Will SOL’s price be affected as Solana hits record daily active addresses?

- Solana’s record active addresses signaled strong network growth, with transaction volumes surging alongside adoption.

- Whale accumulation and increased staking indicate long-term confidence, despite some short-term profit-taking.

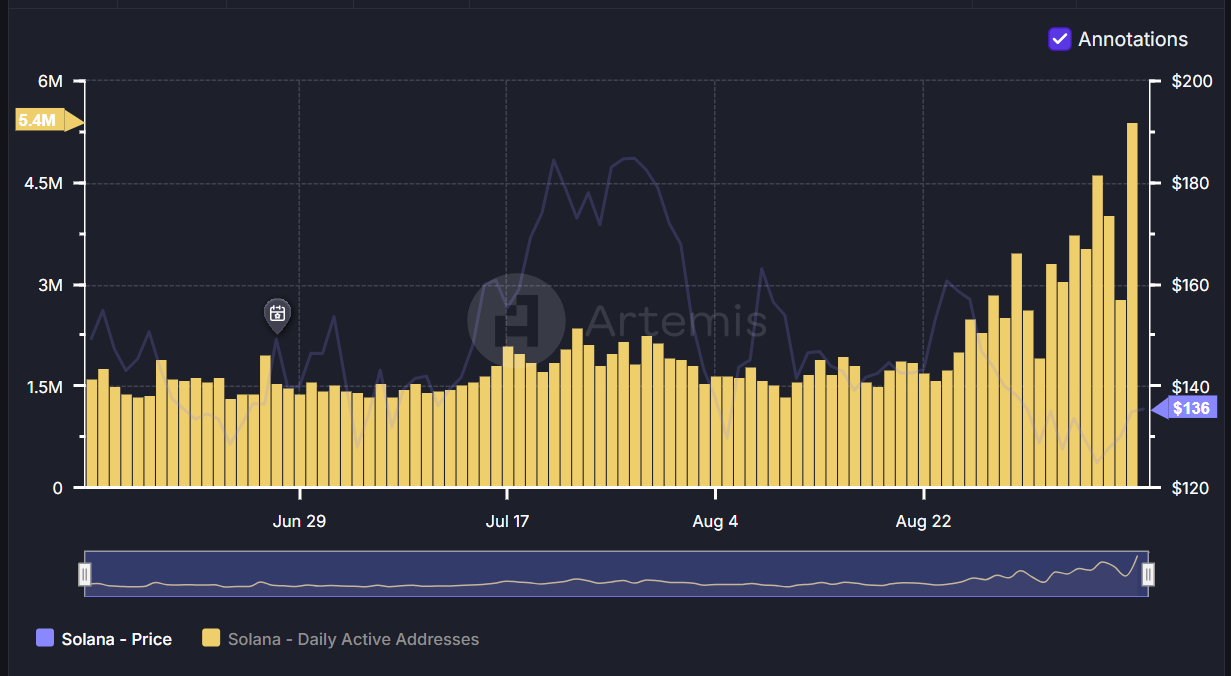

Solana [SOL] recently set a new record with over 5.4 million daily active addresses, sparking conversations about a potential price rally for the native token.

This surge in network activity has raised questions about whether the on-chain growth and technical factors could signal bullish momentum.

