Solana hits $175, faces pullback: What’s next for SOL?

- Solana’s price increased by more than 20% in the last seven days.

- If the bull rally resumes, then SOL might go above $180.

Solana [SOL] managed to reclaim $175 on the 18th of May, but it soon witnessed a price correction, pushing the token’s value down. Does this mean SOL is bound to go down further in the coming days?

Let’s take a look at SOL’s current state to find out.

Solana back to $175

Last week was a tremendous success for Solana, as the token’s price rallied substantially. According to CoinMarketCap, SOL’s price surged by more than 20% in the last seven days, allowing it to touch $175.

However, SOL couldn’t hold that spot as it dipped.

At the time of writing, SOL was trading at $174.39 with a market capitalization of over $78.2 billion.

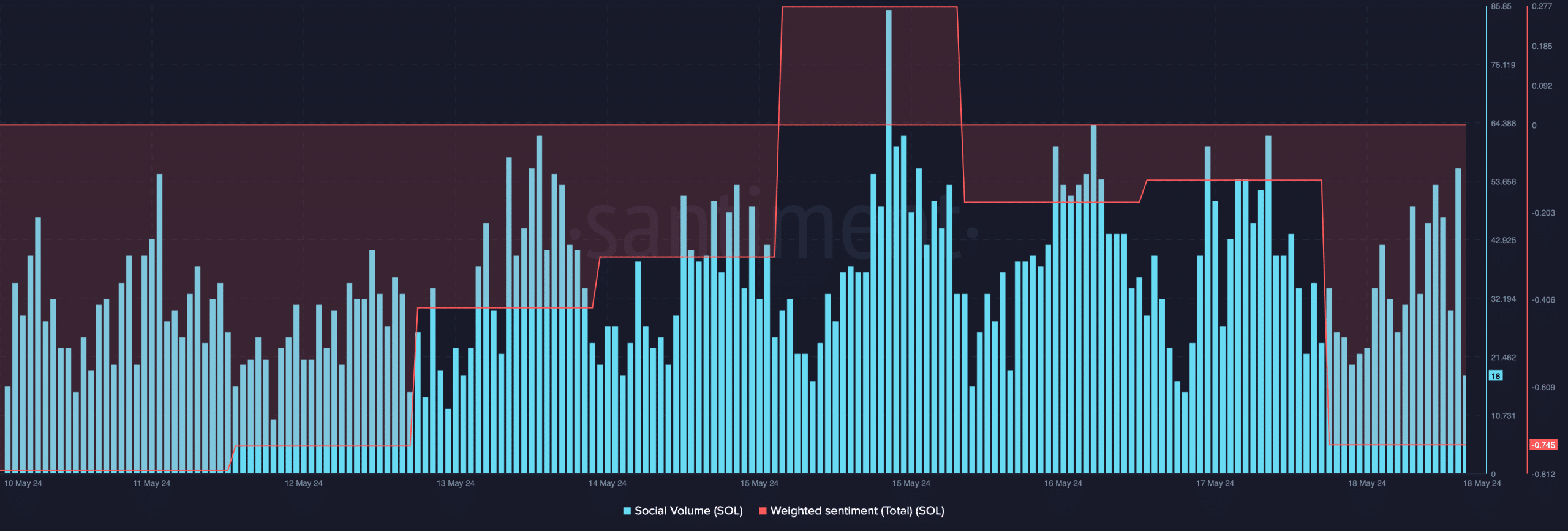

The decline from $175 also had a negative impact on the token’s social metrics. Its Weighted Sentiment dropped sharply, meaning that bearish sentiment around it was dominant in the market.

Nonetheless, its Social Volume remained stable.

Investors shouldn’t get disheartened, as a recent analysis suggested that SOL’s price might skyrocket. Alex Clay, a popular crypto analyst, recently posted a tweet highlighting an interesting development.

