This suggests a moderately positive relationship between the two giants.

The connection could benefit SOL as Ethereum’s ETF launch approaches, potentially driving increased interest in both assets.

Is your portfolio green? Check out the SOL Profit Calculator

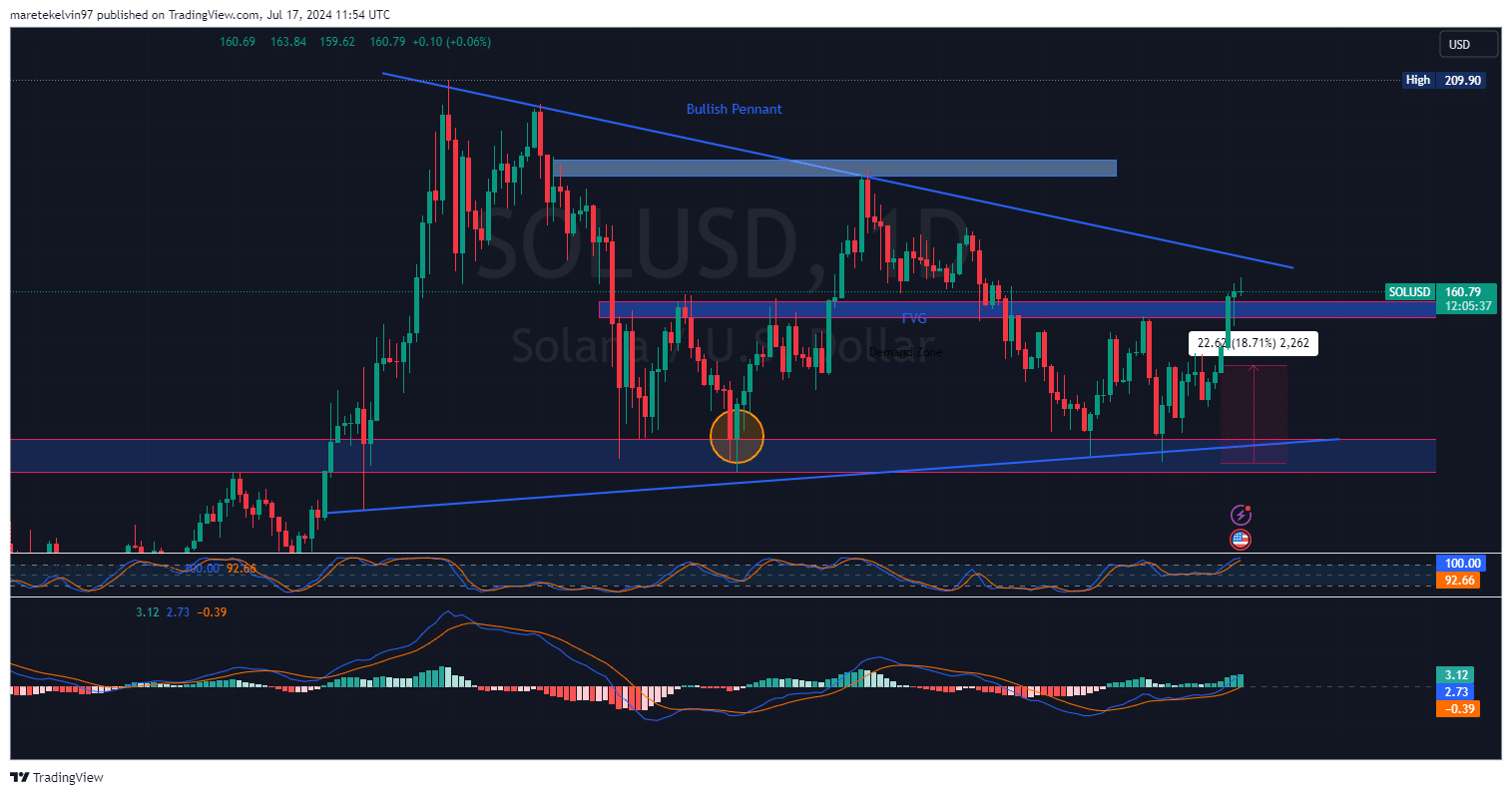

At press time, Solana was trading around $160.79, forming a bullish pennant pattern. The recent breakout above key resistance signals potential for further gains.

If it breaks through the bullish pennant resistance, the rally will continue. Both the RSI and MACD indicators support an optimistic bullish outlook.