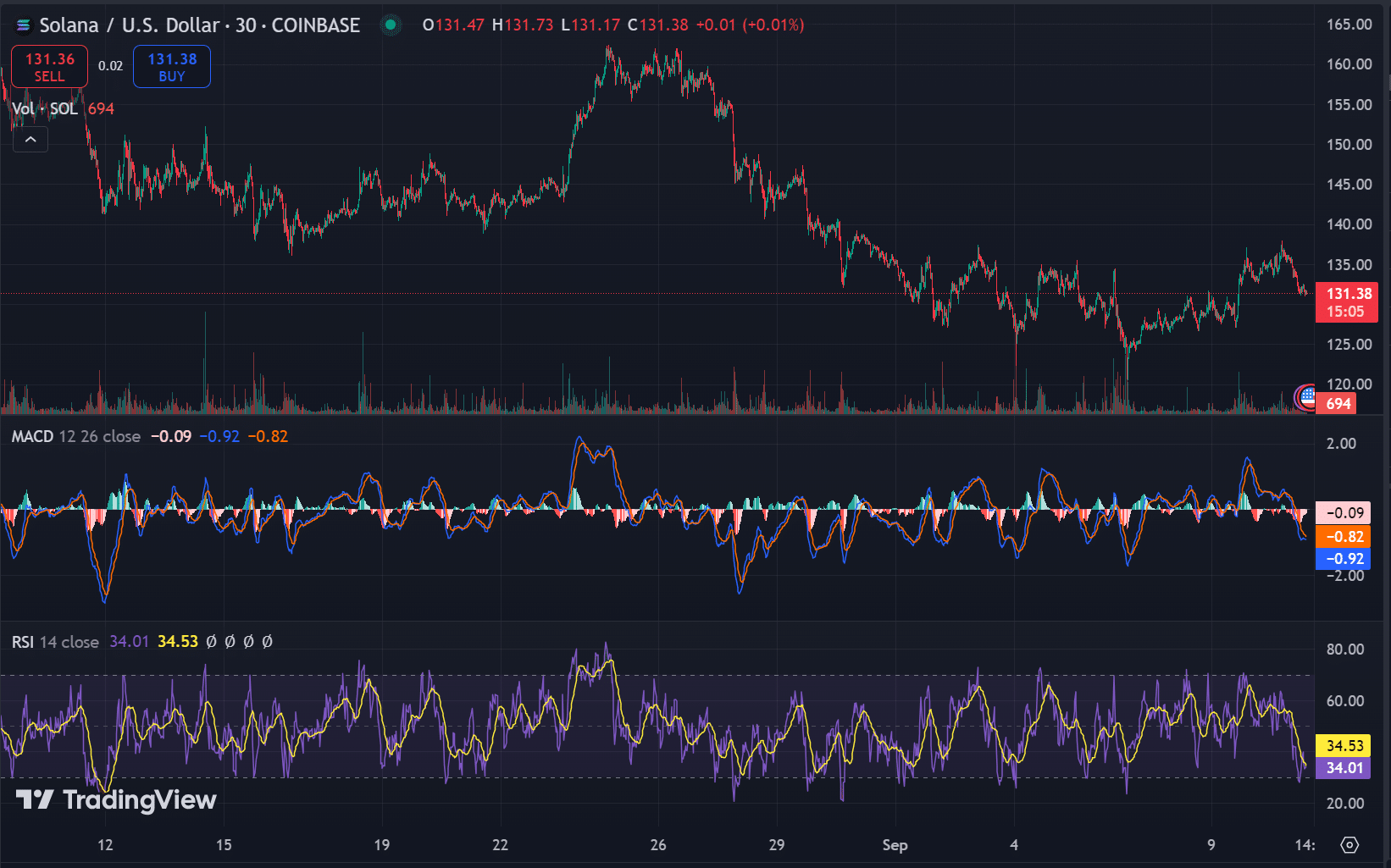

At the time of press, SOL was trading at $131.36, down 2.63% over the last 24 hours. Solana’s market cap stood at $61 billion, making it the fifth-largest cryptocurrency by market capitalization.

The token’s trading volume has seen significant fluctuations, driven in part by recent whale activity.

Despite some short-term bearish sentiment, the overall strength of Solana’s network and the massive rise in active users highlight its growing prominence in the blockchain space.

Technical indicators signal breakout rally?

From a technical standpoint, Solana faced resistance at $140, which could act as a crucial price level for bulls to break if a rally is to occur.

The $125 support level has consistently provided a safety net for the token, reducing the likelihood of further declines in the near term.

The 200-day moving average (MA) was hovering around $135 at press time, a key indicator of long-term price trends.

Meanwhile, Solana’s RSI (Relative Strength Index) was at 34.53, indicating that the token was nearing oversold territory, often a sign of a potential rebound.

The key to Solana’s on-chain surge

Solana’s daily active addresses have surged to a record 5.4 million, showcasing increased user adoption. Such growth often correlates with increased demand for the token, which could translate into upward price pressure.

Furthermore, Solana’s transaction volume has spiked significantly, with a 41% increase in the past 24 hours, reflecting heightened market interest and trading activity.

However, despite Solana’s record-breaking active addresses and rising transaction volume, mixed whale activity raised caution.

While some whales were accumulating and staking at press time, others were taking profits, indicating short-term uncertainty.

Is this a bullish sign for SOL?

The increase in daily active addresses, combined with rising transaction volumes and notable whale accumulation, pointed to a bullish outlook for Solana.

Historically, such on-chain growth often precedes price rallies, and the oversold RSI supports the case for a potential upward move.

Read Solana’s [SOL] Price Prediction 2024–2025

However, for Solana to experience a sustained price rally, it needs to break through the critical $140 resistance level.

Given the increasing staking activity and overall network health, there are strong indicators that Solana could see upward momentum if key technical levels are breached.