In a monthly time frame, SOL displayed a rounding bottom pattern. If this pattern tests out, then investors might soon witness SOL reach new highs.

What to expect in the short term

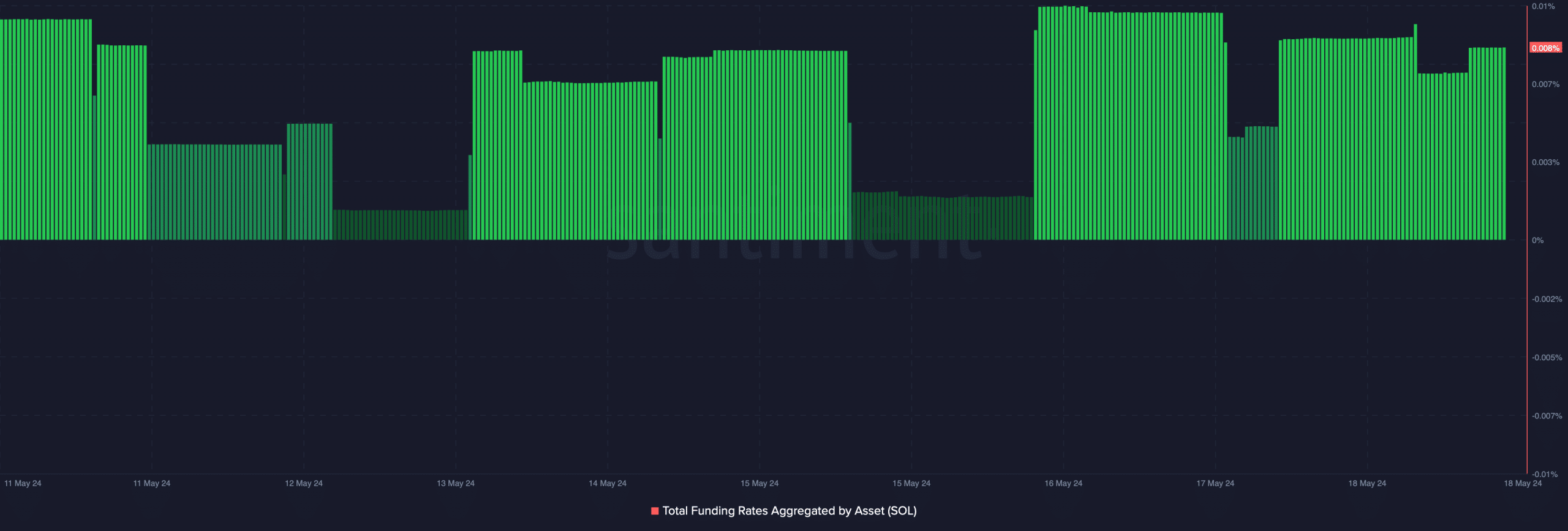

AMBCrypto then analyzed SOL’s on-chain metrics to see whether investors should expect a massive surge in the near term. As per our analysis, SOL’s Funding Rate had increased sharply.

A rise in the metric meant that derivatives investors were buying SOL. According to Coinglass’ data, SOL’s Open Interest also increased, which might serve as a push for the coin’s weekly rally.

However, concerns still remain. The coin’s fear and greed index had a value of 75% at press time, meaning that the market was in an extreme greed phase. Such numbers often result in price drops.

We then analyzed SOL’s daily chart to see which way it was headed.

The Relative Strength Index (RSI) looked pretty bullish, as it had a value of 64. However, the Chaikin Money Flow (CMF) moved in the other direction. ‘

Additionally, Solana’s price had touched the upper limit of the Bollinger Bands, indicating a possible price correction.

Is your portfolio green? Check out the SOL Profit Calculator

If a price correction happens, SOL’s price might fall to $173.5 as liquidation would rise sharply, which might act as a support. A further downfall could push SOL’s price to $165. ‘

However, if SOL manages to continue its weekly bull run, then the token might be able to go above $180.