Solana hits 30M milestone – The odds of SOL’s price reacting are…

- Solana’s daily transactions declined last month

- SOL’s price hiked by over 2% in the last 24 hours

Solana [SOL] has been generating a lot of buzz in the crypto space with multiple token launches on the blockchain. However, apart from that, the blockchain has also seen a massive hike in its network activity, especially as it hit a new milestone.

Solana’s new ‘all-time high’

SolanaFloor, a popular X handle that shares updates related to the blockchain’s ecosystem, recently posted a tweet highlighting a major development. According to the same, monthly active addresses on Solana surpassed 30 million – An all-time high.

Since this was a commendable development, AMBCrypto took a closer look at how the blockchain’s network activity has been over the last 30 days. Our analysis of Artemis’ data revealed that SOL’s daily active addresses touched 1.9 million on 17 June. However, the graph then started to decline.

In fact, it was surprising to note that despite hitting an ATH in terms of monthly active addresses, the blockchain’s daily transactions declined over the past month.

In terms of captured value too, there was a decline over the month. This seemed to be the case as both Solana’s fees and revenue dropped.

A similar trend was also seen on its TVL chart, reflecting a decline in the blockchain’s performance in the DeFi space.

SOL is back on track

While all this happened, SOL bulls stepped up their game as the token’s price finally managed to move up. According to CoinMarketCap, SOL fell by more than 6% in the last seven days. However, the last 24 hours showed signs of recovery from past losses as SOL’s price appreciated by over 2%

At the time of writing, SOL was trading at $134.67 with a market capitalization of over $62 billion.

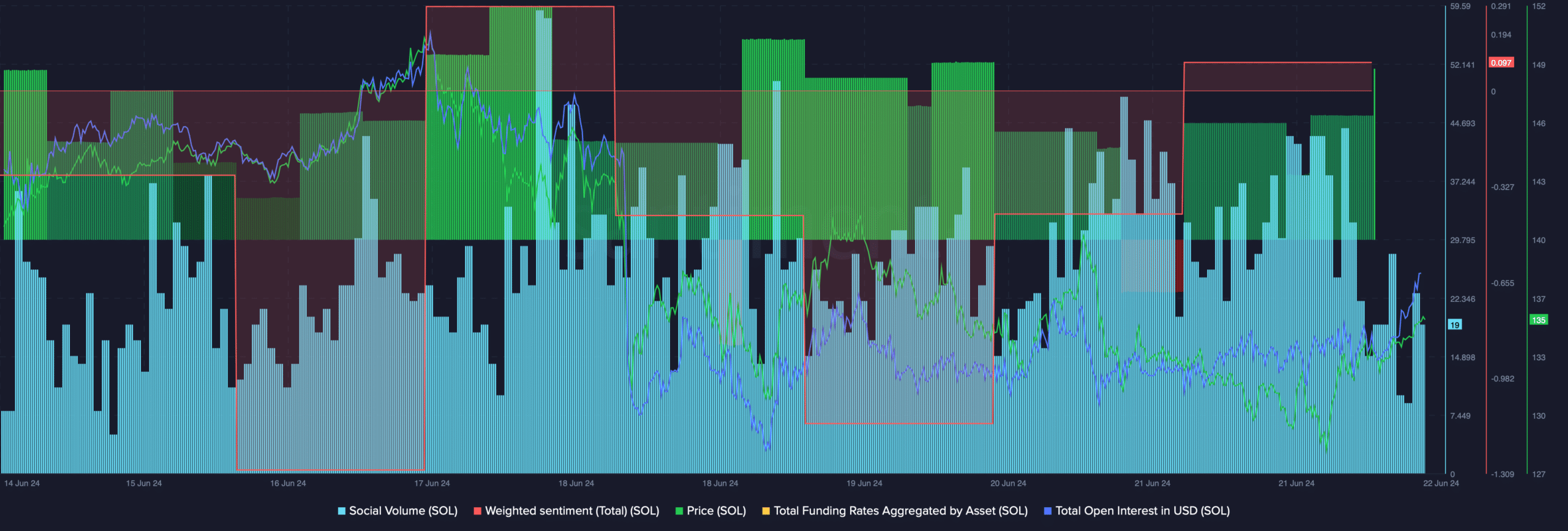

The recent price uptick also had a positive impact on the token’s social metrics. For instance, its weighted sentiment, after dipping on 19 June, moved up and went into the positive zone. This clearly meant that investors remain confident in SOL, and bullish sentiment around the token was increasing.

Its social volume also remained high, reflecting its popularity in the crypto space. Additionally, SOL’s open interest also hiked along with its price. Whenever open interest rises, it implies that the chances of the current price trend continuing are high.

Is your portfolio green? Check out the SOL Profit Calculator

Nonetheless, SOL’s funding rate also went up. Generally, prices tend to move in a different direction than funding rates. Hence, this might cause trouble for SOL in the near term.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)