Solana, thank memecoin mania! What its latest ATH means for holders

- Solana mopped its highest-ever weekly fee revenue.

- The network traffic boosted SOL’s value past $200 earlier this week.

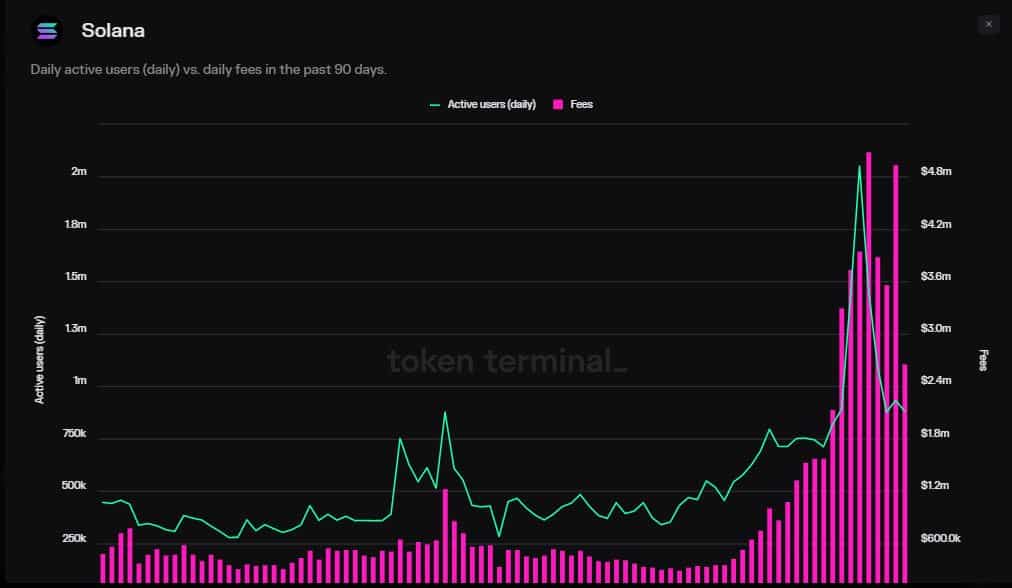

The memecoin mania continued to bring hordes of retail traders to Solana [SOL], causing a dramatic rise in transactions, and in turn, fee revenue.

Memecoins bring more revenue to Solana

Over the week, the smart contracts network collected $20.14 million in fees, the second-highest behind Ethereum [ETH], according to AMBCrypto’s analysis of Token Terminal data.

This also represented Solana’s highest-ever weekly fees, accounting for a 10.75% share of the market.

AMBCrypto dissected the data further and noticed Solana’s daily market share steadily increased from 9% to over 12% through the course of the week.

An on-chain analyst David Alexander II called this a “significant shift in network fee capture”, considering that Solana has historically recorded less than 1% of daily aggregated fees.

The turnaround, spurred by a barrage of new memecoin launches, was testing the limits of the network. Retail traders, known for their affinity for such tokens, flocked to Solana in pursuit of coins like Slerf [SLERF], BOOK OF MEME [BOME], and many more.

The daily active users count went parabolic over the week, with the highest-ever tally of 2.1 million recorded on the 17th of March.

Solana DEXs clock highest weekly volumes

The memecoin frenzy led to a spike in activity on Solana-based decentralized exchanges (DEX). According to AMBCrypto’s analysis of DeFiLlama, Solana DEXes leapfrogged those on Ethereum in total volumes over the week.

Moreover, the hype also helped the network attract more liquidity, with the total value locked (TVL) breaking past $8 billion for the first time since January 2021.

How much are 1,10,100 SOLs worth today?

SOL accrues value from network activity

The network traffic came in handy for the native token, SOL. The fifth-largest asset rose beyond $200 for the first time since December 2021 this week, as per CoinMarketCap. Subsequent profit-taking though, pulled SOL down, with the asset trading at $174 at press time.

Note that Solana burns 50% of its fee revenue, meaning that more the fees collected, more will be the deflationary pressure on SOL.